August-December 2020 Edition of Corona Crash or Everything Bubble Pop?

I created this series to serve as a set of living artifacts. This is the 3rd post in the series. I’m striving to capture major current events and financial market action from the lens of a retail investor in the US. It’s essential to understand how one feels and behaves during times of economic uncertainty and market volatility. What better way to do that then keeping a log here to reference in the future? This is not investment advice!!!

2018–2019

2020

February-March

April-May

June-July

August

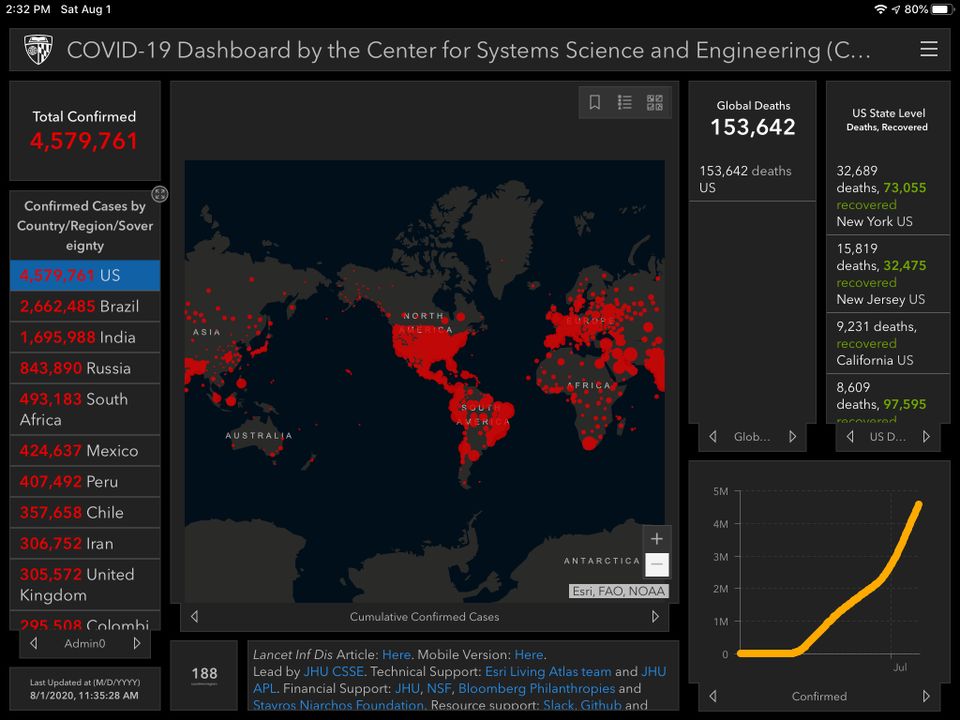

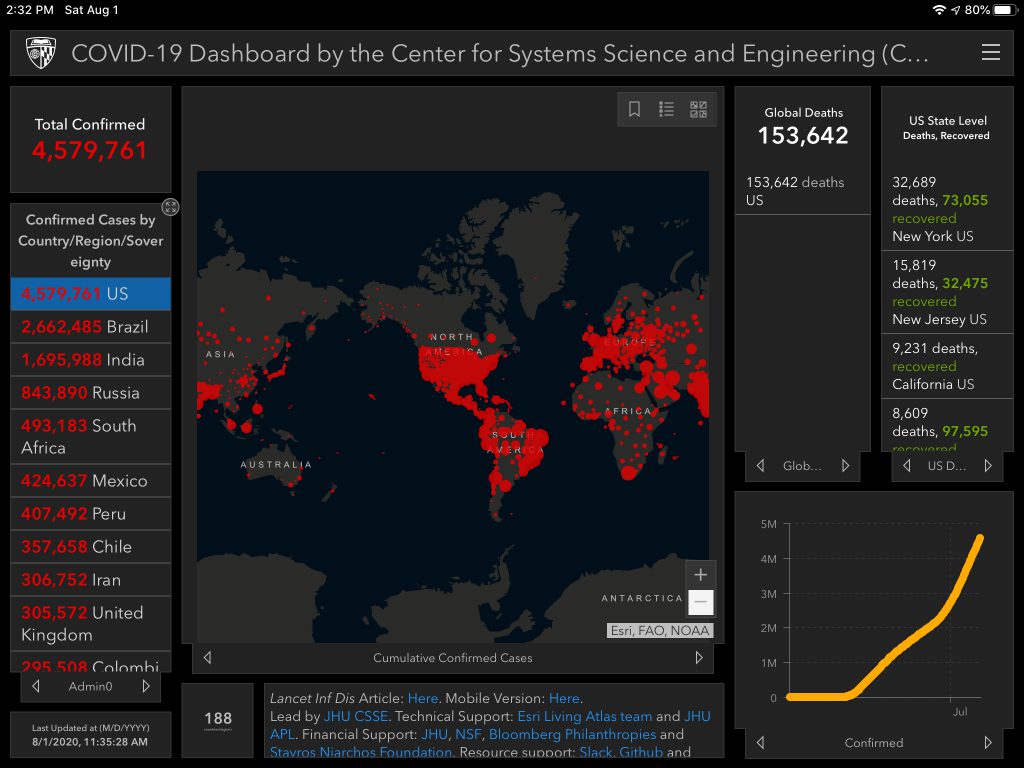

August 1

Saturday. It’s the weekend so most markets are resting. Crypto is showing some signs of life though. The combined market cap just crossed $330B for the first time in over a year.

I toyed around with the free trial for Simply Wall St. It’s pretty cool and I wish Koyfin combined forces with them for their stock analysis report.

The $600 unemployment benefit expired, and a new package still hasn’t been agreed on yet. It’ll be interesting to see how long it takes to wrap it up and what it’ll look like. It sounds like it could take at least one more week. Next Jobless Aid Bill Could Decide Path of U.S. Economic Rebound.

I wrapped up my June-July edition of Corona Crash or Everything Bubble Pop? I’ll continue with the series for the rest of the year, but I’ll probably decrease my frequency from daily to just a few days a week.

We’re supposedly getting hit by a tropical storm or hurricane here in Florida today, which would be our first since moving last year. The weather has been beautiful so far all day, though, so we’ll see what happens.

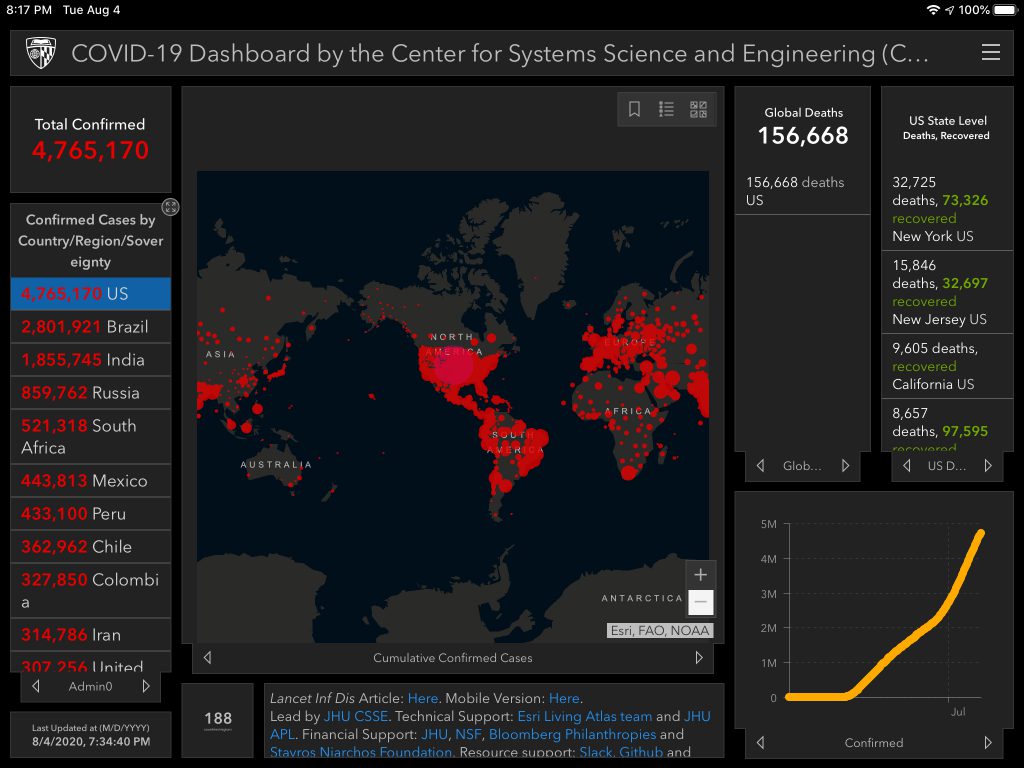

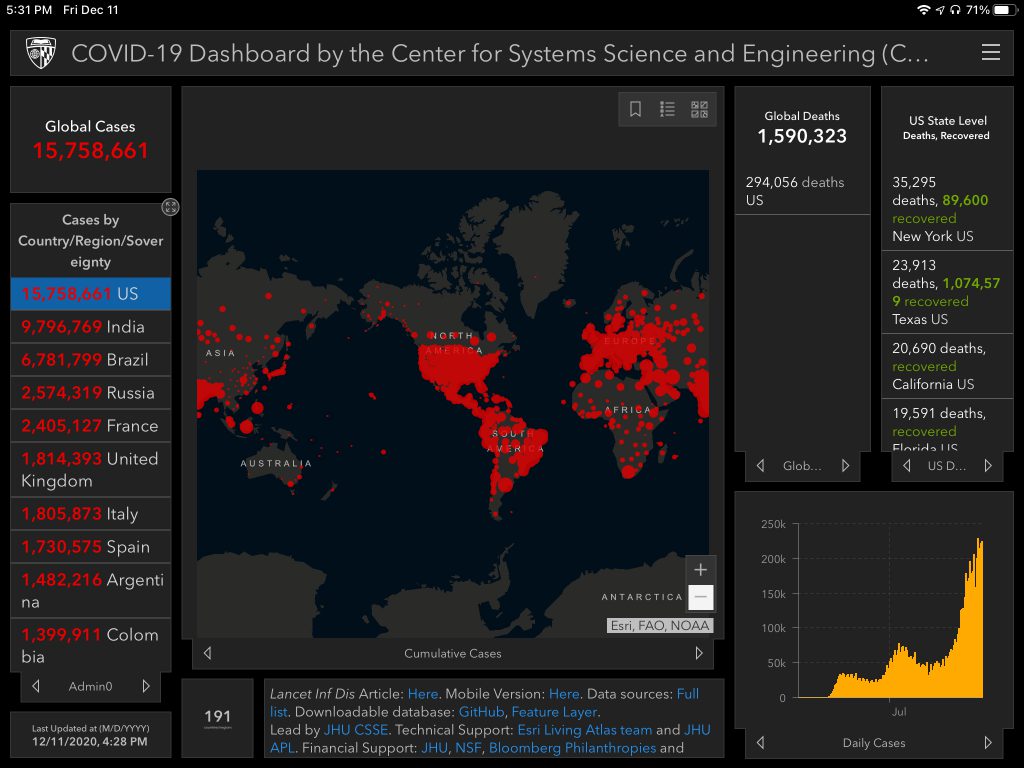

India reported its highest daily case increase to date– a total of 57,118 cases.

Japan saw their third day in a row of record new COVID cases.

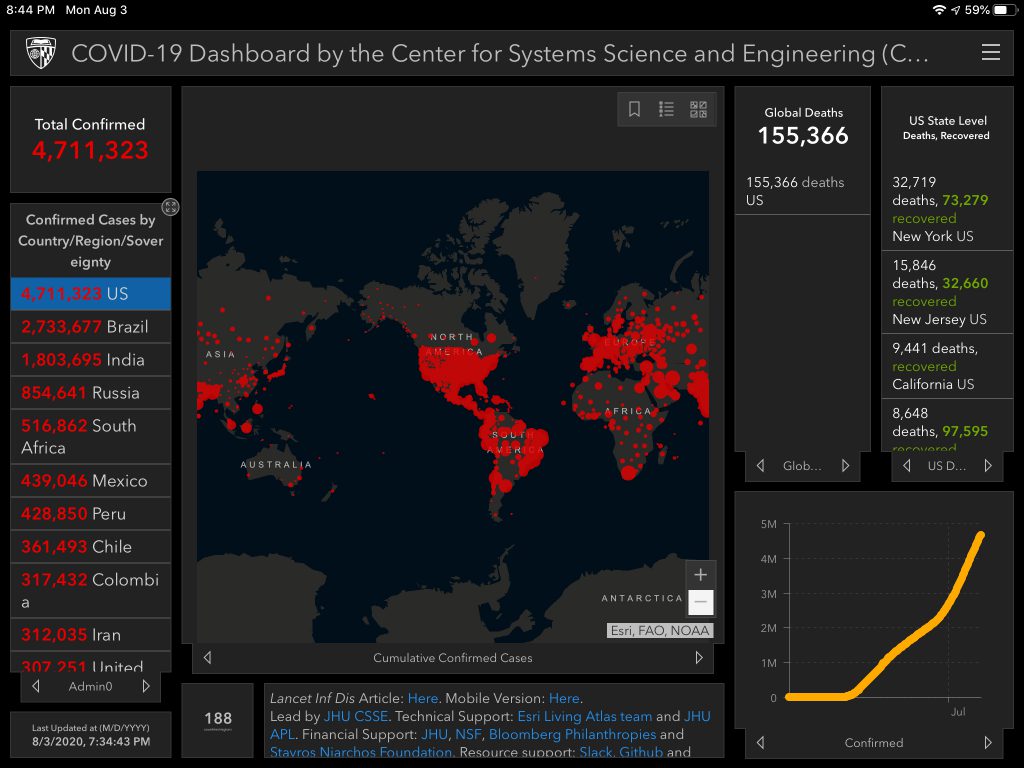

August 3

Monday. All green. The Russell 2k and Nasdaq closed +1.5%, Dow +.9%, and S&P 500 +.7%. Tech led, closing +2.5%. Gold and Silver were both relatively flat.

Todays edition of COVID-Bankruptcy-Mayhem features the parent company of Men’s Wearhouse and Jos. A. Bank. “Tailored Brands is gradually returning to normal operations after the coronavirus temporarily shut its doors. It re-opened just under half of its stores as of June 5, according to a statement. All of them, as well as e-commerce distribution centers in the U.S. and Canada, were temporarily closed in the first quarter.”

UPS Readies Freezer Farms to Ship Virus Vaccine — If We Get One. “The facilities, under construction in Louisville, Kentucky, and the Netherlands, near UPS air hubs, will house a total of 600 deep-freezers that can each hold 48,000 vials of vaccine at temperatures as low as -80 Celsius (-112 Fahrenheit). That’s on par with some of the coldest temperatures in Antarctica. Distributing a Covid-19 vaccine — if one is approved for use — will be the second huge logistical challenge spawned by the pandemic for delivery giants UPS and FedEx Corp., which earlier this year mobilized to airlift thousands of tons of protective gear across the world for health-care workers.”

This story is heartbreaking: Georgia teen loses parents to coronavirus four days apart. Donate here.

August 4

Tuesday. More green. The Russell 2k led, closing +.7%, followed by the Dow +.62%, and the Nasdaq and S&P 500 +.35%. $GLD increased 2% and $SLV flew 6.6%. Spot gold hit $2,000/oz for the first time.

Still no signs that stimulus discussions are nearing an end.

Tropical storm Isaias completely missed us in South Florida but caused some damage up north after making landfall yesterday in North Carolina.

August 5

Wednesday. Green everywhere. Seriously. Why wouldn’t it be? Everything is fine and dandy. The Russell 2k led again, closing +1.7%. The Dow closed +1.3%, S&P 500 +.64%, and Nasdaq +.5%. Gold is up over 1.6%, and Silver is up nearly 4%. As for my portfolio, I shifted my 401k to be significantly more conservative than it already was. We’re now allocated over 41% to cash & alts. I’m happy to secure gains and miss out on a little upside if the rally continues. I value my ability to sleep and can’t do that without being positioned securely.

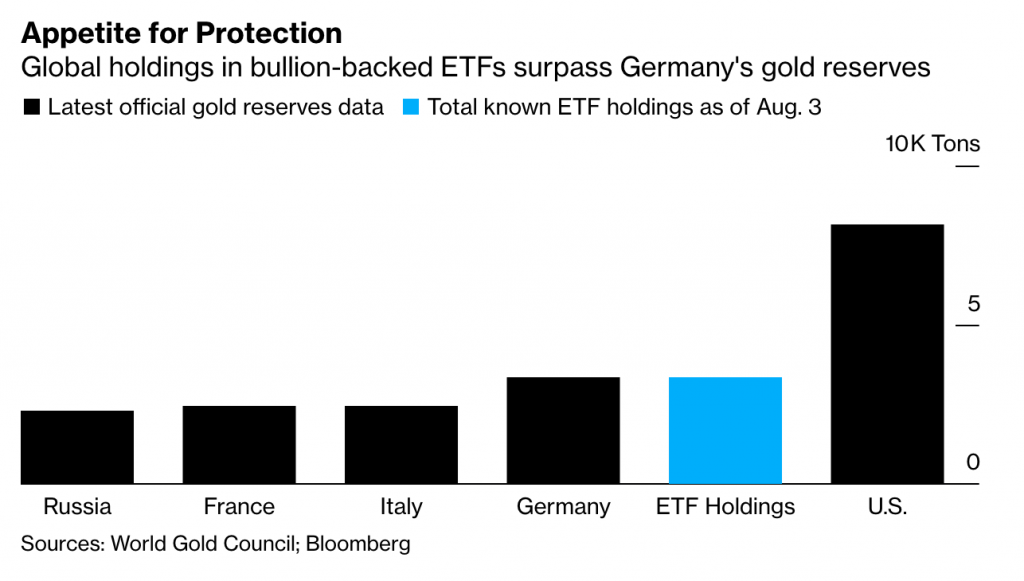

Now that gold as topped $2,000/oz, folks are calling for $3,000.

An ADP jobs report today was bleak. “ADP said companies added 167,000 jobs in July, far short of the 1.2 million economists polled by FactSet expected. That follows bigger gains in June and May, when employers added a total of 7.6 million jobs.”

Howard Marks & Oaktree published Time for Thinking, his first since mid-June. This one is a reflection on the health crisis, the failure to fix it, the non-cyclical nature of this situation, the shape of the recovery, the Fed, and a bull case. Excerpts:

- Not a Cycle: “My main response is that the developments of the last five months are non-cyclical in nature, and thus not subject to the usual cycle analysis… I’m convinced cycles will continue to occur over time, highlighted by excessive movements away from “normal” and toward extremes – both high and low – that are later followed by corrections back toward normalcy, and through it to excesses in the opposite direction. But that’s not to say that every event in the economy or markets is cyclical. The pandemic is not.“

- What Shape Are We In?: “Fast down and slow up: to me, that’s no V. I prefer to think of it as a checkmark.”

- The Markets and the Fed: “…These are the traditional concerns with regard to monetary expansion. Modern Monetary Theory (“MMT”) stands ready to refute them. The actual outcome is unknowable. But does it really make sense that bank reserves, the Fed balance sheet and the federal deficit can be increased ad infinitum without negative effects? My answer is the usual: we’ll see… “

- Bottom Line: “That leads me to end with a great bit of wisdom from Charlie Munger concerning the process of unlocking the mysteries of the markets: ‘It’s not supposed to be easy. Anyone who finds it easy is stupid.'”

Eric Cinnamond at Palm Valley Capital Management published Believers. I always enjoy his writing style. “Conviction is one of the most important attributes of a successful investor… Investing with conviction isn’t easy. The future is unknowable, making it difficult to invest with certainty and according to plan… Facing uncertainty can be particularly challenging when standing apart from the crowd, or as a contrarian… Investing differently and fighting the seductiveness of the crowd is extremely difficult—significant conviction is required… While we believe investing with conviction has never been more difficult, we also feel it’s never been more important… Every cycle is different, but in our eyes, the fundamentals of investing have not changed—prices matter, cycles revert, and risk may hide for extended periods, but it never disappears and should not be underestimated.”

There was a terrible explosion in Beirut yesterday.

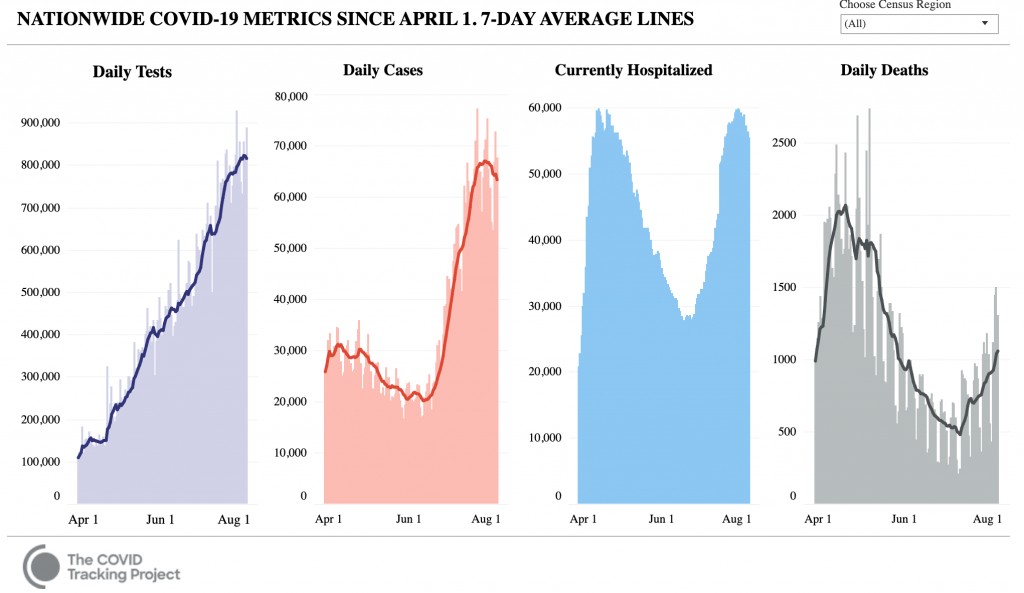

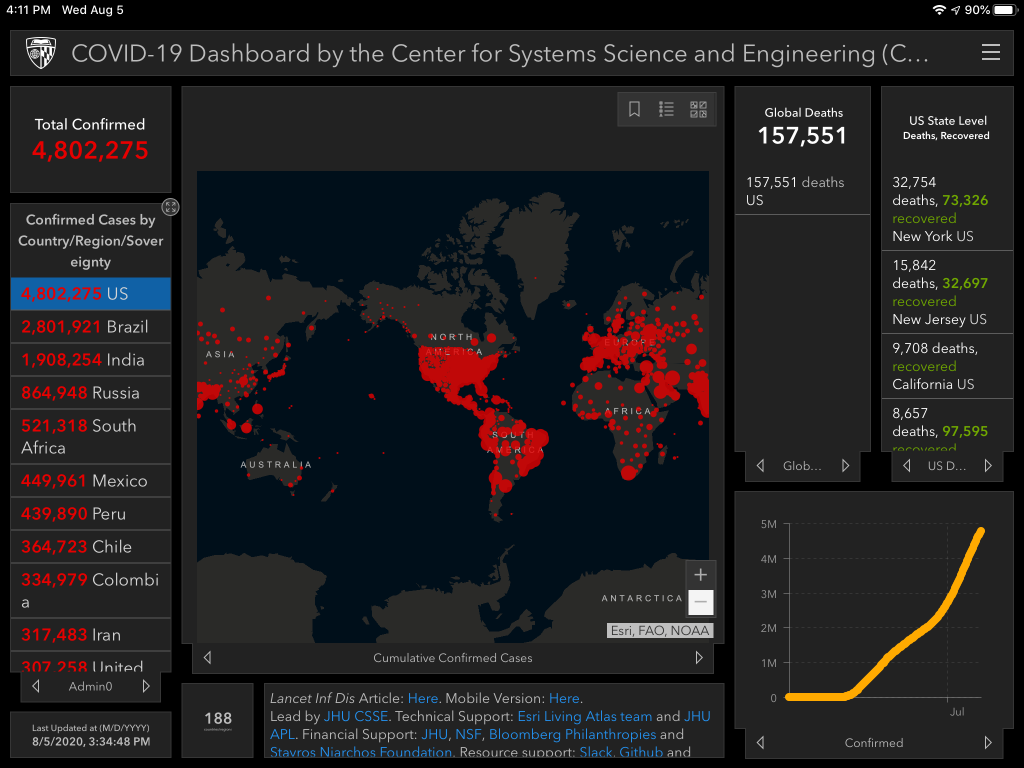

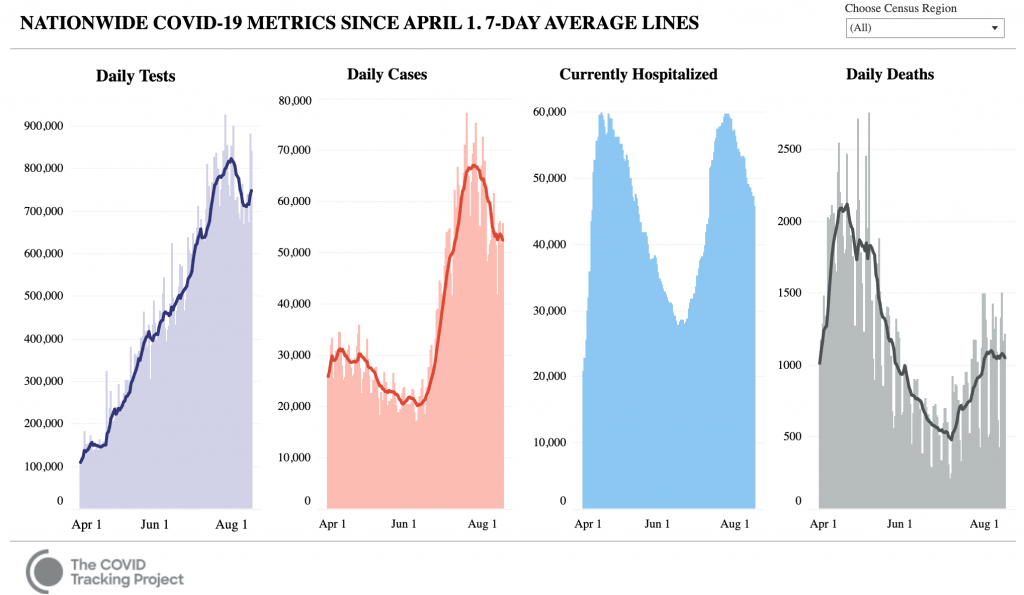

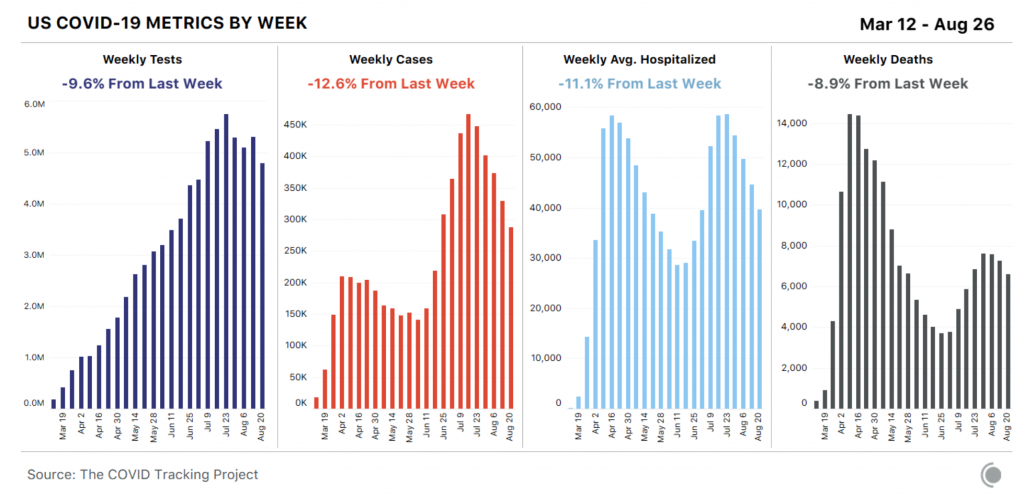

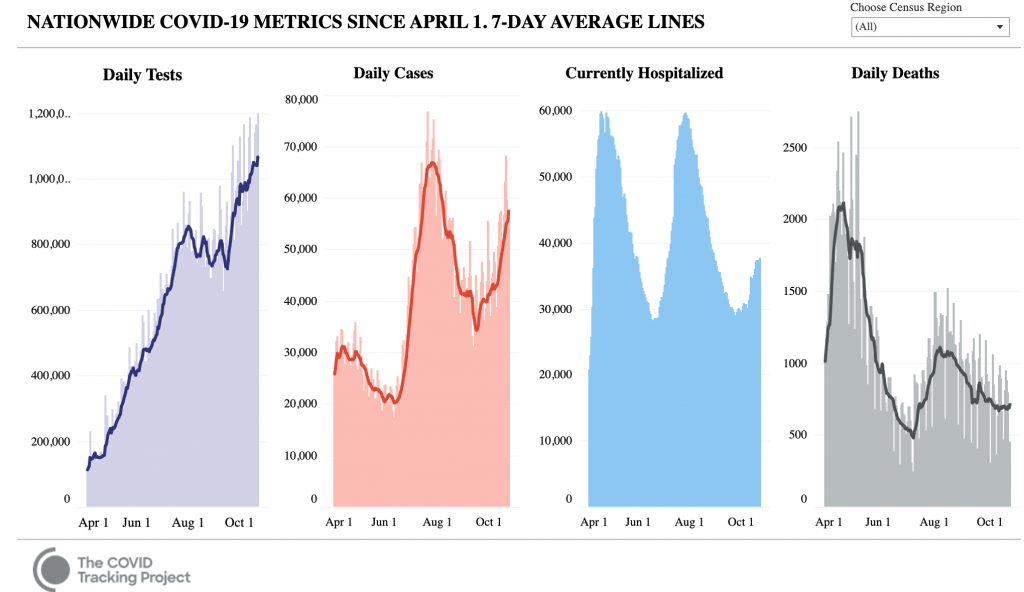

The trend in cases is looking promising.

August 6

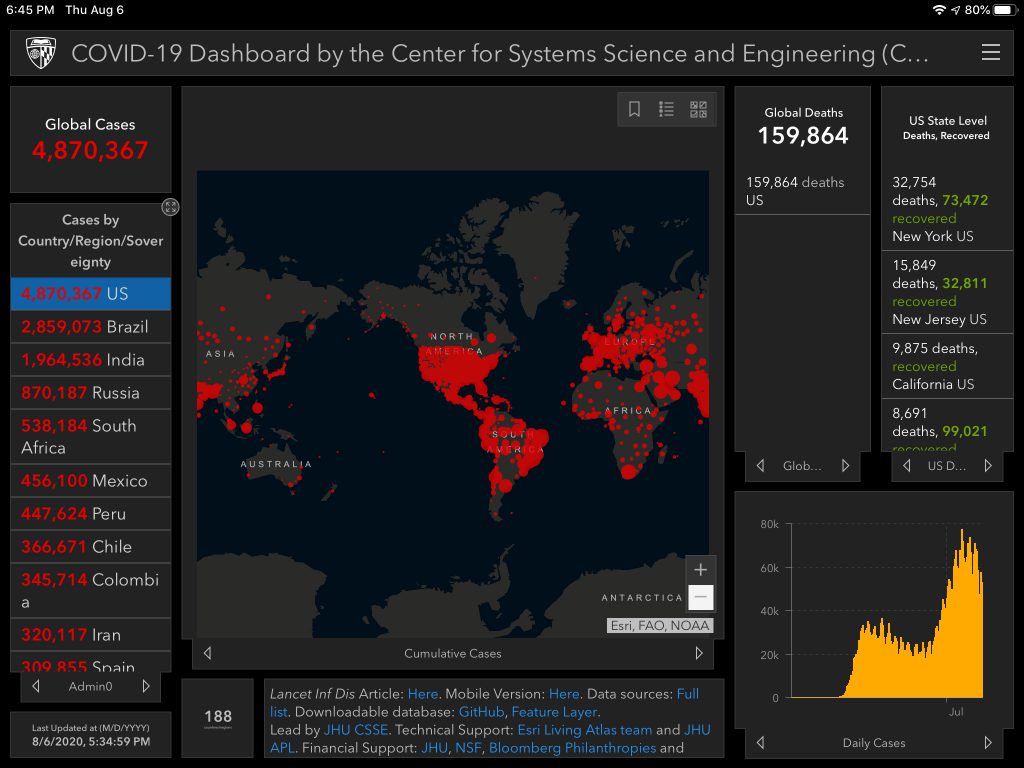

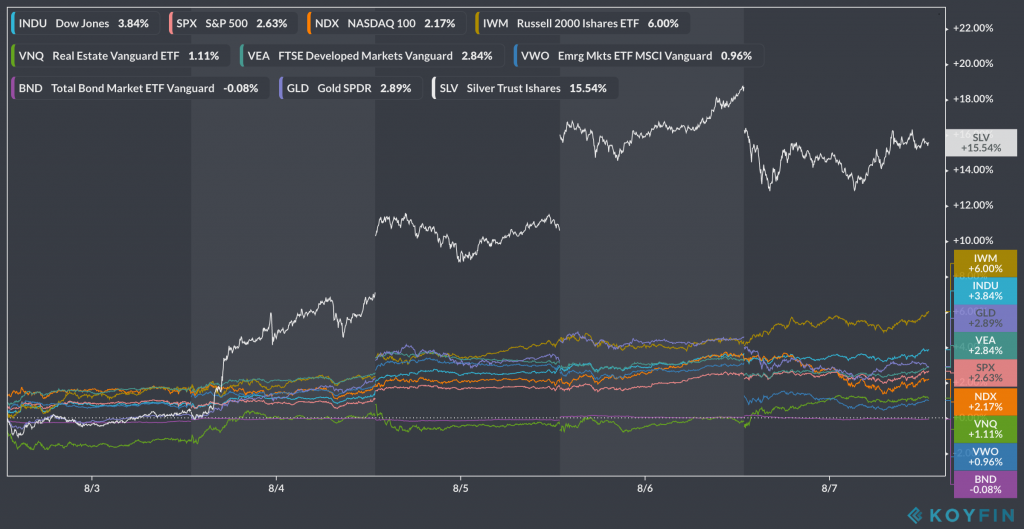

Thursday. The Nasdaq closed +1%, Dow +.68%, S&P 500 +.6%, and the Russell 2k lagged a bit, closing -.1%. $GLD rose another 1.3% to $193 and $SLV flew another 7.3% to nearly $27– the highest since 2013.

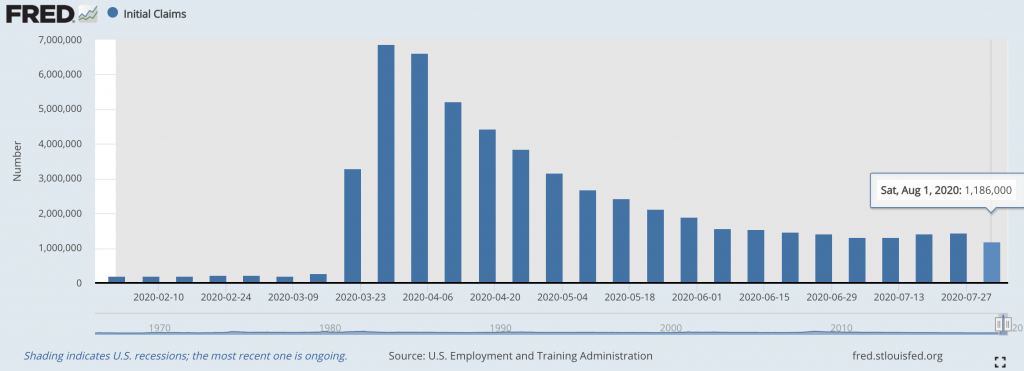

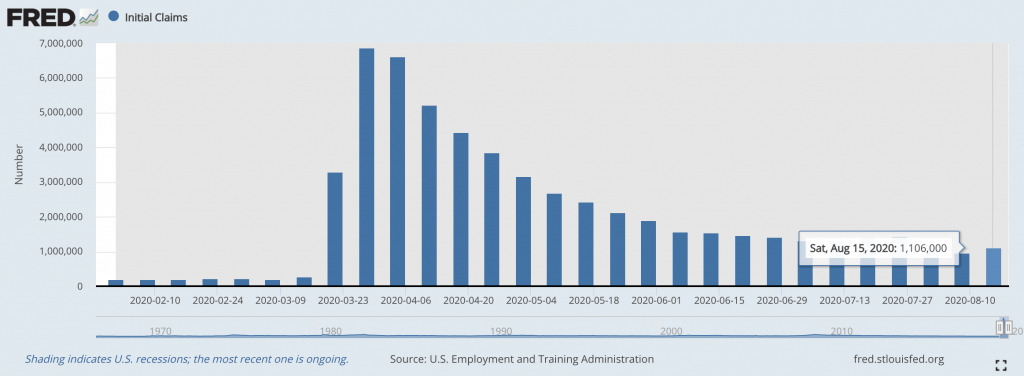

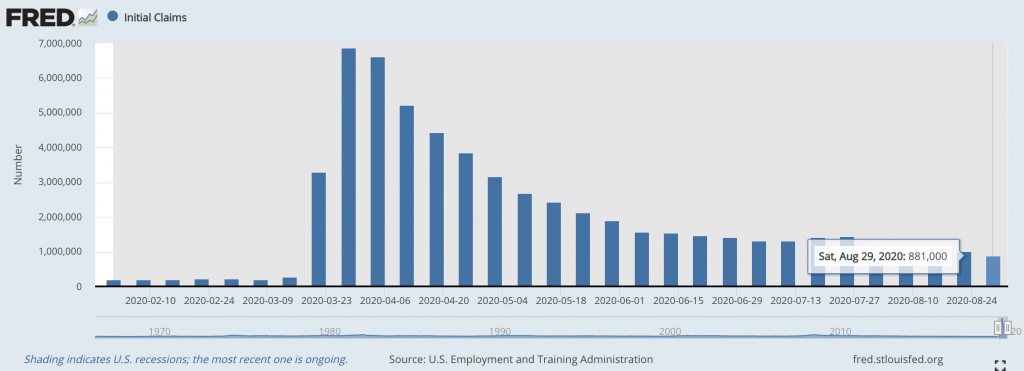

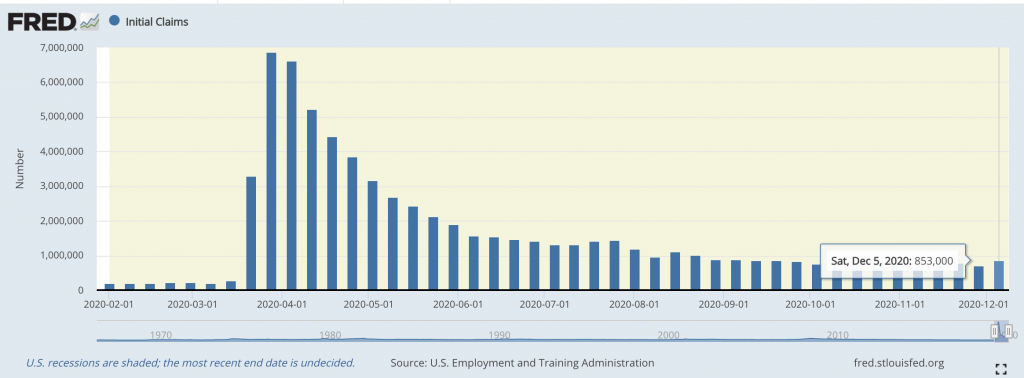

Jobless claims rose another 1.186M. The total since mid-late March is ~55M. For context, the entire GFC of 08-09 saw just over 37M. This was the first weekly decline in almost a month and the lowest claim count since the pandemic rocked life as we knew it.

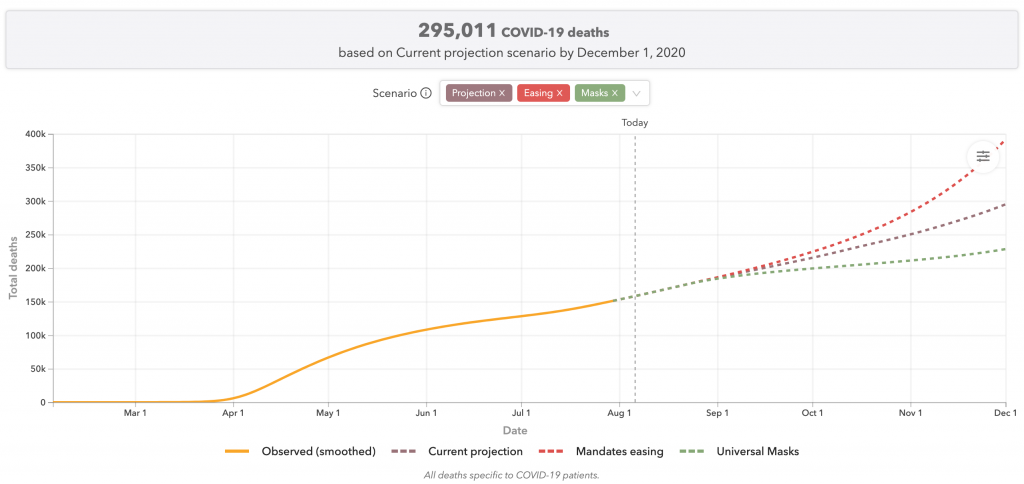

A model from the University of Washington is predicting 295,000 COVID deaths in the US by December.

Covid Tracking Project published their weekly post and titled it, The Last Thing We Need Is Fewer Tests. “For the first time since early March, the number of people tested in the United States went down. This week’s tests were 9.1 percent lower than last week’s national peak of 5.7 million tests… As testing declines in many US regions, K-12 schools, colleges, and universities have begun to reopen for in-person classes in many US states, we have already begun to see on-campus and residential outbreaks that mirror those we’ve seen from summer camps. In Hong Kong and Israel, where the pandemic was under greater control than it remains in the United States, school reopenings were followed by spiking outbreaks.”

August 7

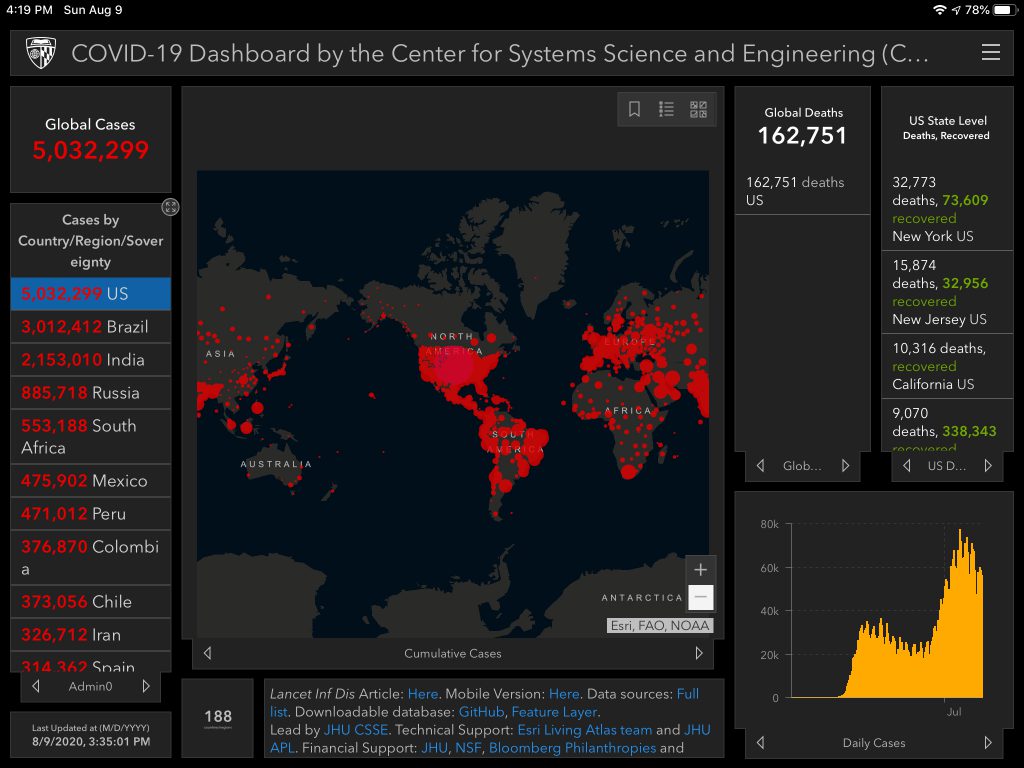

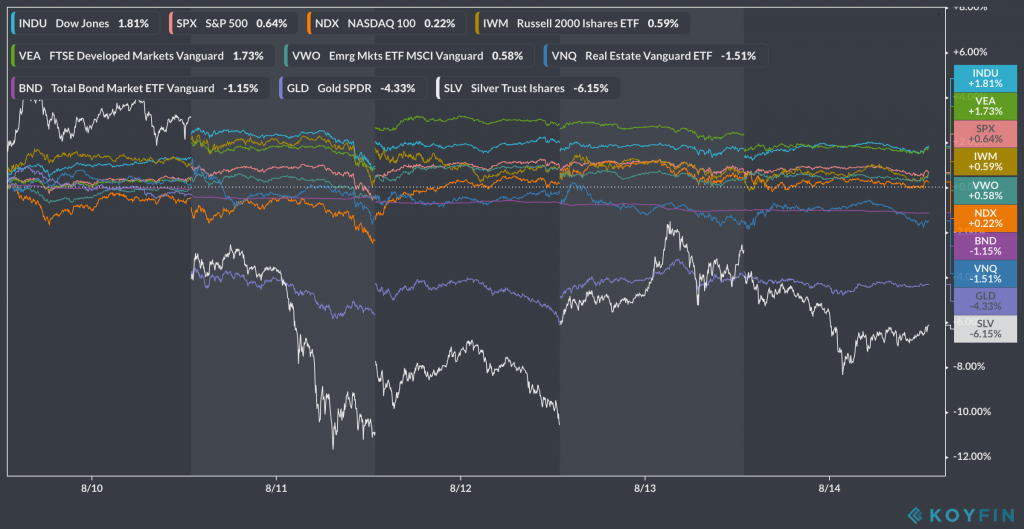

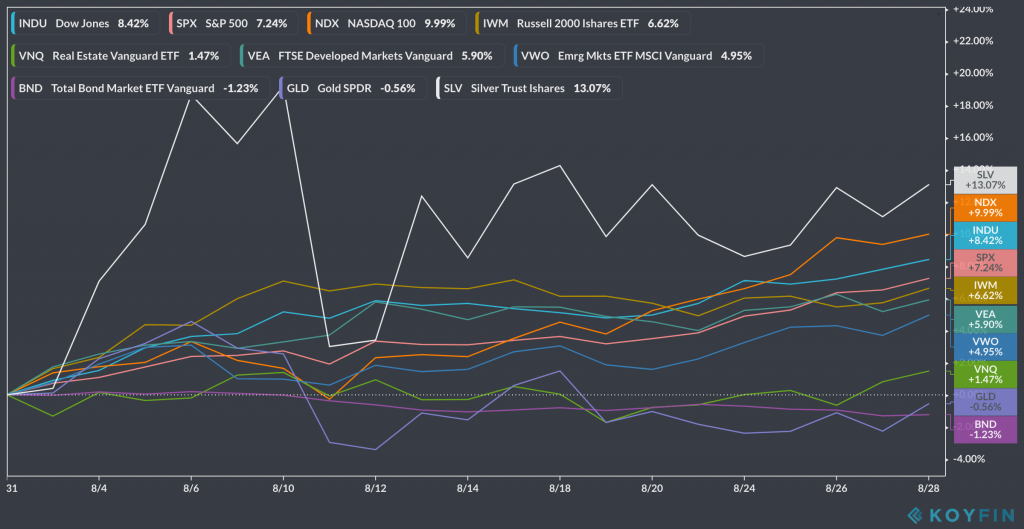

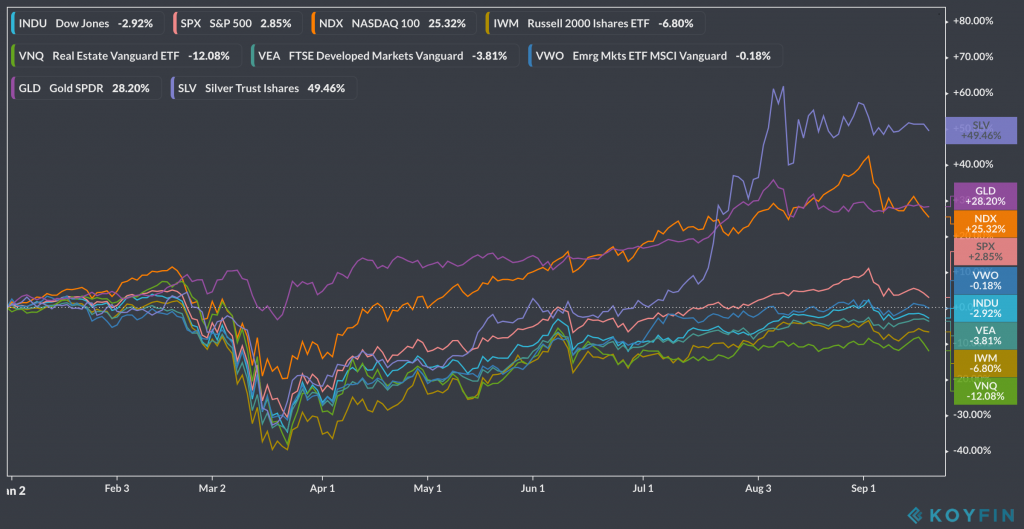

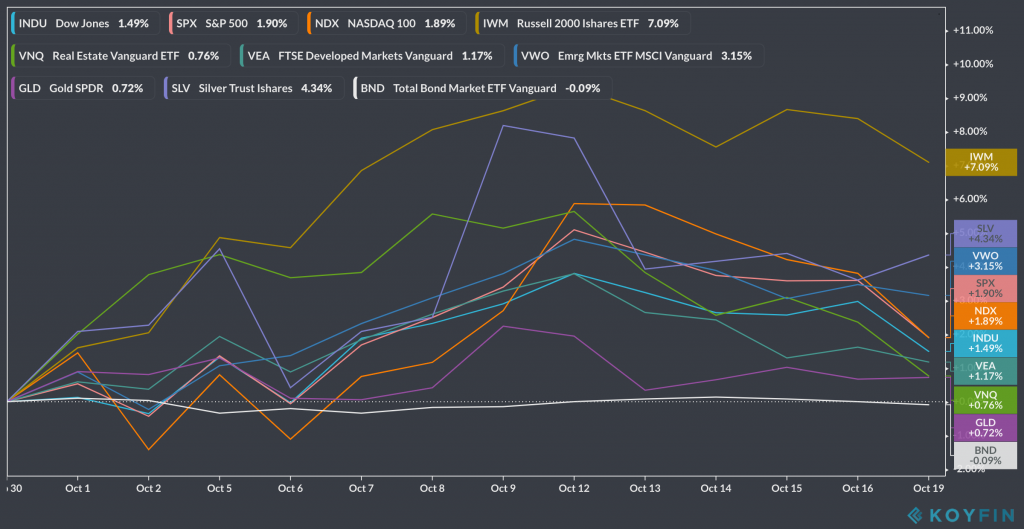

Friday. A little more red than we’re used to these days. The Russell 2k closed +1.6%, Dow +.17%, and S&P 500 +.6%. The Nasdaq closed -.87%, gold dropped -1.3%, and silver dropped -.8%. I suppose it’s reasonable for them to cool off a bit given their recent rise. Here’s a weekly:

Little progress is being made on a new stimulus package apparently.

MarketWatch published 55% of coronavirus patients still have neurological problems three months later: study. “Now a study of 60 COVID-19 patients published in Lancet this week finds that 55% of them were still displaying such neurological symptoms during follow-up visits three months later. And when doctors compared brain scans of these 60 COVID patients with those of a control group who had not been infected, they found that the brains of the COVID patients showed structural changes that correlated with memory loss and smell loss.”

August 9

Sunday.

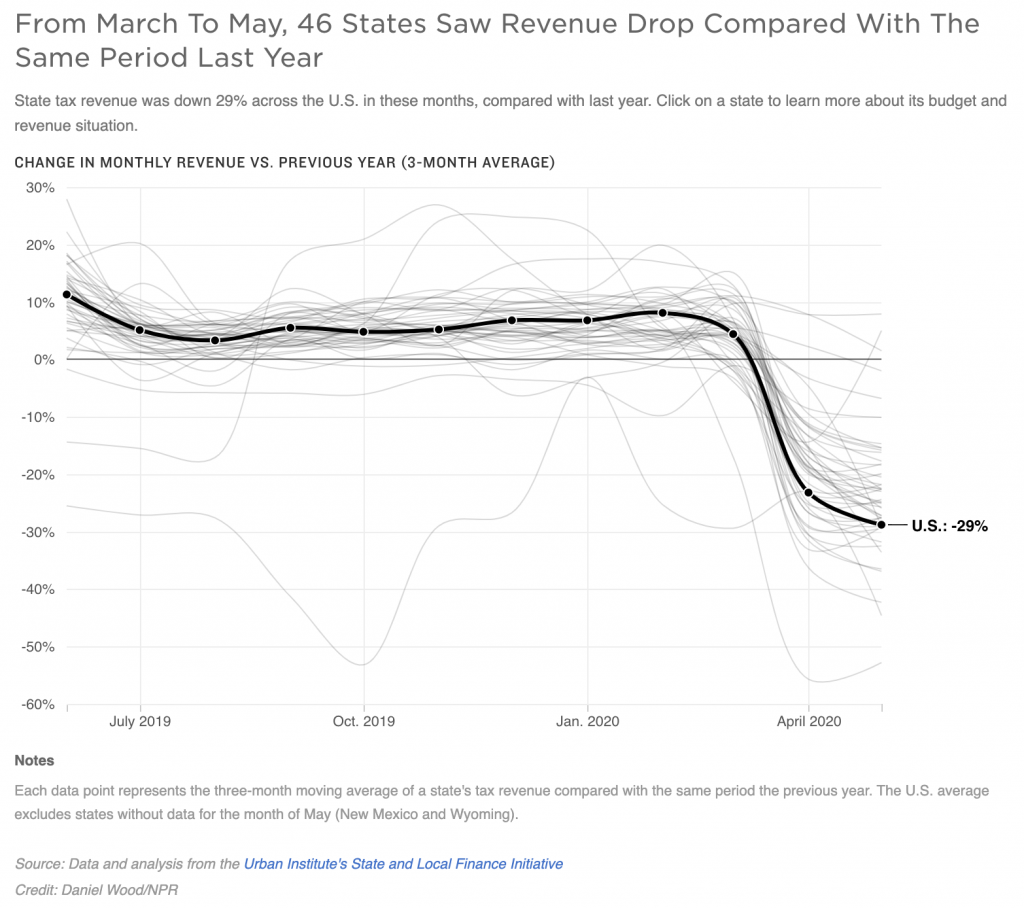

NPR published States Are Broke And Many Are Eyeing Massive Cuts. Here’s How Yours Is Doing. “Record-high unemployment has wreaked havoc on personal income taxes and sales taxes, two of the biggest sources of revenue for states.”

Ben Carlson wrote about how this is The Most Counterintuitive Recession Ever. “It’s possible all of this government spending is a one-off because of the nature of this downturn. This was the first recession in history where everyone knew the exact moment it began. The telegraphed nature and shutdowns forced government officials into action. But it’s hard to believe voters won’t push for politicians to enact further fiscal rescue packages in the future. If the government can stop a depression in its tracks, why wouldn’t they do so during future recessions?2 No one knows the unintended consequences of these types of policies moving forward but it sure feels like 2020 is going to mark a turning point in the way we look at the response to economic crises in the future. And regardless of the policy implications, this will go down as the strangest recession ever.”

We struggled to find anything great on Netflix or Prime this weekend. Good thing Shark Week starts tonight!

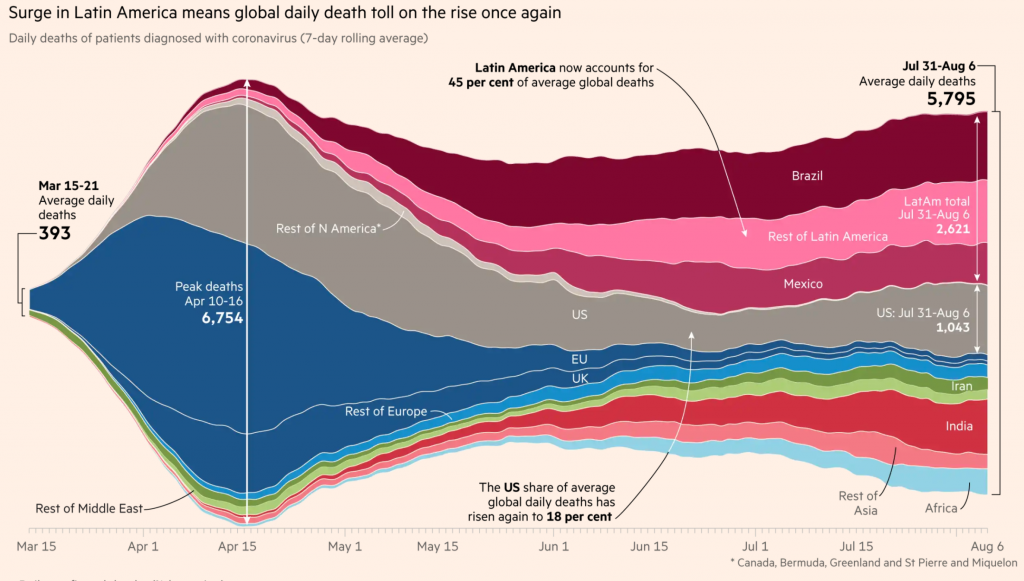

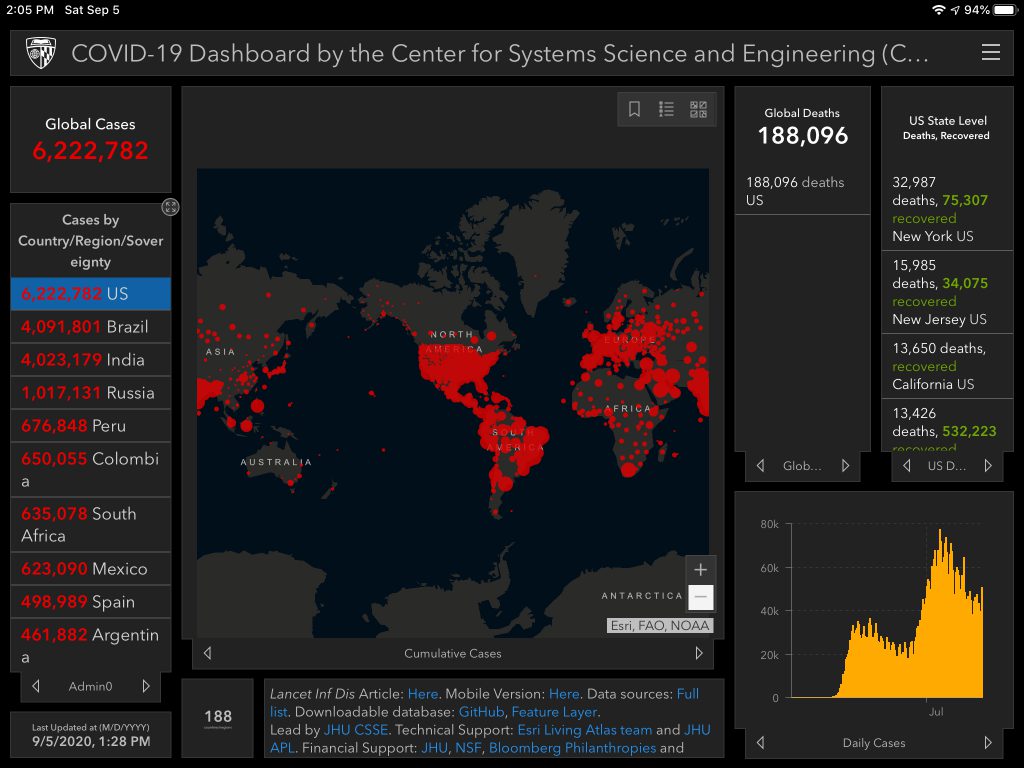

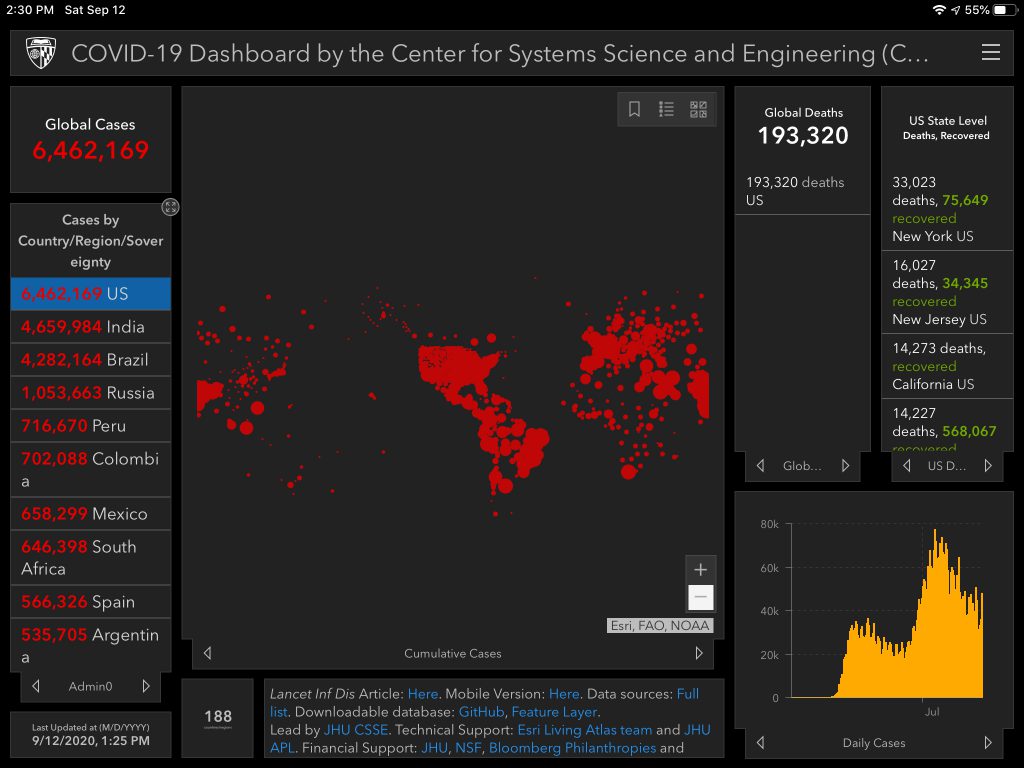

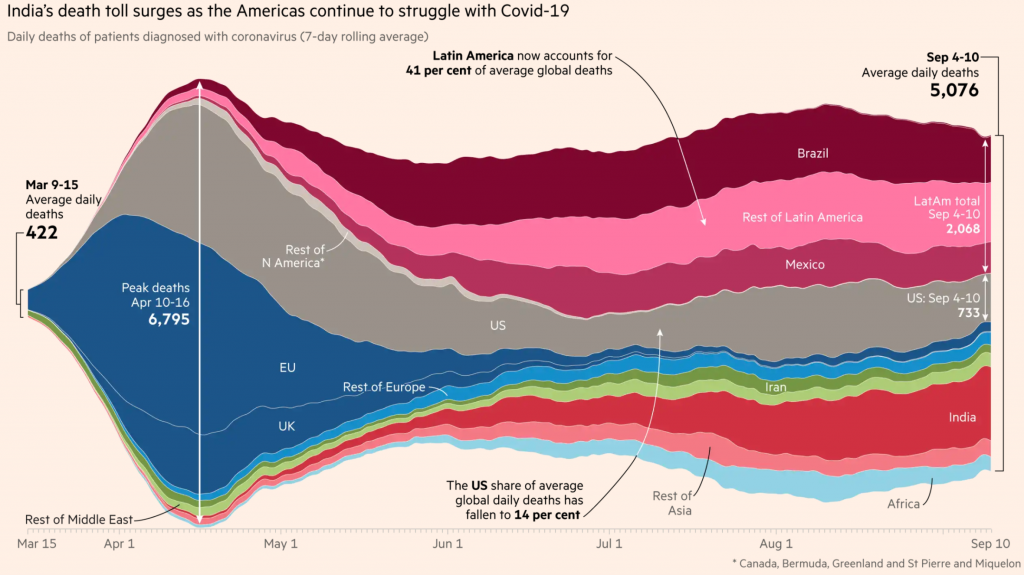

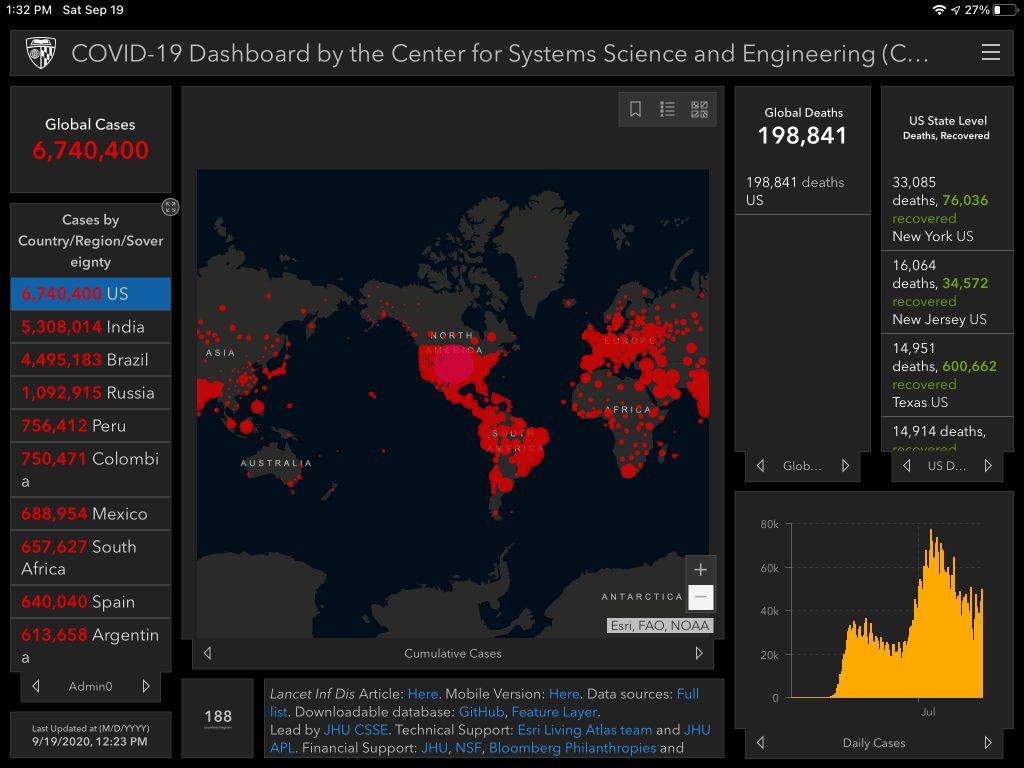

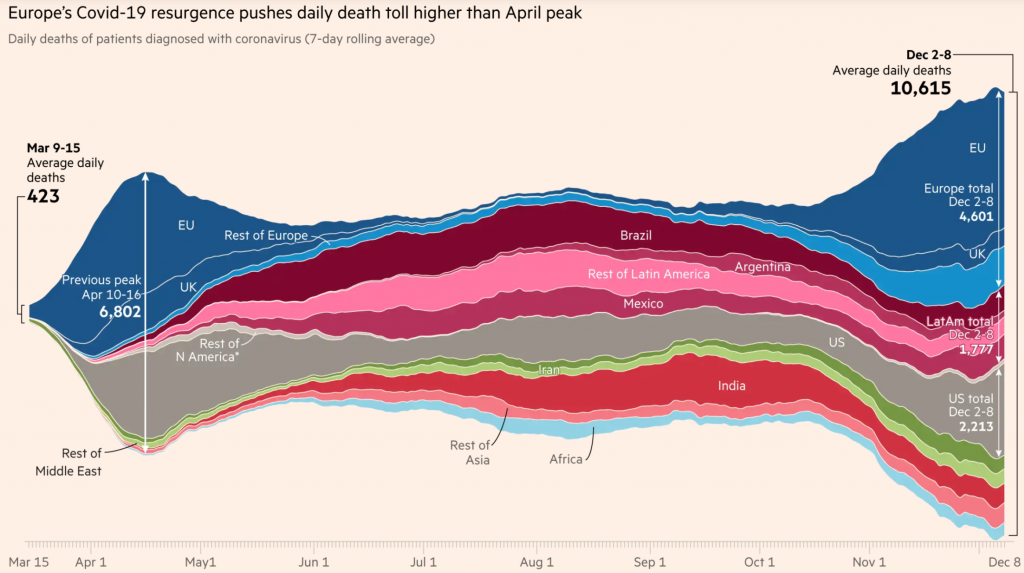

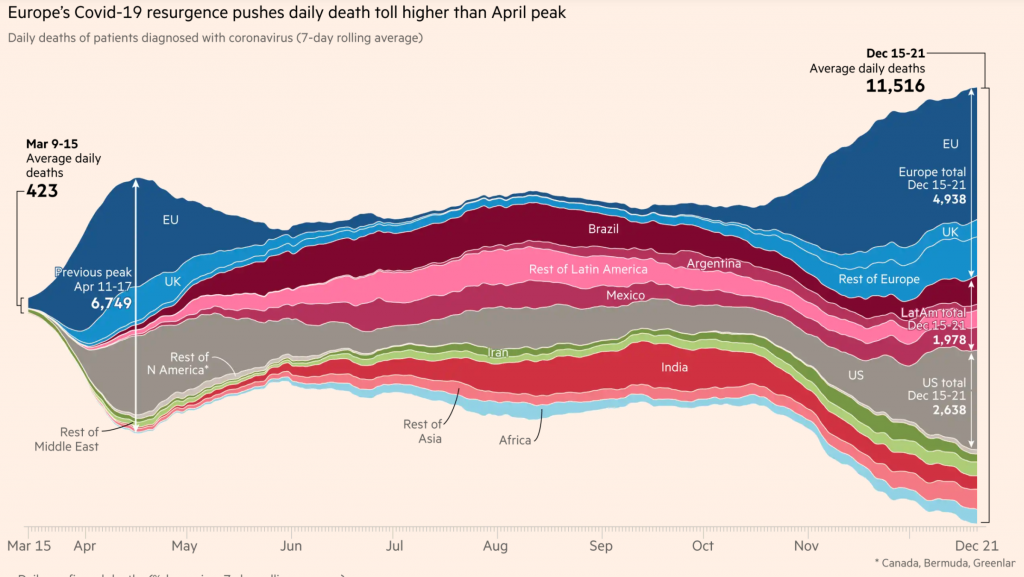

Here’s an updated shot of the COVID death situation globally from FT.com:

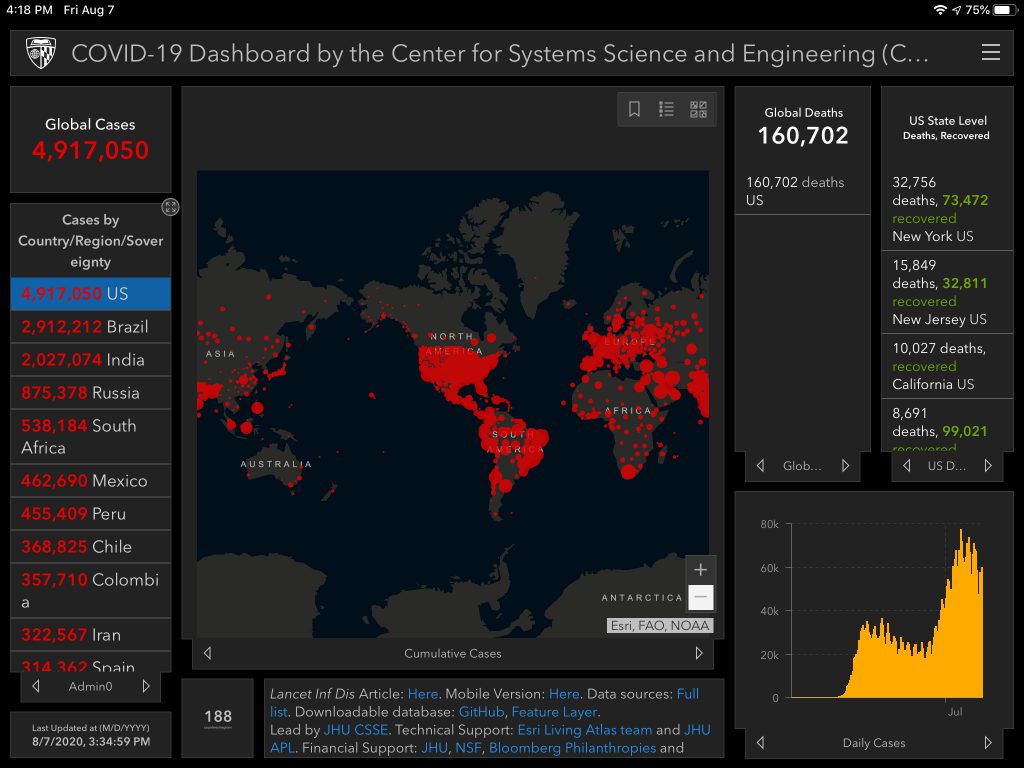

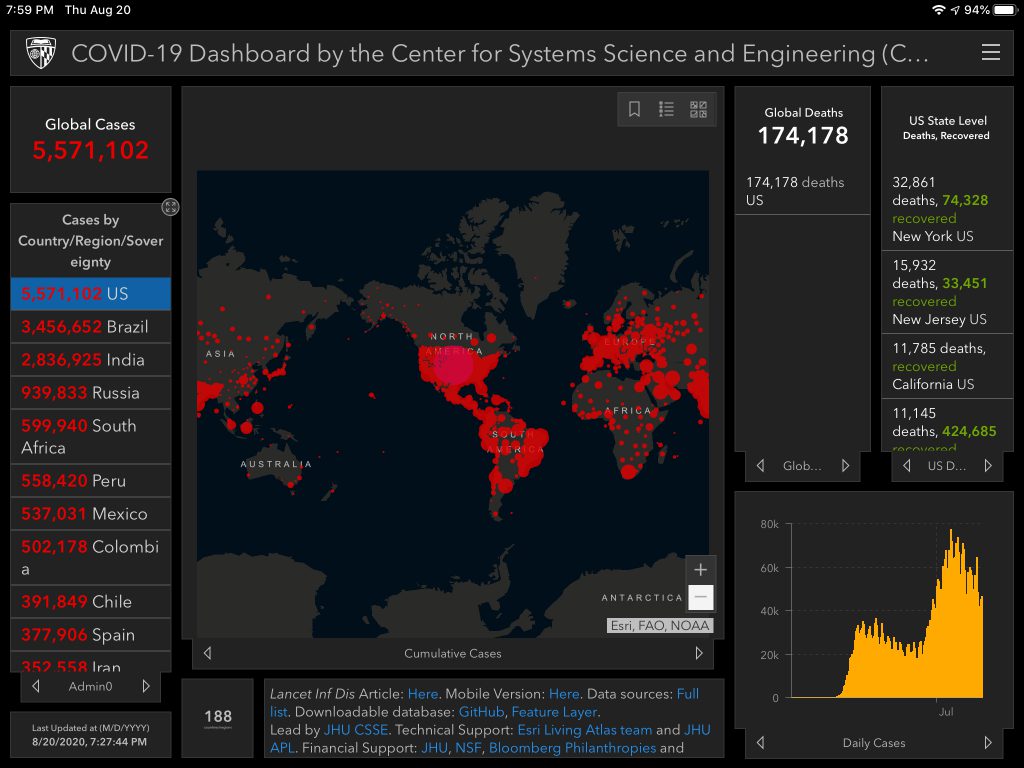

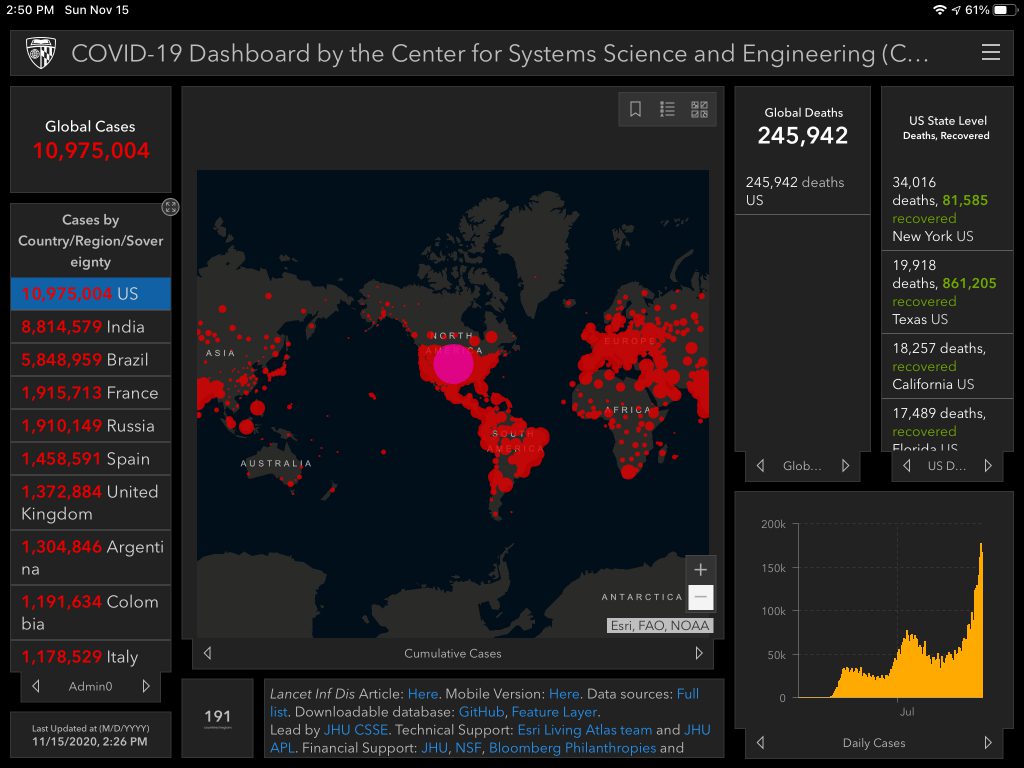

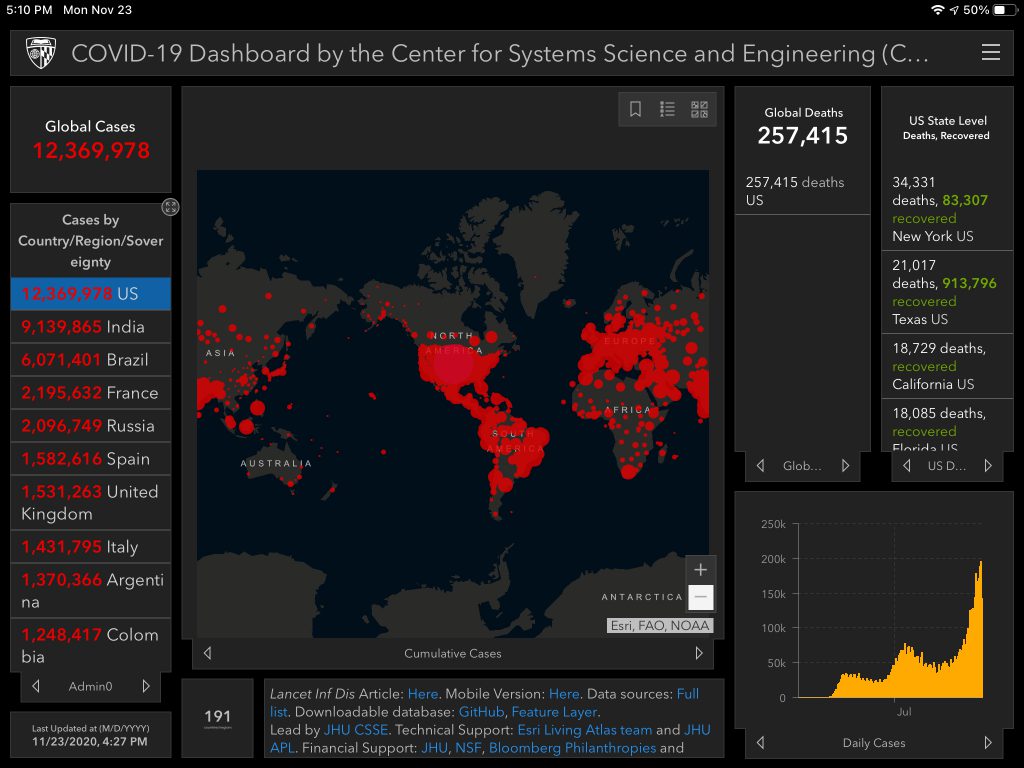

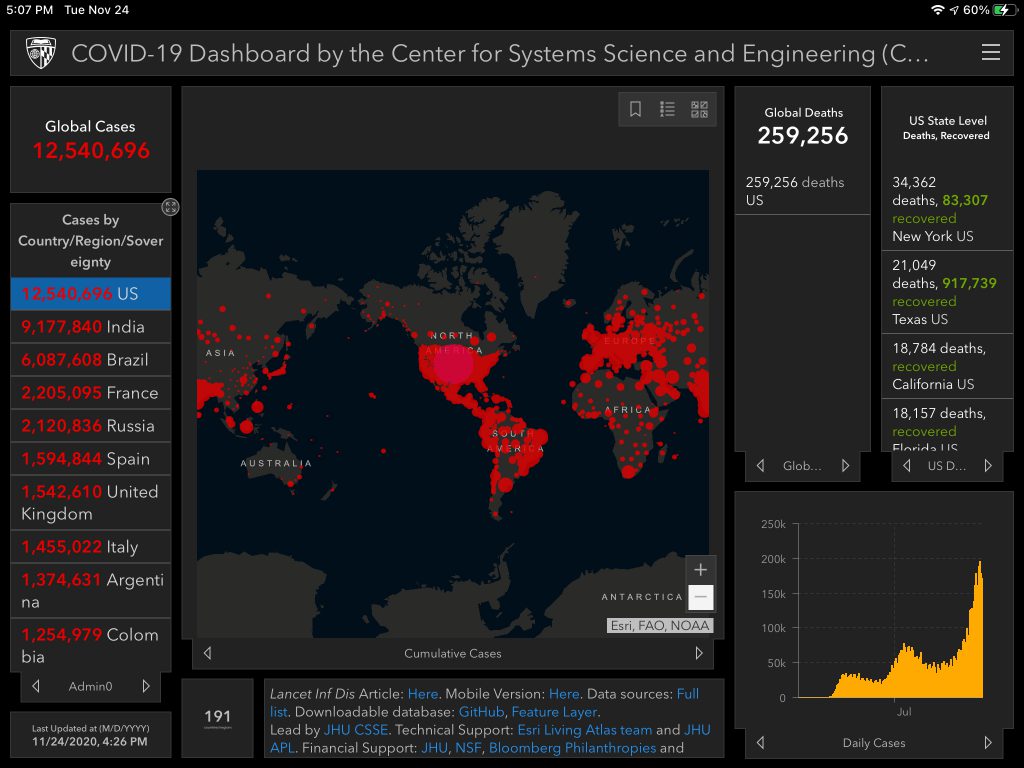

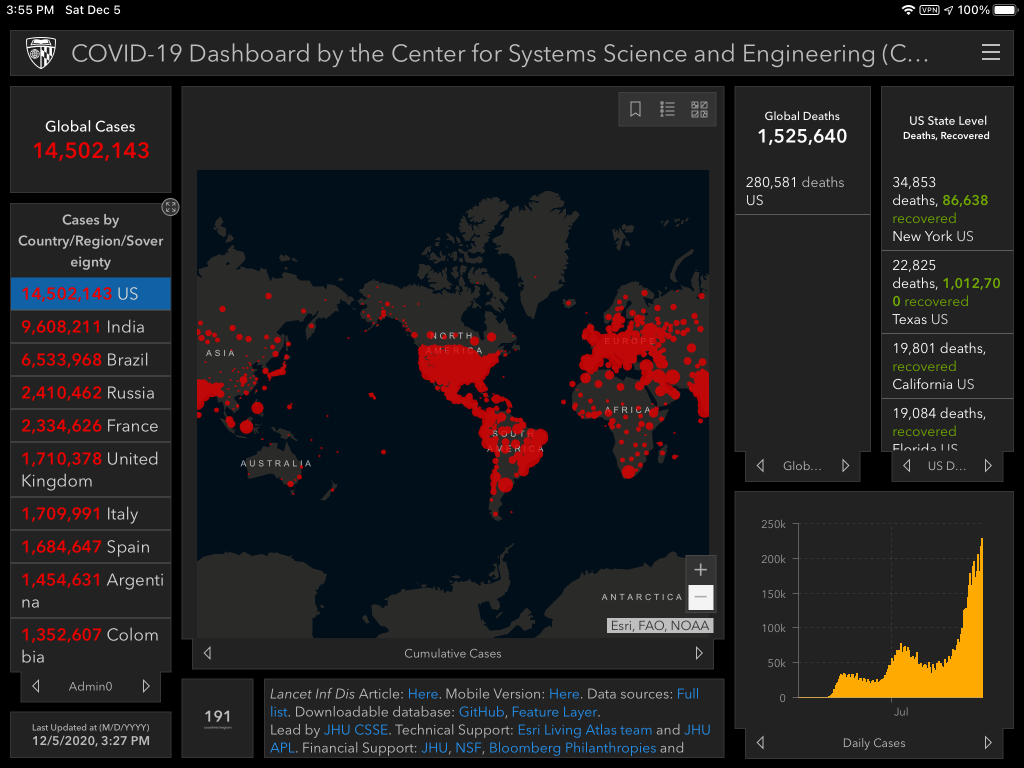

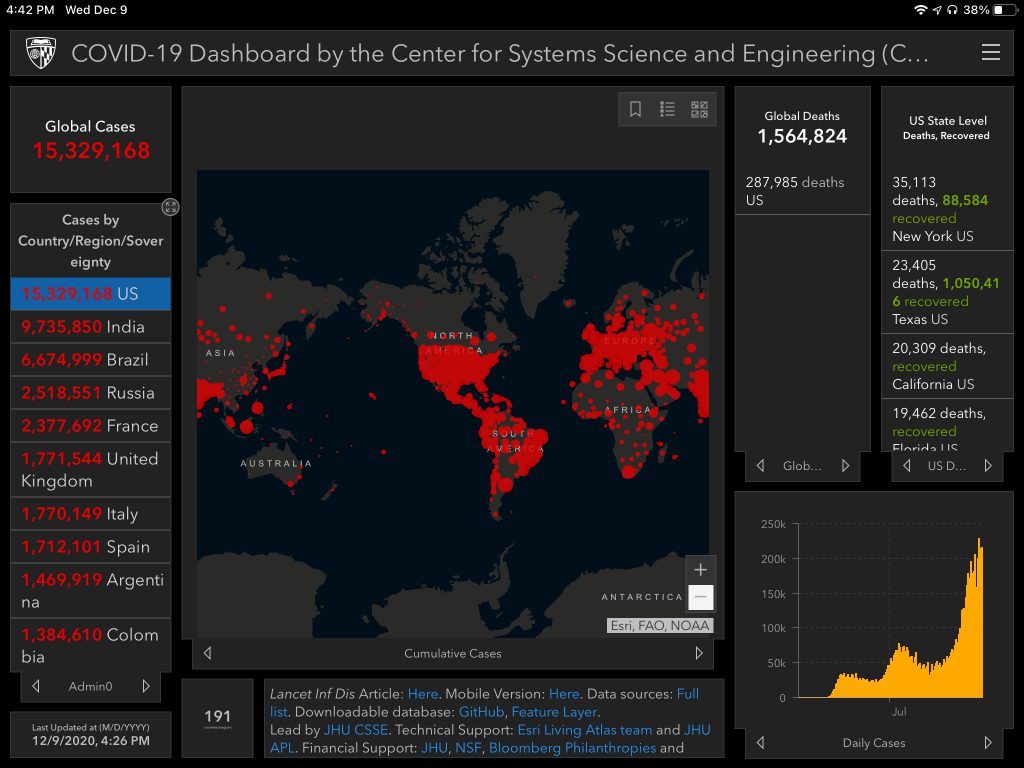

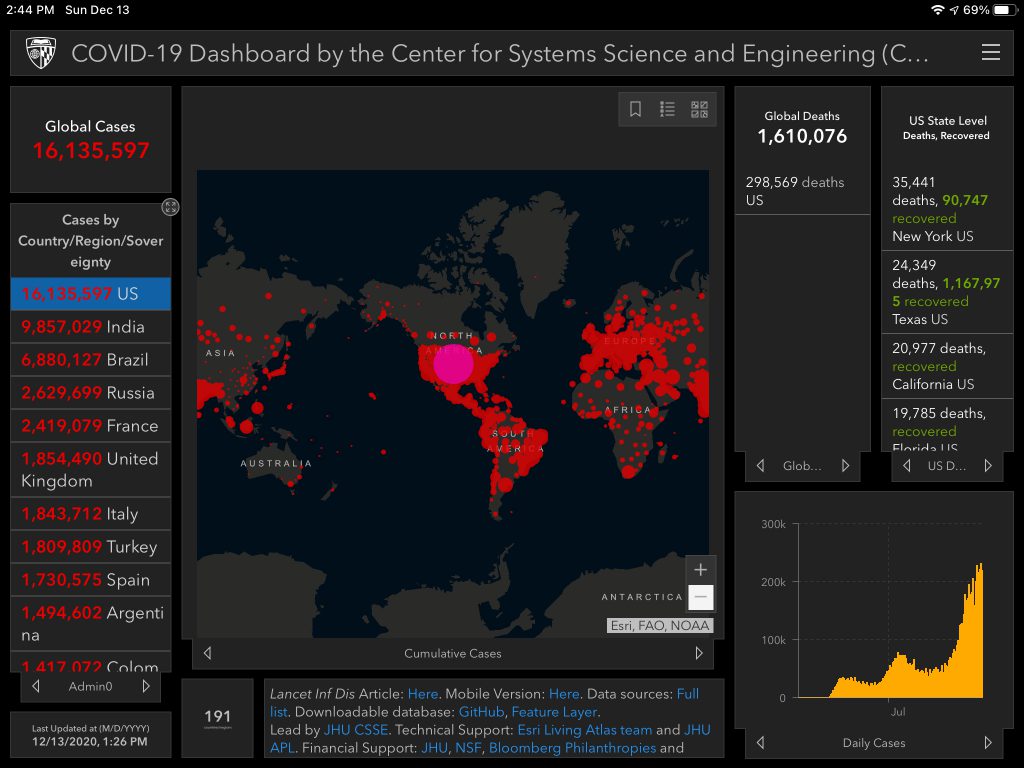

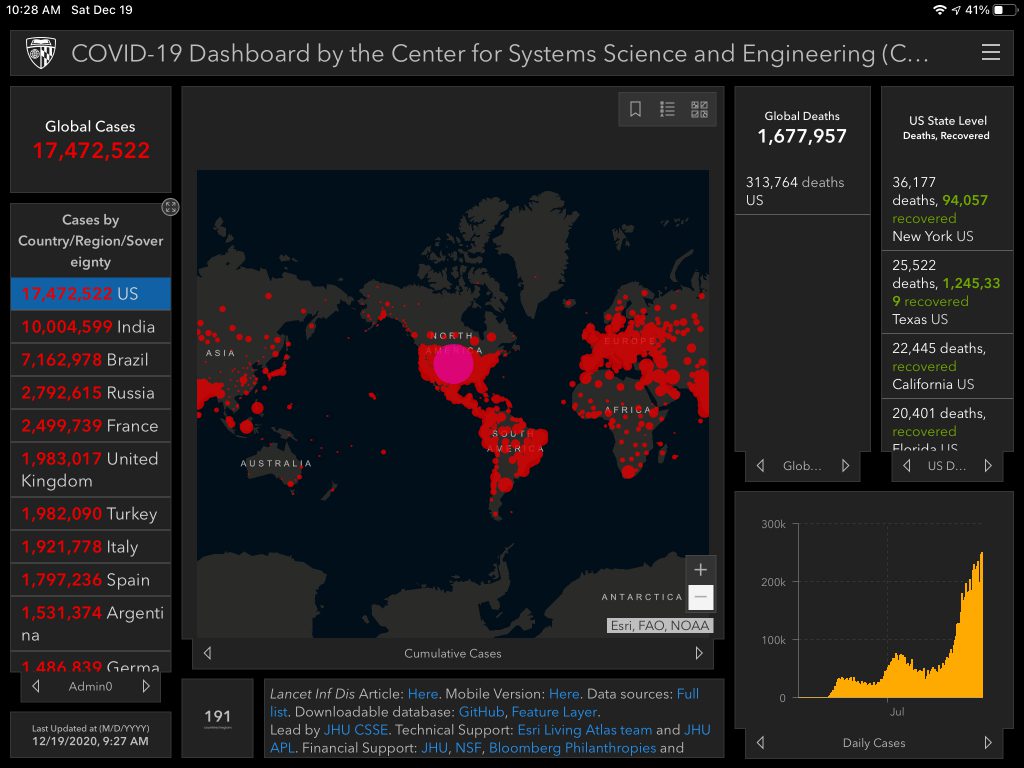

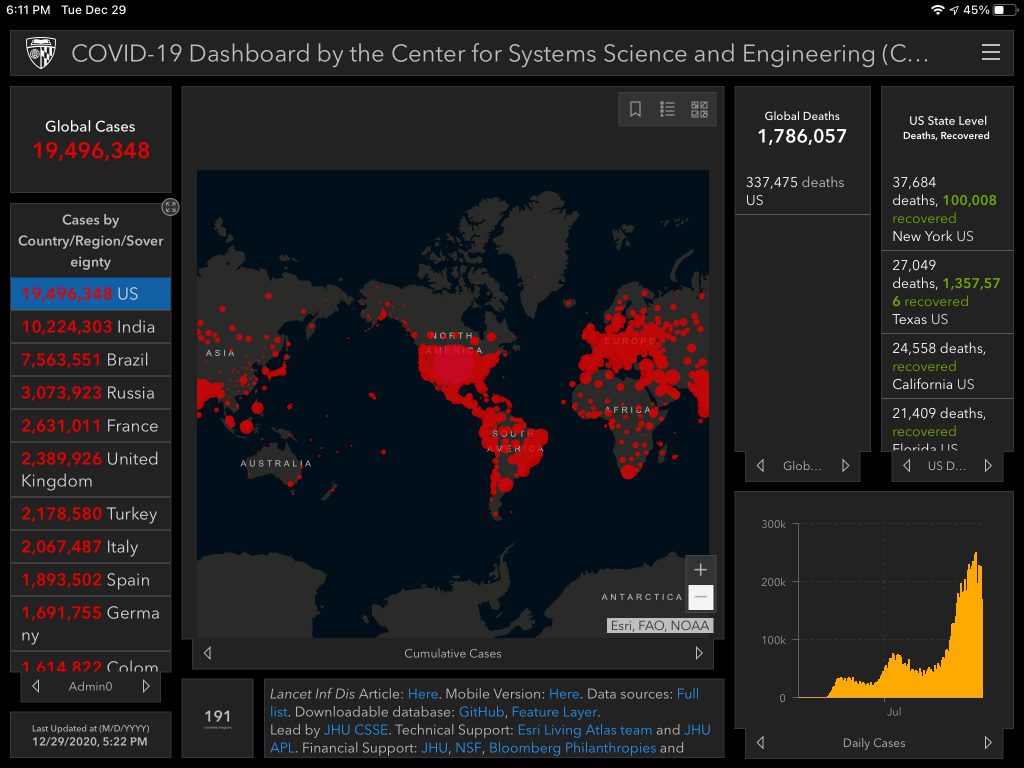

The US crossed 5 million cases.

August 15

Saturday. This is my first update in a week which is the longest break I’ve taken between posts since starting this series back in March. I started a new job last week and have been focusing the majority of my attention on that. I like to get as up to speed as possible, as fast as possible.

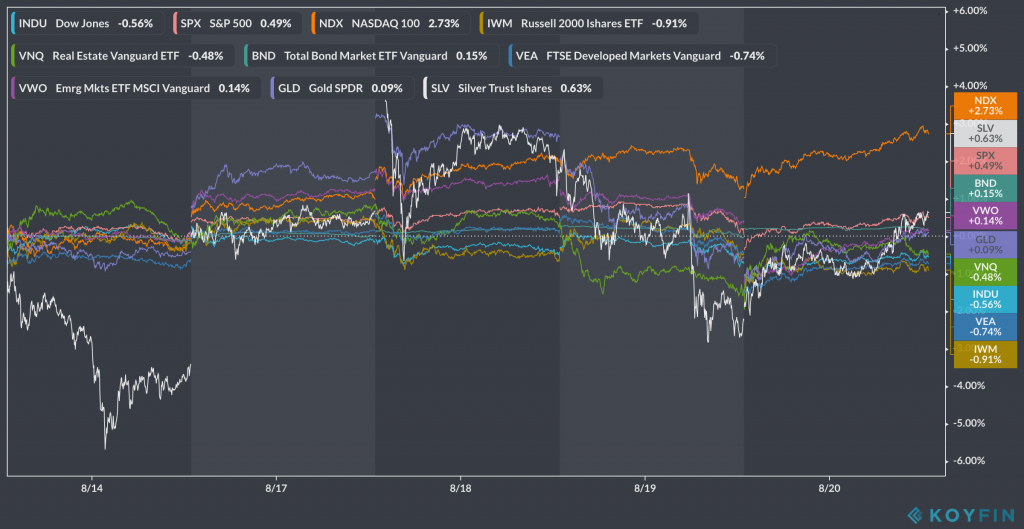

Looks like it was a relatively flat week for the indexes and both Gold and Silver dropped a bit. The S&P 500 actually reached a new high for a brief moment, passing its February high. Here’s a look at the weekly:

Joe Biden chose Senator Kamala Harris as his running mate.

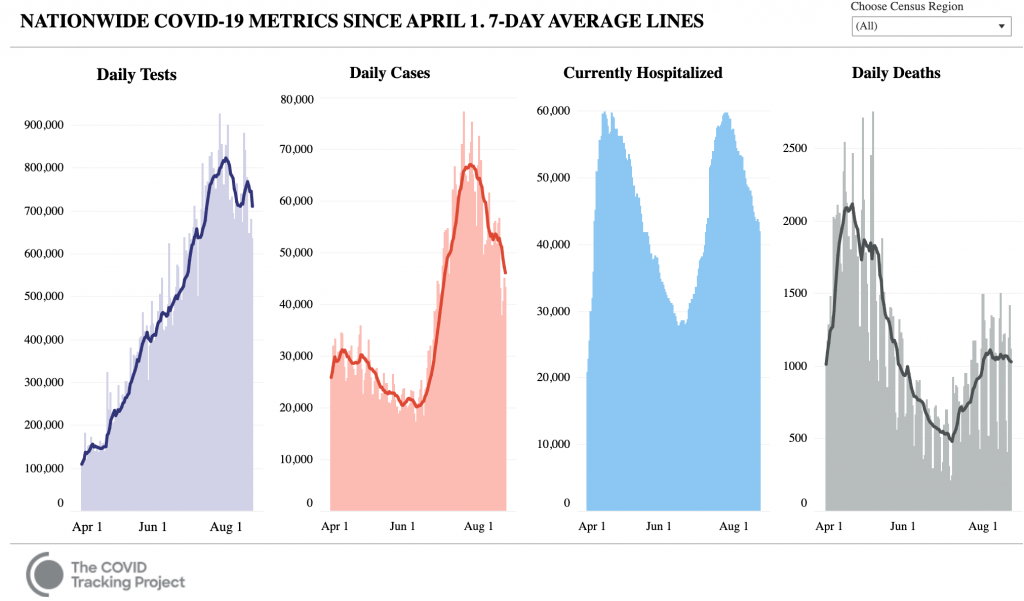

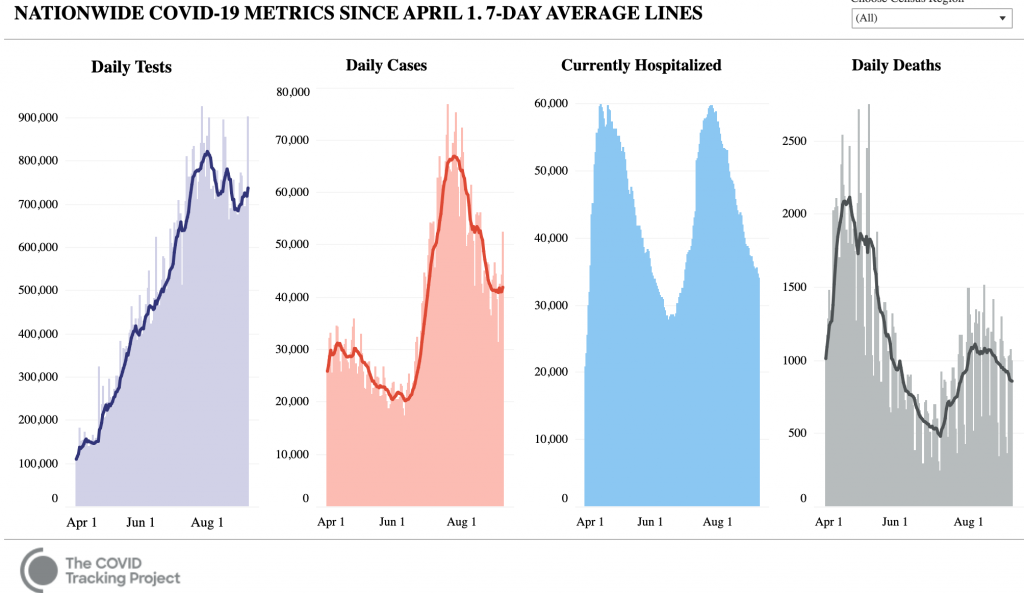

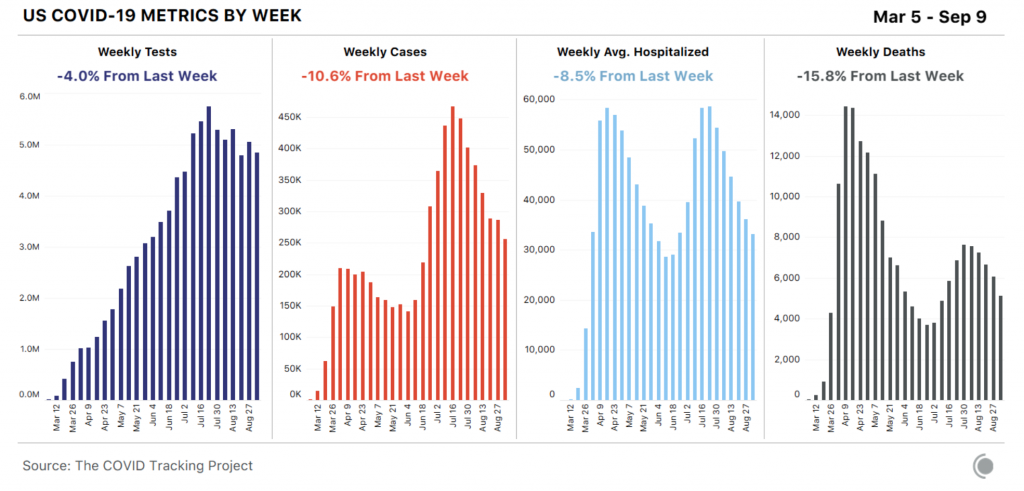

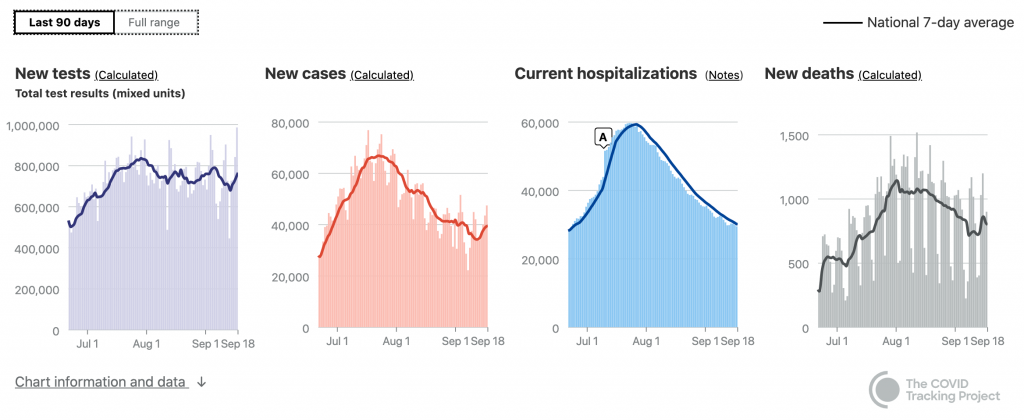

The COVID Tracking Project published its weekly report, Tests, Cases, and Hospitalizations Keep Dropping. “The falls in cases, hospitalizations, and deaths should be good news, and in reality, they likely do reflect an improving reality on the ground. But tests are also dropping, nearly as much as cases are. In an ideal world where the Sunbelt surge is genuinely easing, we’d see increased testing combined with falling case counts.”

August 20

Thursday. The Nasdaq led, closing +1% followed by the S&P 500 +.3%, Dow +.2%, and the Russell 2k which dropped -.5%. Silver is up 1.1% and Gold is up .6%. Tesla crossed $2,000/share. Here’s what the week looks like so far:

Jobless claims rose another 1.106M. The total since mid-late March is ~57M. For context, the entire GFC of 08-09 saw just over 37M. This was the first increase in 3 weeks.

Wildfires are raging throughout California. “More than 50,000 residents have been evacuated as blazes rage across the state, burning over 500,000 acres… Beyond the fires burning north of San Francisco, blazes are forcing evacuations in Santa Cruz and San Mateo counties to the south, along with Santa Clara near Silicon Valley. Smoke has blanketed the Bay Area, with San Franciscans finding cars covered in ash and a city that smelled like a camp fire.”

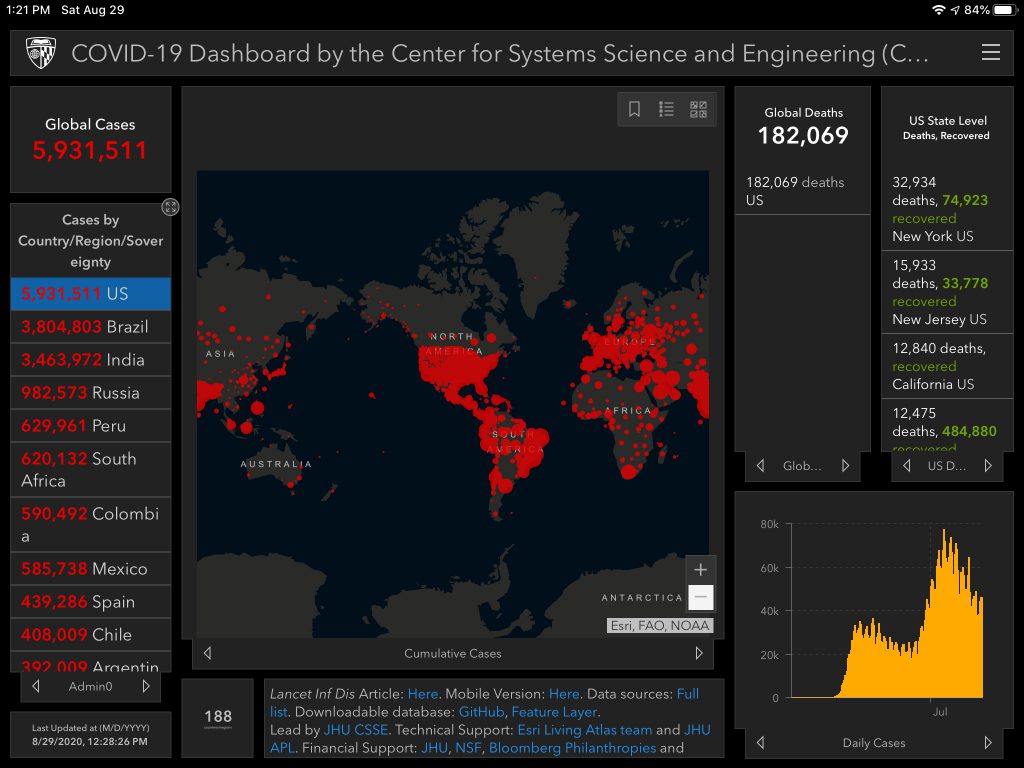

August 29

Saturday. Two more trading days left in the month. Here’s how August looks so far:

I recently switched jobs so I’m in the process of rolling my 401k into my IRAs. The check’s in the mail. I don’t think there could be a better time than now to do a rollover– zero concerns given the height of the markets.

Bloomberg published Job Cuts at MGM, Coca-Cola, Boeing Herald Economic Pain Ahead. “Global corporations have announced more than 200,000 job cuts or buyouts in recent weeks, a worrying sign that more losses will come as furloughs implemented early in the pandemic turn into permanent layoffs.”

College students across the country have made their way back to campus in recent weeks. CNN published Coronavirus outbreaks identified at 4 sororities at Kansas State University. “More than 60 US universities and colleges in at least 36 states have reported positive cases of Covid-19, and some have returned to remote learning to try to stem the spread. More than 8,700 infections among American college students and staff were reported through Friday, as the nation approaches 6 million confirmed cases.”

The week’s blog post from COVID Tracking Project is encouraging: Testing Looks Shaky But National Progress Continues. “Though testing across the US can’t seem to regain the peak of late July, we believe conditions on the ground are improving across the country—and that the data states report is, by and large, trustworthy.”

September

Sept 5

Saturday. Labor Day weekend. Equities dropped Thursday and into Friday. The Nasdaq dropped nearly 5% on Thursday. The mild drop doesn’t bother me because I have a check in the mail for a 401k rollover, and I’ve been waiting for a much bigger drop than this to deploy the rest of the cash in my portfolio back into the market. Of course, it doesn’t look so bad when you zoom out a bit, even just by looking at the week:

Jobless claims rose another 881k. The total since mid-late March is ~59M. For context, the entire GFC of 08-09 saw just over 37M. This was the first increase in 3 weeks.

I started watching Hard Knocks. I don’t really care about sports, but I always enjoy this show… maybe because I’m a closet reality TV fan. There, I said it. Anyway, the first episode will serve as a good history lesson in the future. It clearly demonstrates the extent to which COVID has disrupted norms.

New Covid-19 Death Forecast Sees Big Cold-Weather Boost in Cases summarizes new projections from the Institute for Health Metrics and Evaluation at the University of Washington’s School of Medicine. “Covid-19 deaths could rise to 410,451 by the end of 2020. In a worst-case scenario, there could be 620,029 fatalities, according to the estimates.”

Dr. Fauci issued a pre-Labor Day warning to 7 states who are specifically at risk of seeing cases surge: North Dakota, South Dakota, Iowa, Arkansas, Missouri, Indiana, Illinois.

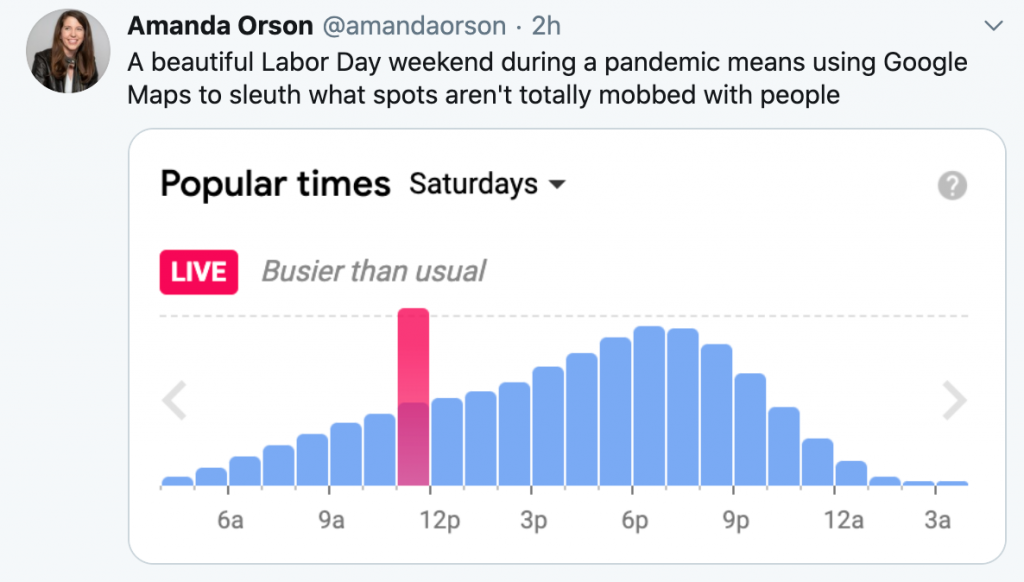

Pandemic holiday weekends require doing things like this:

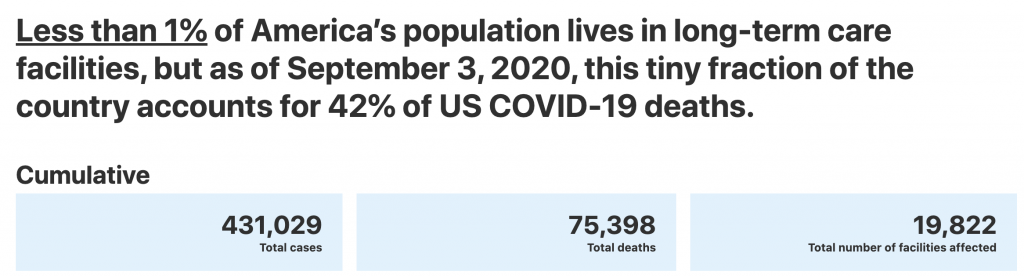

The COVID Tracking Project launched The Long-Term Care COVID Tracker.

Sept 12

Saturday. Here’s a look at markets this past week:

Howard Marks was interviewed on CNBC on Wednesday: “I think we’ve developed a real dichotomy between the things that are obviously successful but expensive, and the things that look low-priced but are challenged in terms of business. And big money will be made by buying the latter which works in my opinion…”

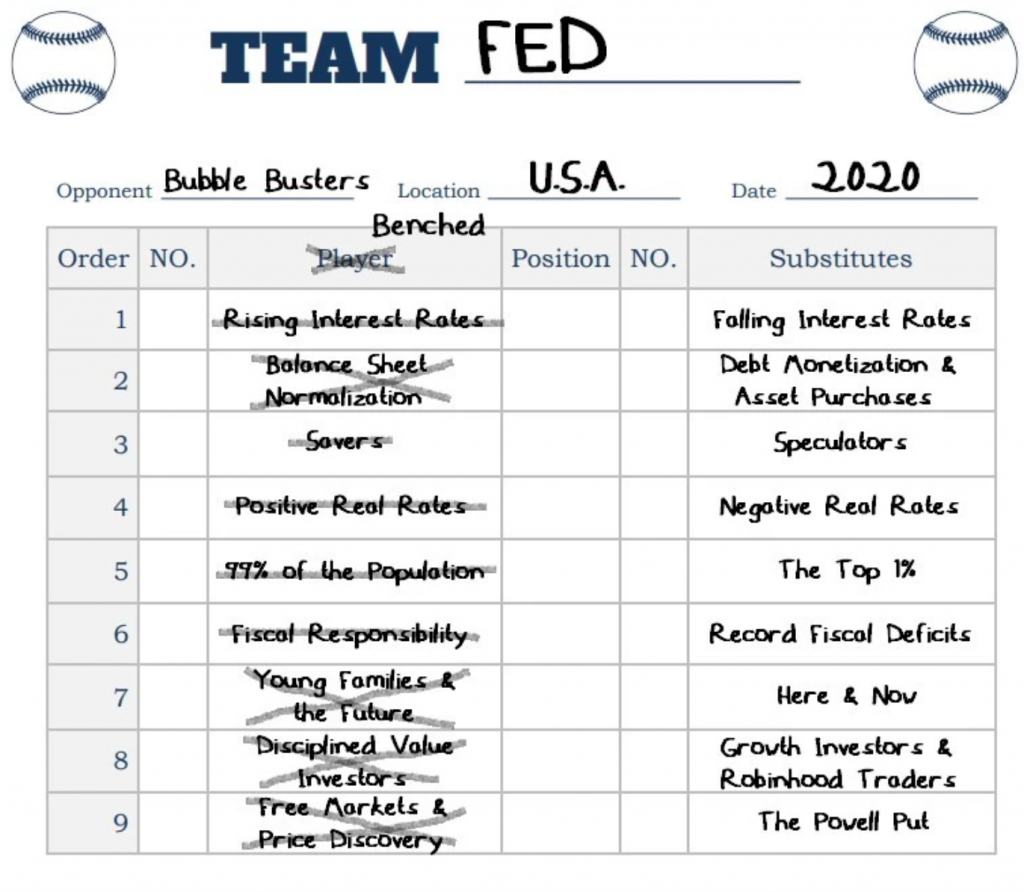

Eric Cinnamond at Palm Valley Capital Management published Daddy Ball. As usual, it doesn’t disappoint. “And finally, Young Families and Future Generations, Disciplined Value Investors, and Free Markets and Price Discovery were also benched. Despite their well-known shortcomings in previous seasons, Coach Powell was favoring Here and Now, Growth Investors and Robinhood Traders, and Coach’s new favorite rookie, his son, The Powell Put!… While the intention of daddy ball is usually to help, it can be quite harmful. Players handed positions without working for them are less likely to practice or play hard. As a result, beneficiaries of daddy ball may develop into less talented and less competitive players. Daddy ball can also be counterproductive for the team and is typically unsustainable… Whether it’s this season or next, we believe parents (grown-ups) will revolt, Coach Powell will lose control, and the team’s fair-weather fans will be deeply disappointed. And for the talented players sitting on the bench who are frustrated and confused: Keep your chin up, continue to work hard, and be patient—your time will come!”

Recent quarantine entertainment in our household has been dominated by Rectify.

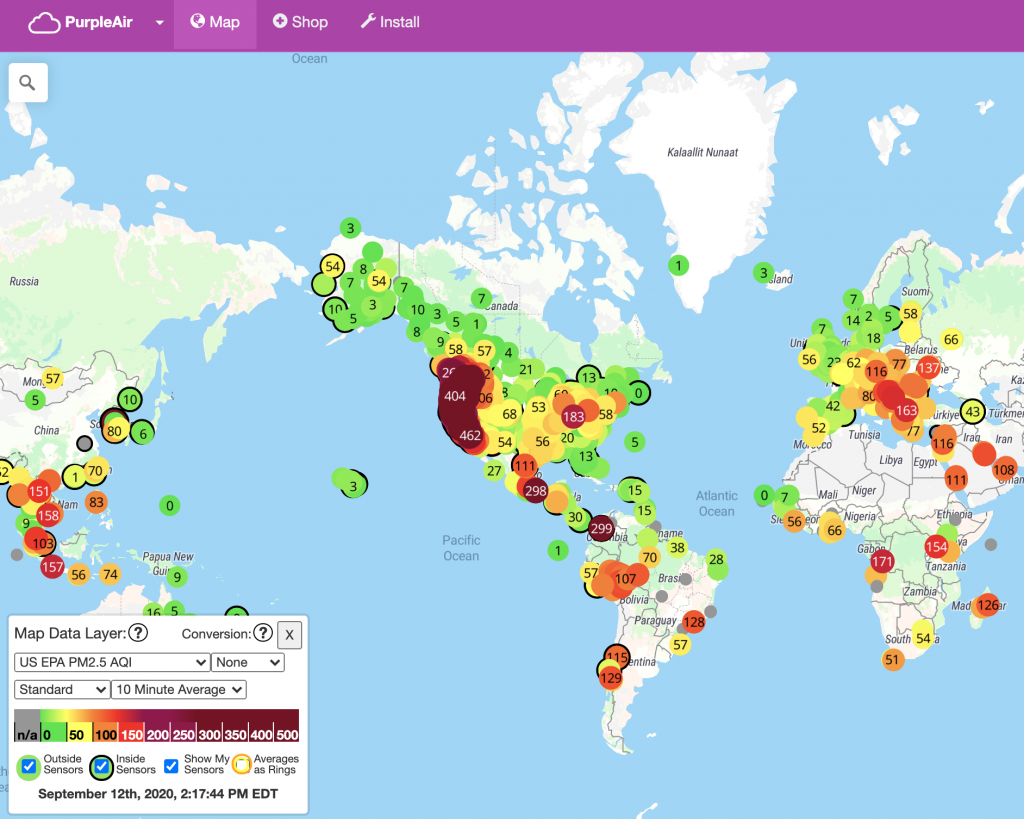

Wildfires are ripping through parts of the West Coast, resulting in many miles of the worst air quality in the world.

Sept 19

Saturday. Here’s a look at markets this past week:

And zooming out to YTD:

Wknd notes by Eric Peters returned after taking a summer break. This week’s post is titled Until Inflation Returns… “When economy-wide debt reaches levels where each incremental dollar yields very little real economic growth, either cascading defaults will accompany a recession, or government fiscal and monetary policy coordination is applied to obfuscate the problem and eventually inflate it away. The US and by extension the developed world have chosen the latter, having no appetite whatsoever for the former. Neither path is right or wrong, just different. Each carries profound risks, though unique. And on each, heightened volatility is inevitable. That is my bias… Because the conditions of the late 1930s and today bear numerous similarities. Which suggests a tumultuous decade ahead, as we discover whether we’ve developed the wisdom and humility to respect nature – that which surrounds us, and that within us.”

Supreme Court Justice Ruth Bader Ginsburg passed away yesterday at 87 years old. In 2002 she said, “I had the good fortune to be alive and a lawyer in the late 1960s when, for the first time in the history of the United States, it became possible to urge before courts, successfully, that society would benefit enormously if women were regarded as persons equal in stature to men.” Saira Rahman shared:

As if poor air quality wasn’t bad enough, residents in Southern California had a 4.5 magnitude earthquake last night, 10 miles from LA.

Here’s an updated shot of the global COVID death toll from FT.com:

Last 90 days according to the COVID Tracking Project:

October

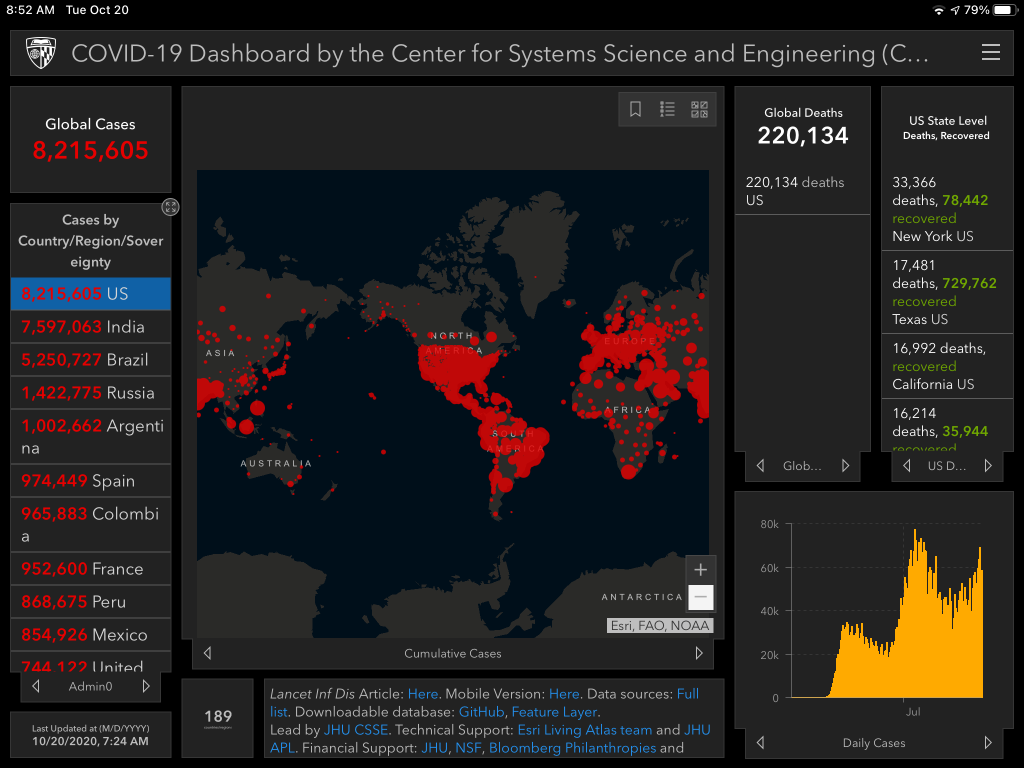

Oct 20

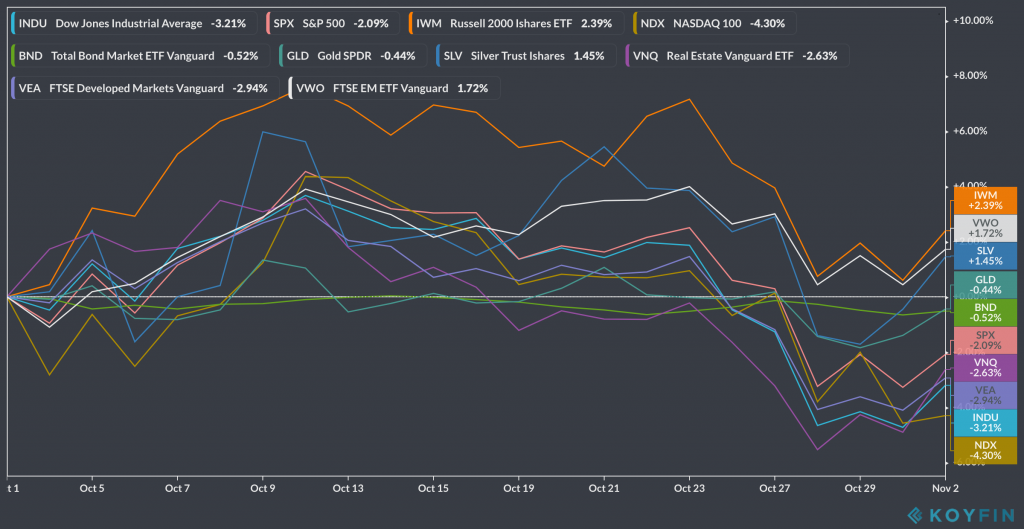

Tuesday. Here’s a look at the MTD:

I looked closely at some of my March buys that are up ridiculously. Unfortunately, I was just dipping my toes and didn’t buy many shares, so the profits aren’t meaningful to me. $PTON +620%, $TWST +213%, $KMX +142% are a few that are up more than 100%. I’m not sure what the lesson here is, and I don’t think I can know for another few years. As of now, I’m still pleased with my overall defensive allocation. It helps me sleep well at night. I still think there’s a good chance of a painful downturn.

Howard Marks & Oaktree published Coming into Focus. “The stock market is back near the high reached in February and selling at an above average valuation (as described earlier). The only things that appear to be low-priced are the ones that appear fundamentally most risky, such as oil & gas, retailers and retail real estate, office buildings and hotels, and low-rated tranches of structured credit. As I said earlier, everything appears to be fairly priced relative to everything else, but nothing is cheap thanks to the low base interest rate. Thus, after a brief foray into bargain-land in March, we’re back to a low-return world. But since most investors haven’t reduced their required or targeted returns, they have to engage in elevated risk in order to pursue them…. Thus the odds aren’t on the investor’s side, and the market is vulnerable to negative surprises. This is how I described the prior years, and I’m back to saying it again. The case isn’t extreme – prices aren’t grievously high (assuming interest rates stay low, which they’re likely to do for several years). But it’s hard in this context to find anything mouth-watering.”

November

Nov 5

Thursday. The only portfolio moves I’ve made in the past few weeks are a few small purchases of $IDN, $DJCO, and $KRMD. Here’s a look back at October:

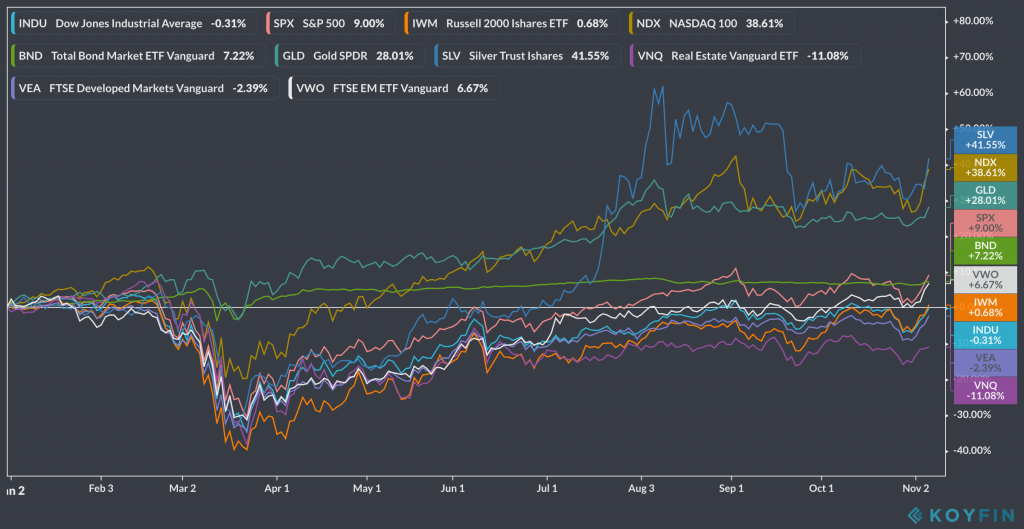

And here’s a look at the YTD:

It’s worth throwing in a look at $BTC given the recent pump:

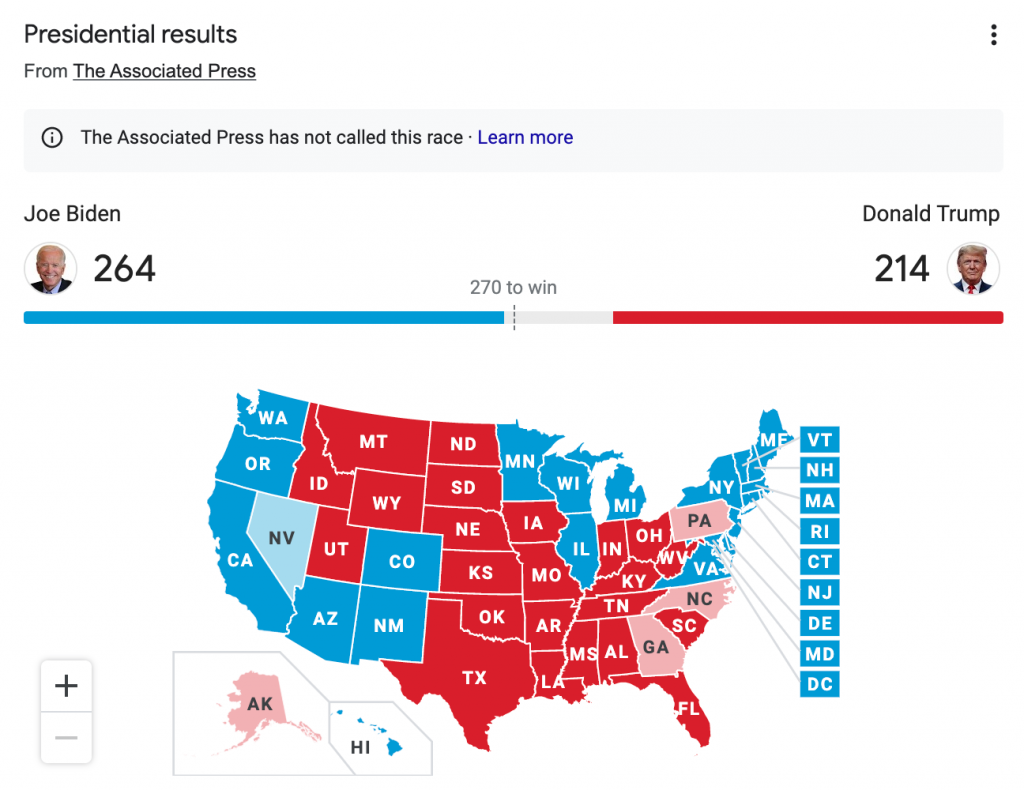

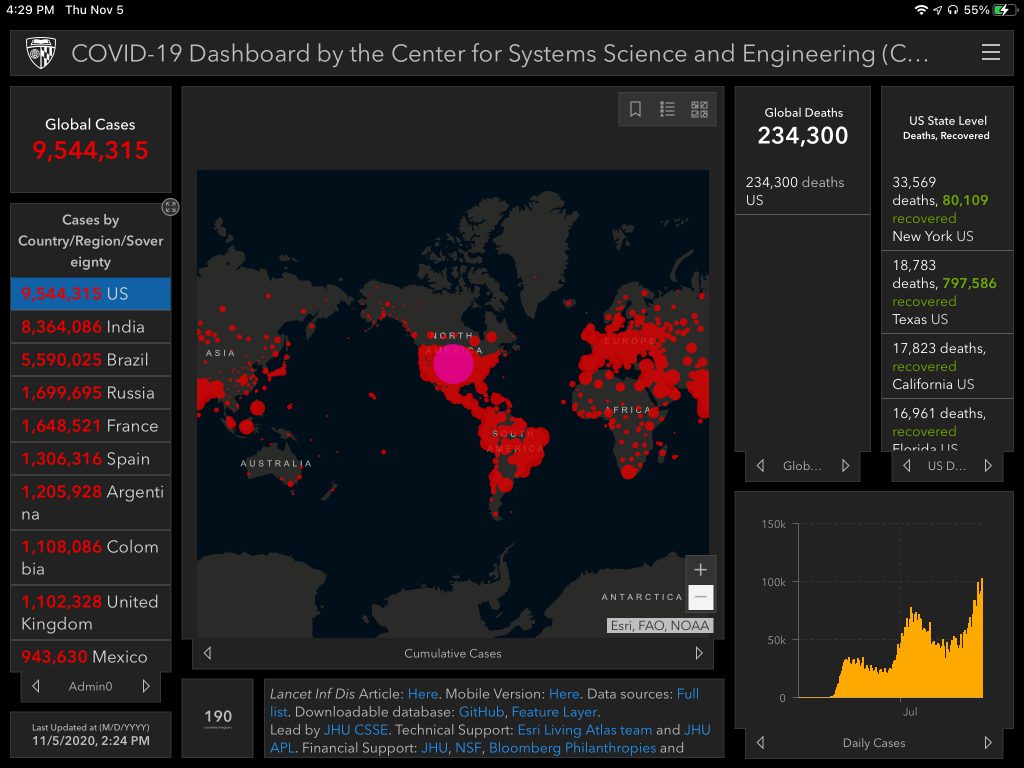

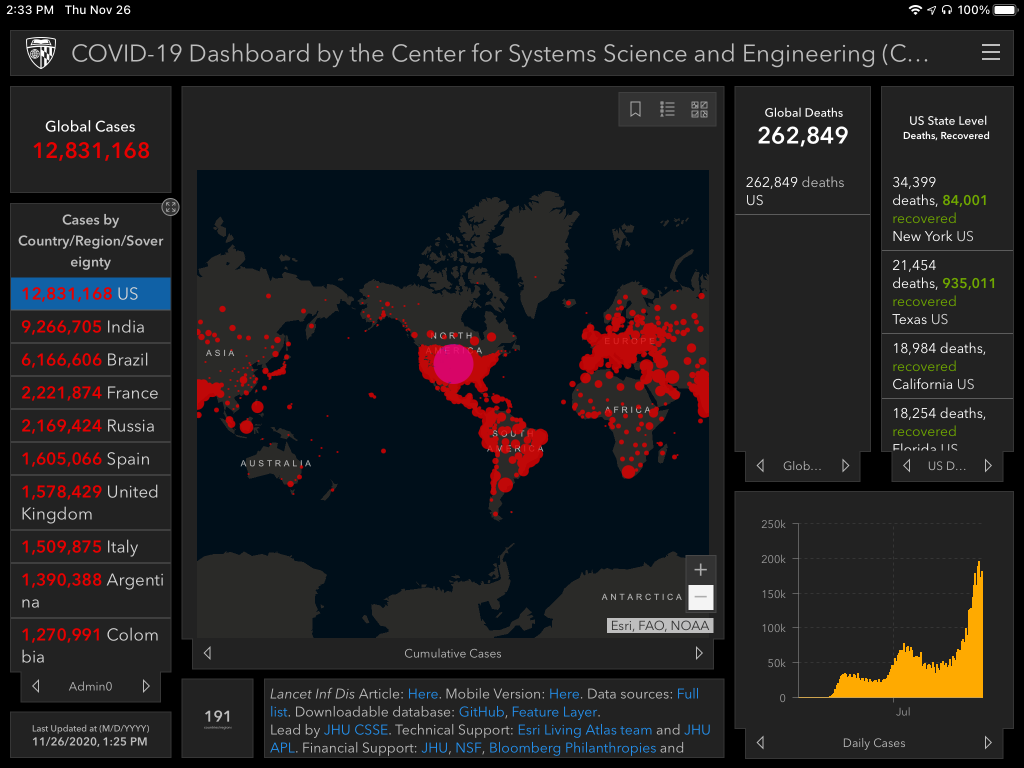

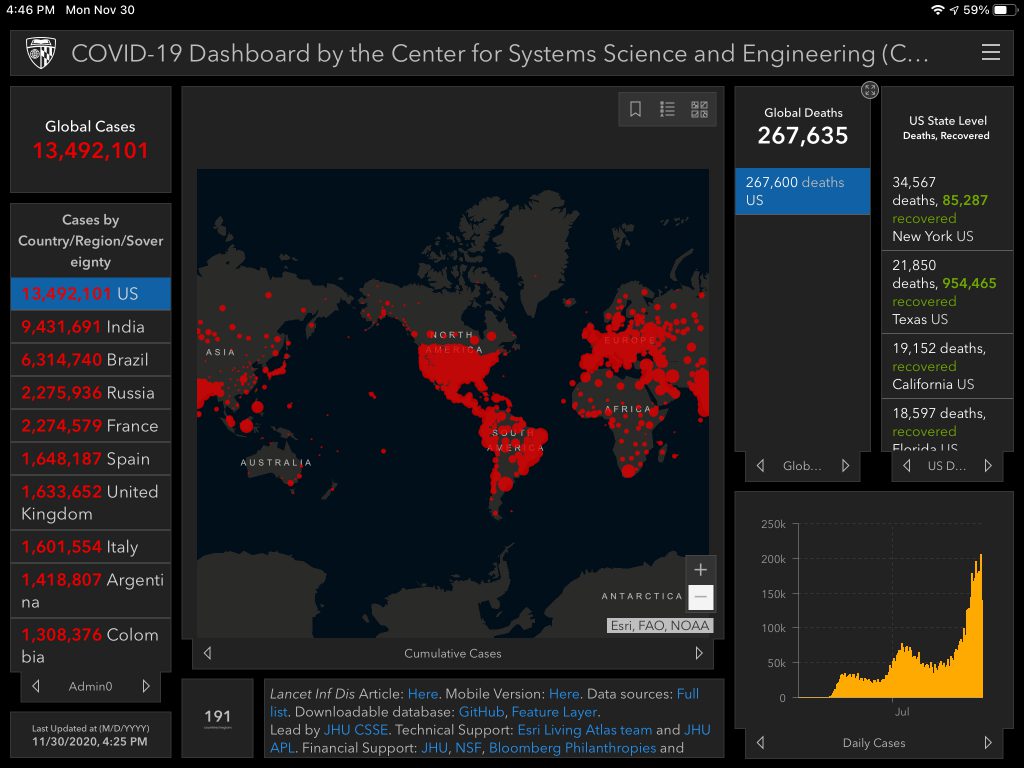

What else is going on right now? This:

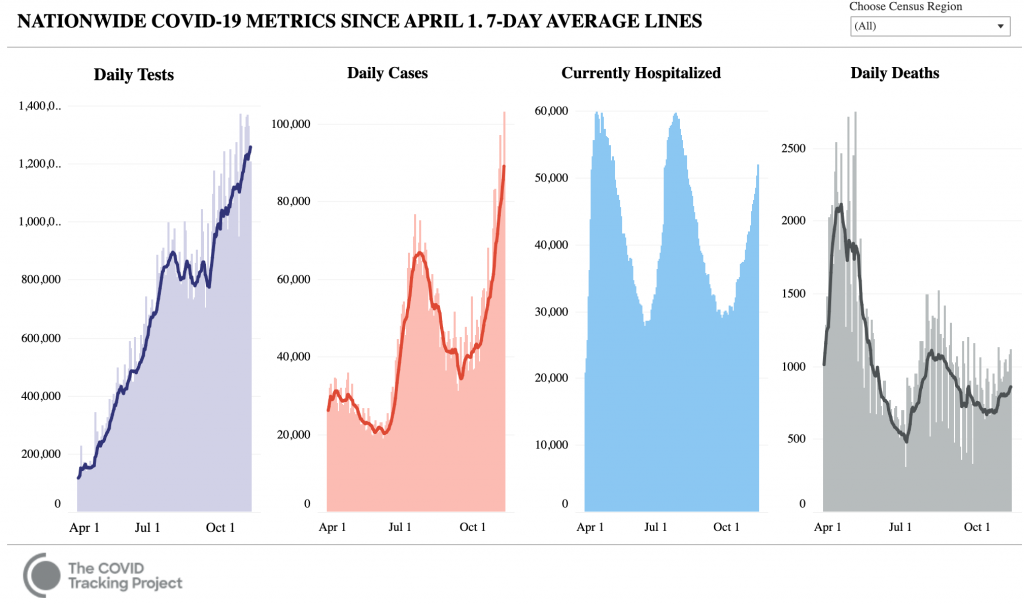

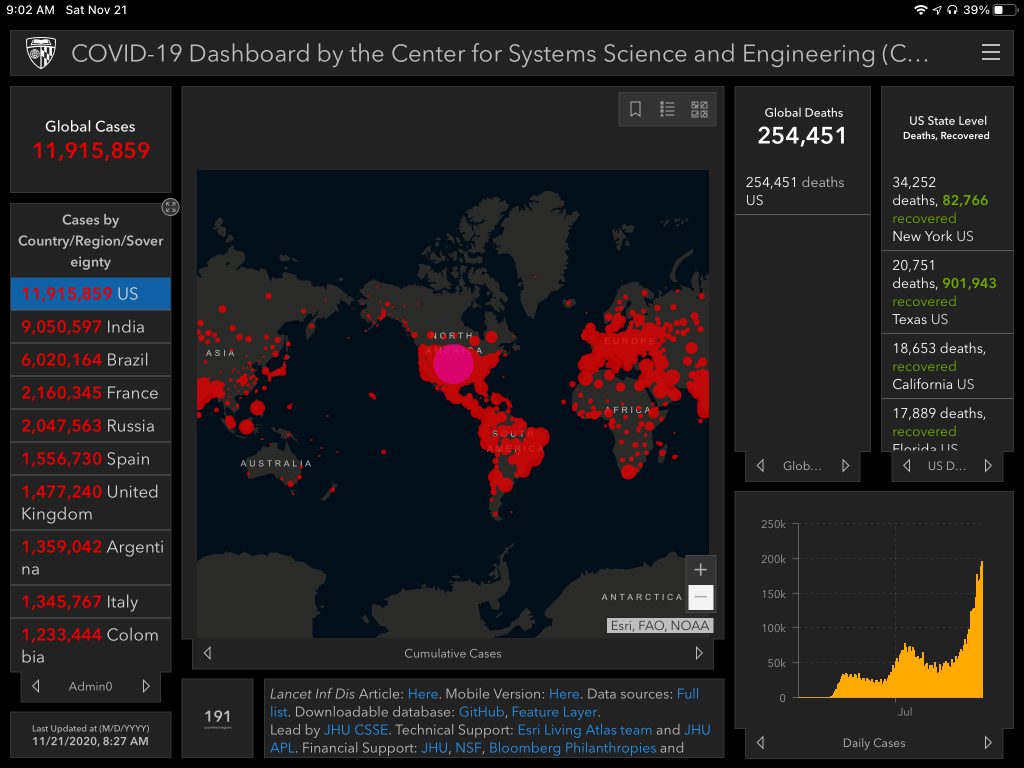

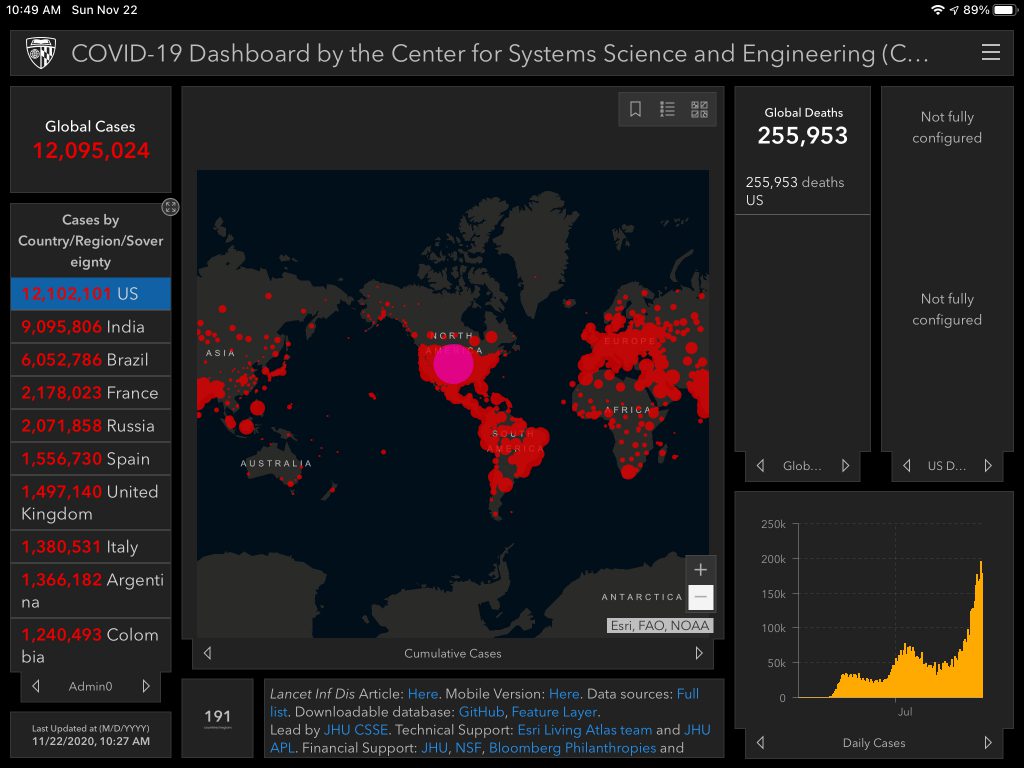

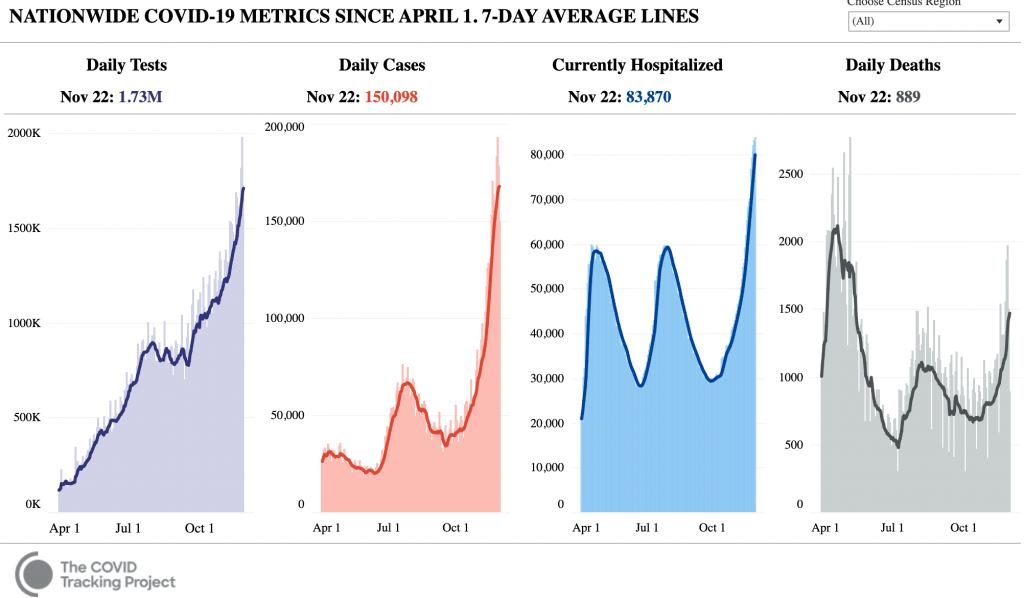

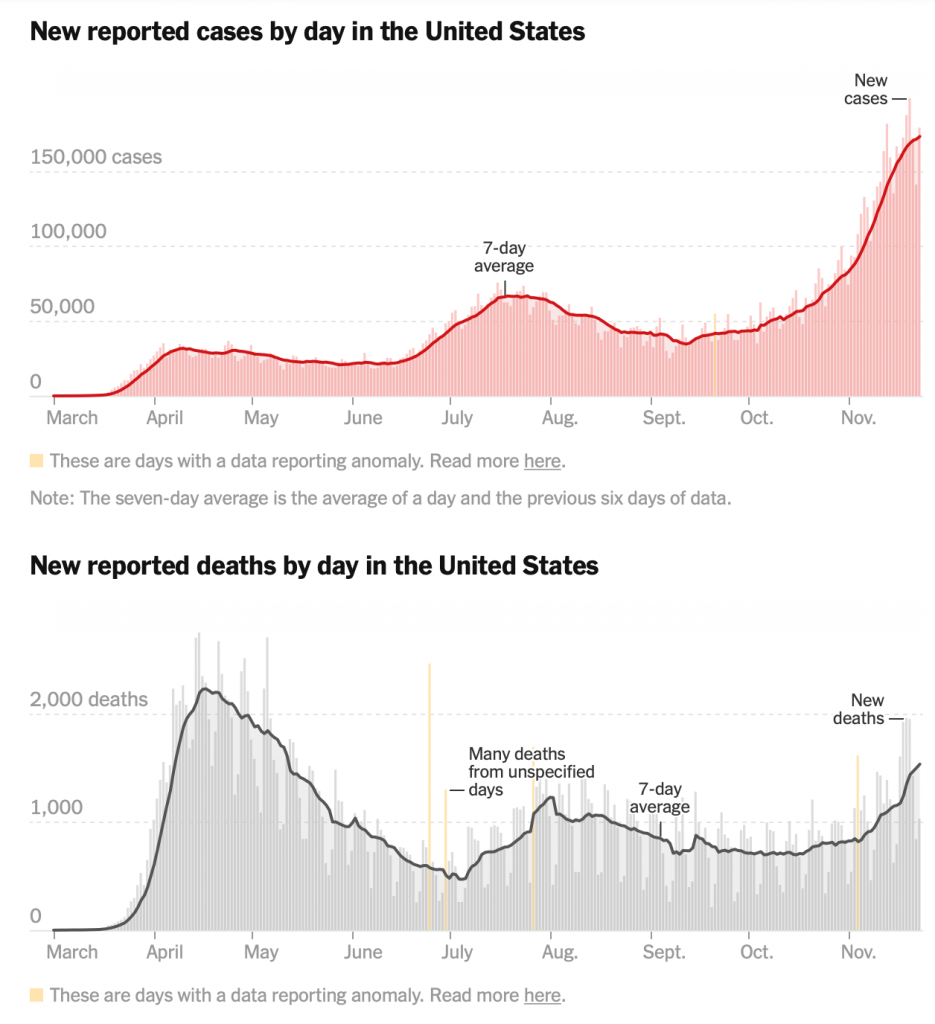

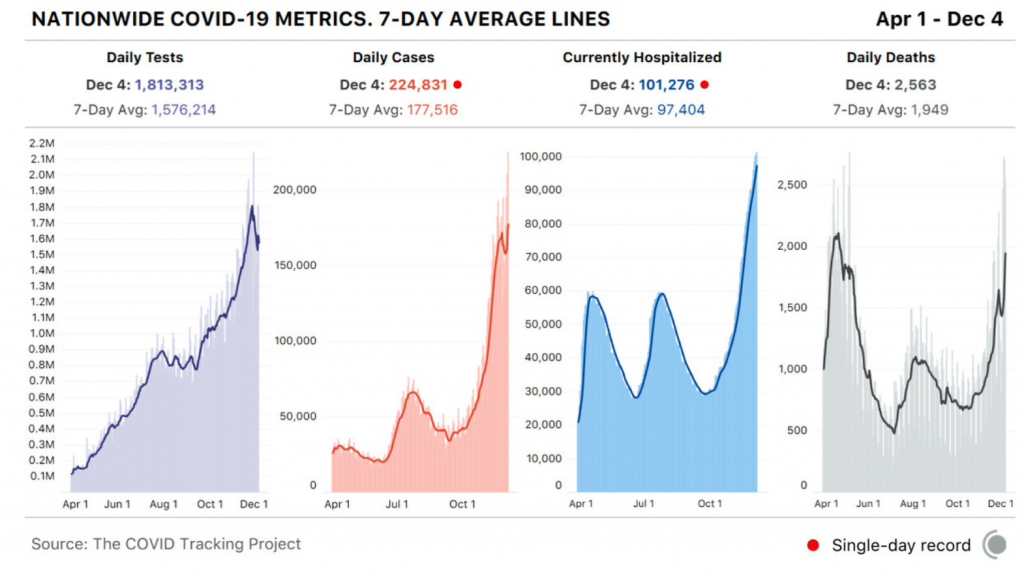

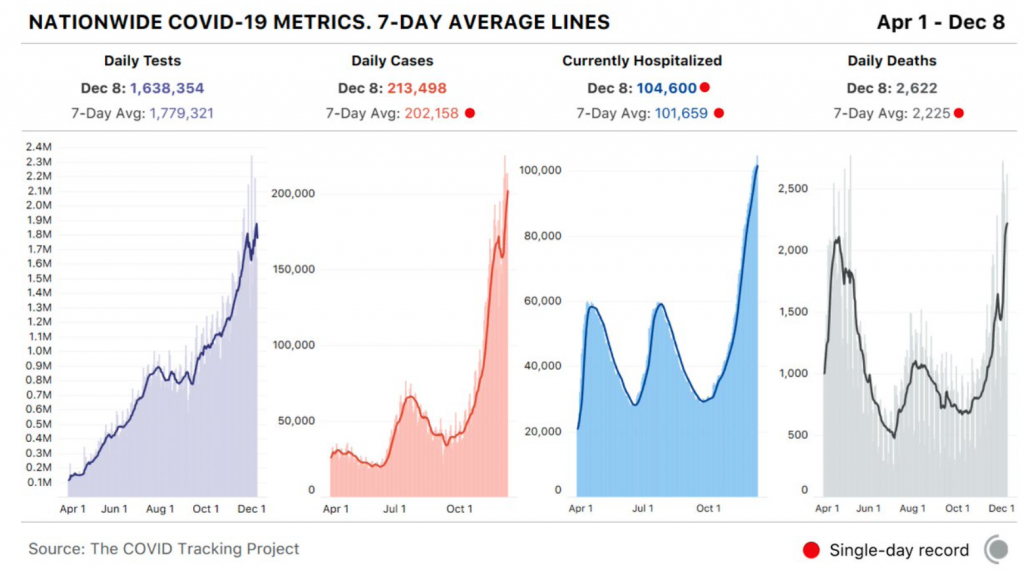

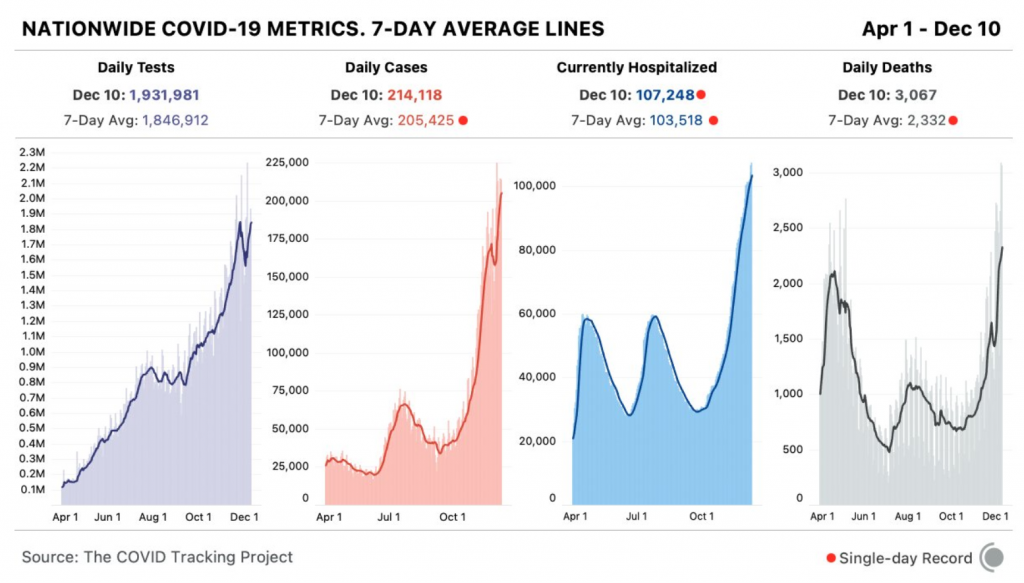

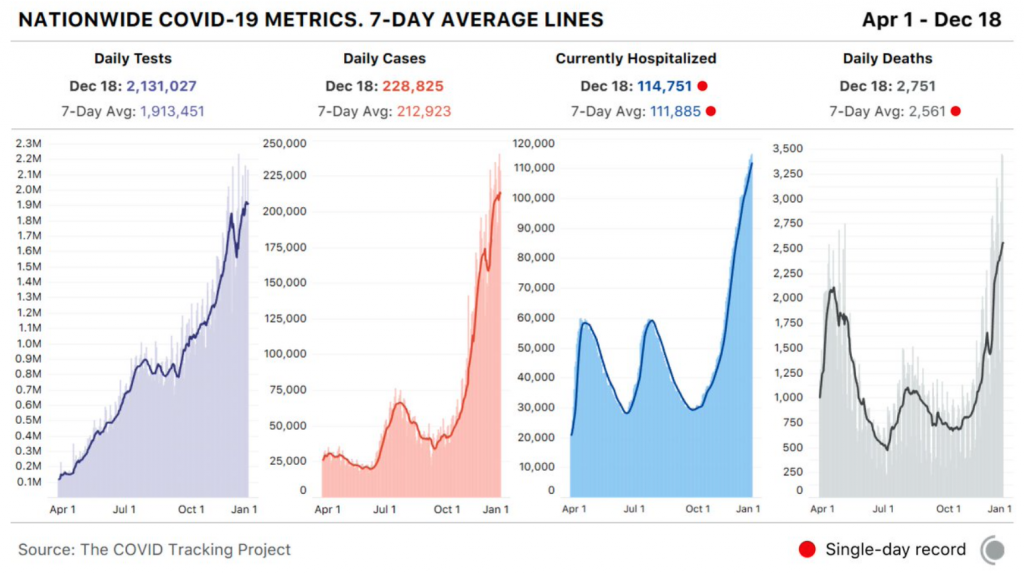

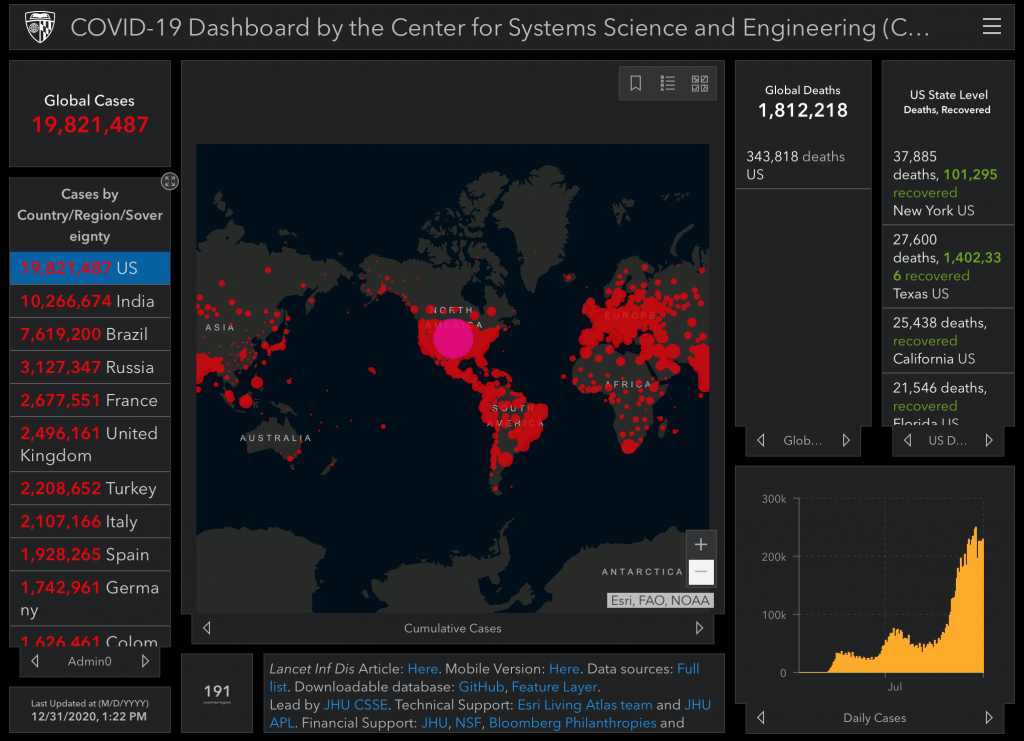

Oh yeah, COVID’s still here (surprise!). The US just had a record case day with 102,831 positives.

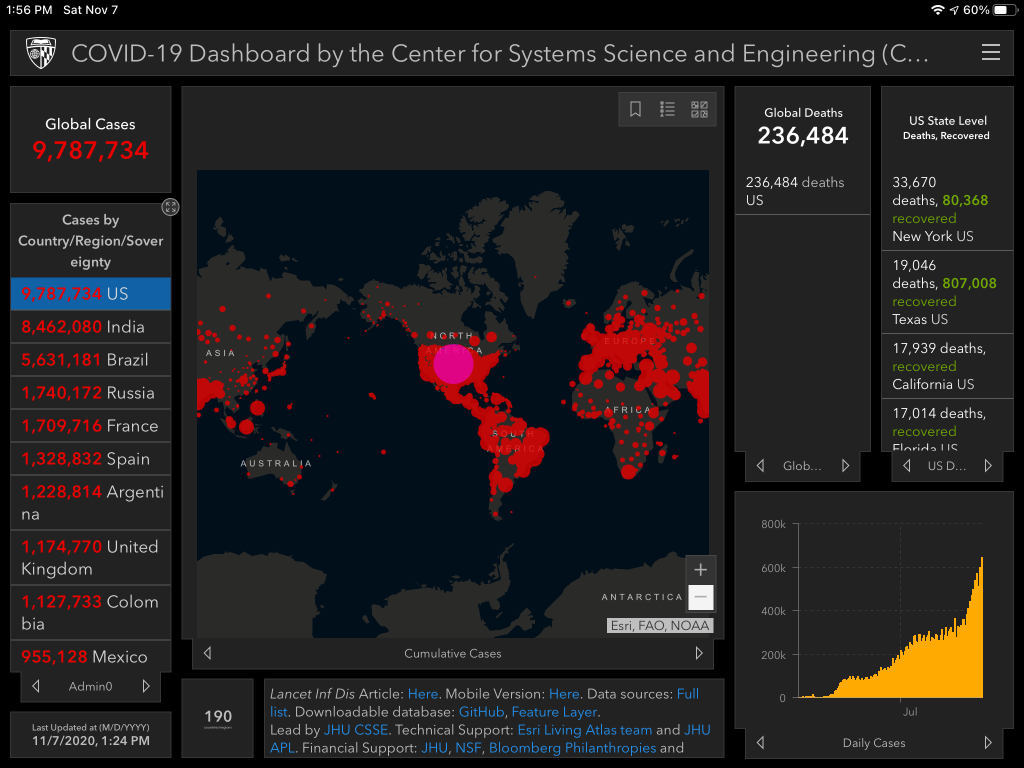

Nov 7

Saturday.

Nov 15

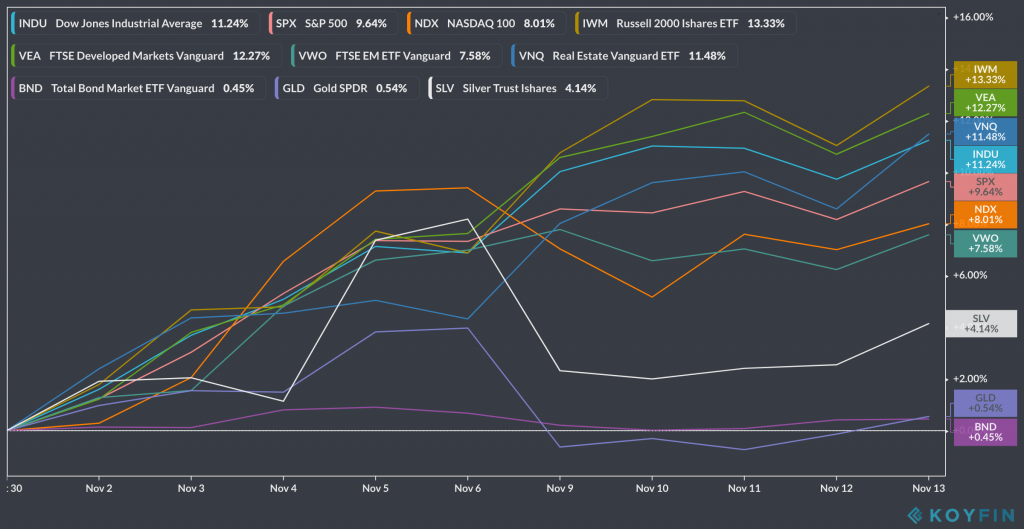

Sunday. Small-caps are having one of their best starts to a month ever, outpacing larger caps. Here’s a shot of the MTD:

$BTC is holding pretty strong around $16k. It’s starting to feel a bit like the 2017 run up with the influx of crypto chatter amongst friends who don’t normally have any interest in it.

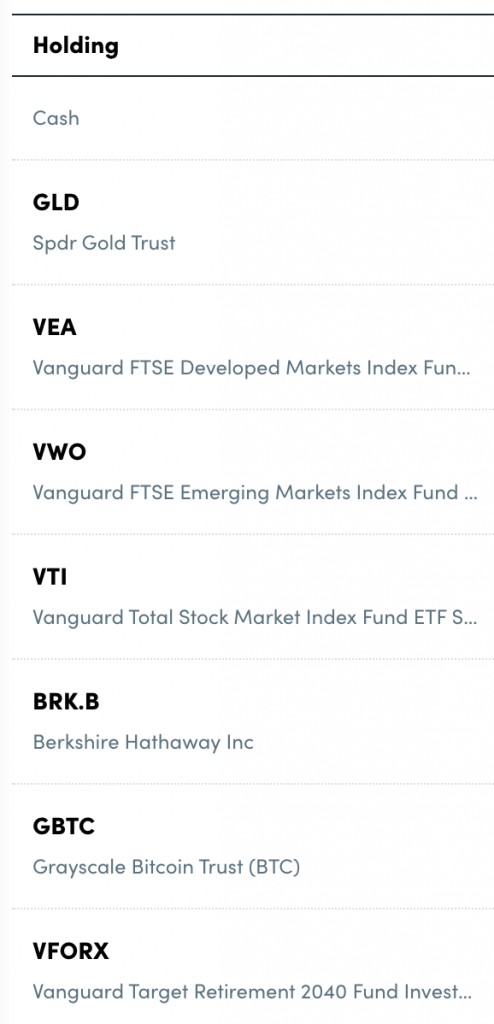

I checked in on my personal performance for the first time since July. Our portfolio is comprised of ~50% cash + alts now. We’re up 19% YTD and 23% in the last 12 months. I can’t complain and in fact, I’m kind of surprised. I haven’t benefited from the gains in most of the high flying tech stocks because I shied away from having a high allocation towards them. My portfolio is pretty weird right now. I don’t even know how to best describe it. But it allows me to sleep comfortably at night, and it’s performing pretty well. If we experience another ~30% drawdown like we saw in March, it’s highly likely my portfolio won’t drop nearly as much (just like last time) and I value that security.

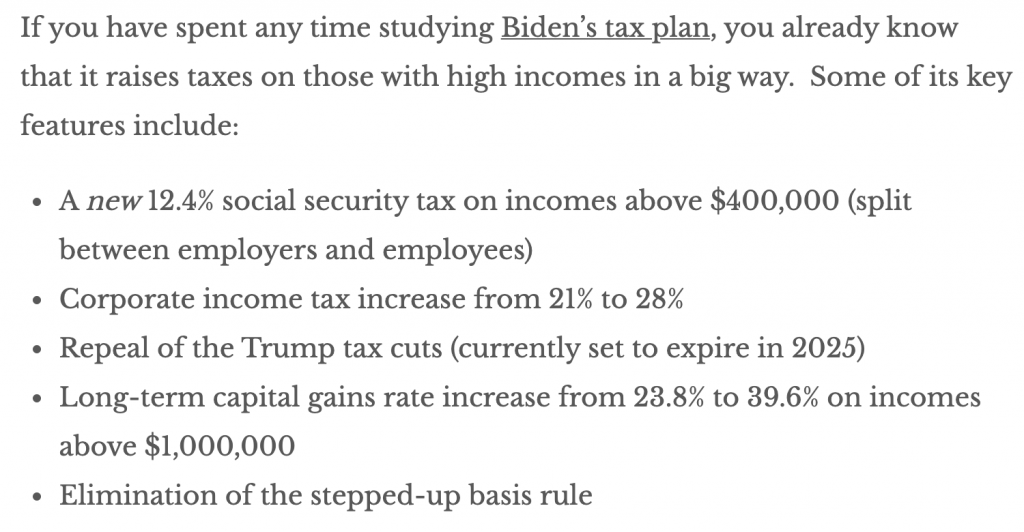

Nick Maggiulli published What a Biden Presidency Means for Your Finances. “If you happen to be somebody that would be impacted by Biden’s proposed tax plan, I wouldn’t worry much at the moment, because it is unlikely that it will pass in the coming year… So while no one knows exactly how markets will perform during a Biden presidency, the bullish case seems to be more convincing than the bearish case as of now.”

Recent quarantine entertainment in our household has consisted of The Undoing, Rebecca, The Queen’s Gambit, and Workaholics (re-runs for me, first time for my wife).

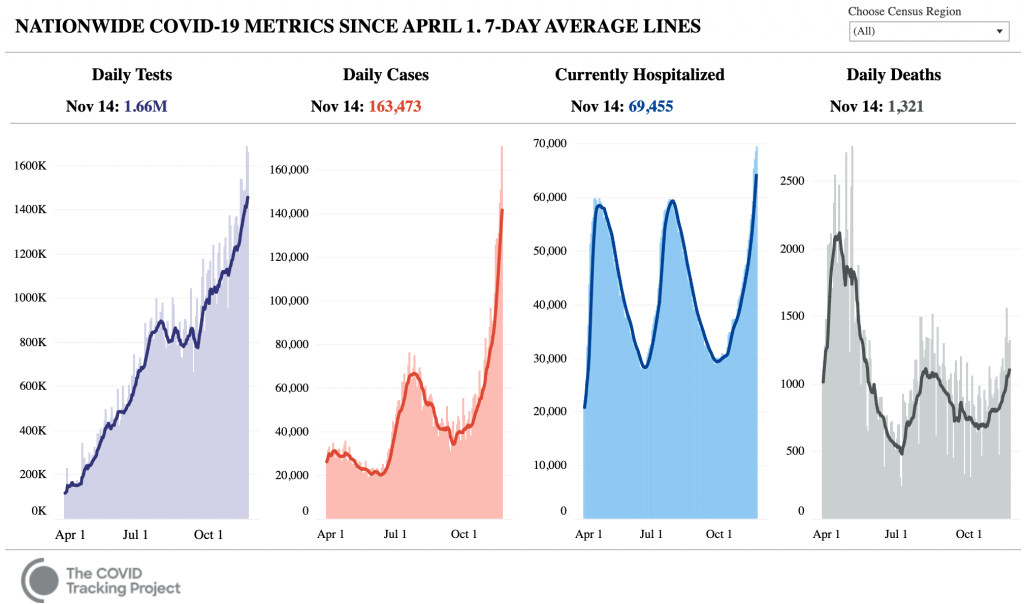

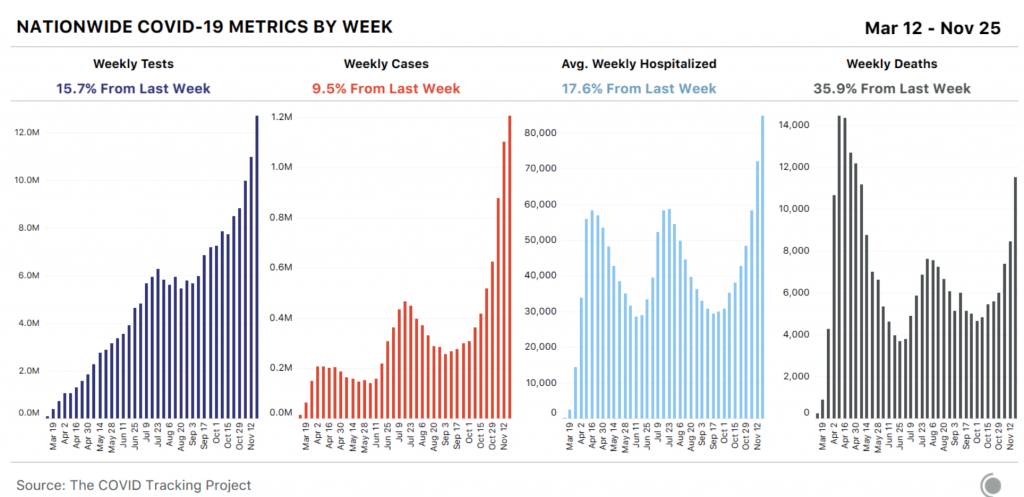

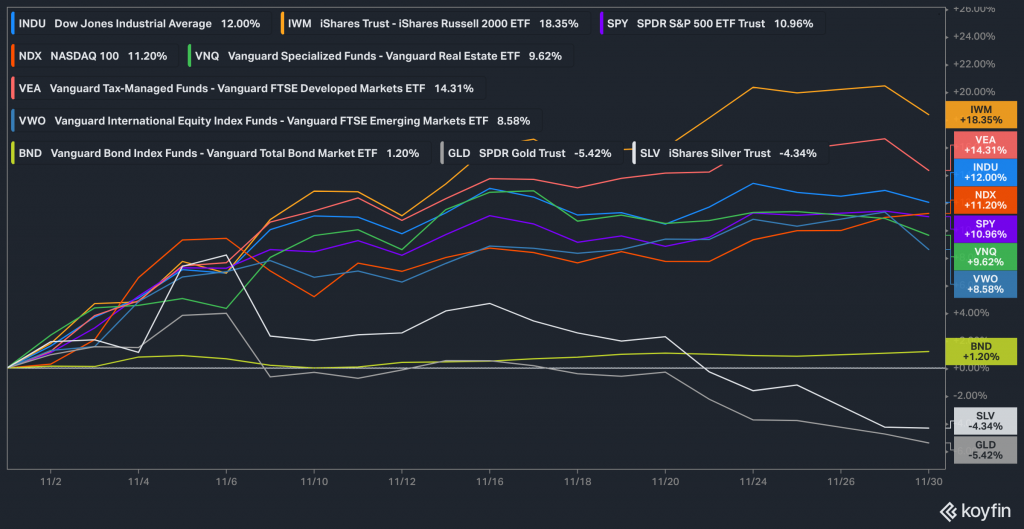

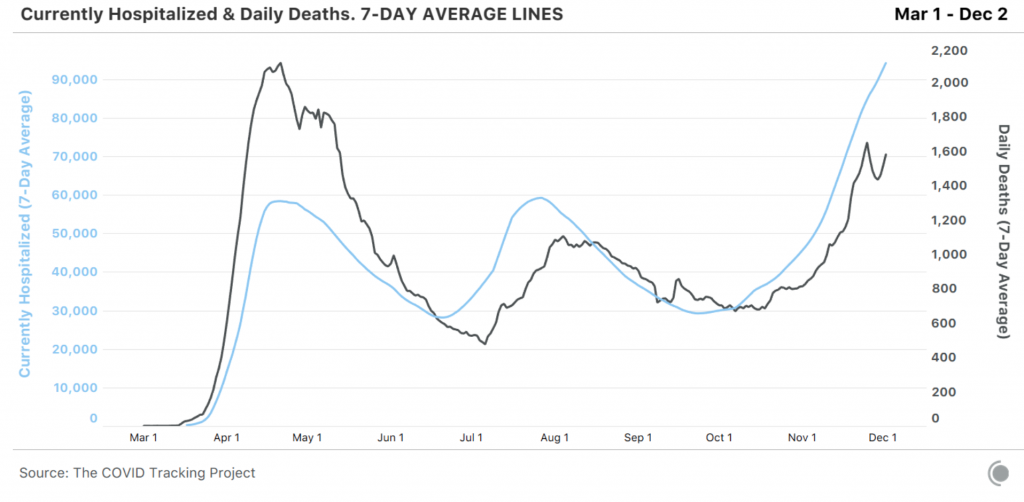

The COVID Tracking Project published their weekly post, A Nationwide Case Surge Hits US Hospitals: This Week in COVID-19 Data. “The number of people who are hospitalized with COVID-19 in the United States has nearly doubled in the past two weeks… the dangerous spike in hospitalizations suggests that further increases in the number of fatalities are imminent. Twenty-seven states this week hit a record for the number of new cases reported.”

Nov 21

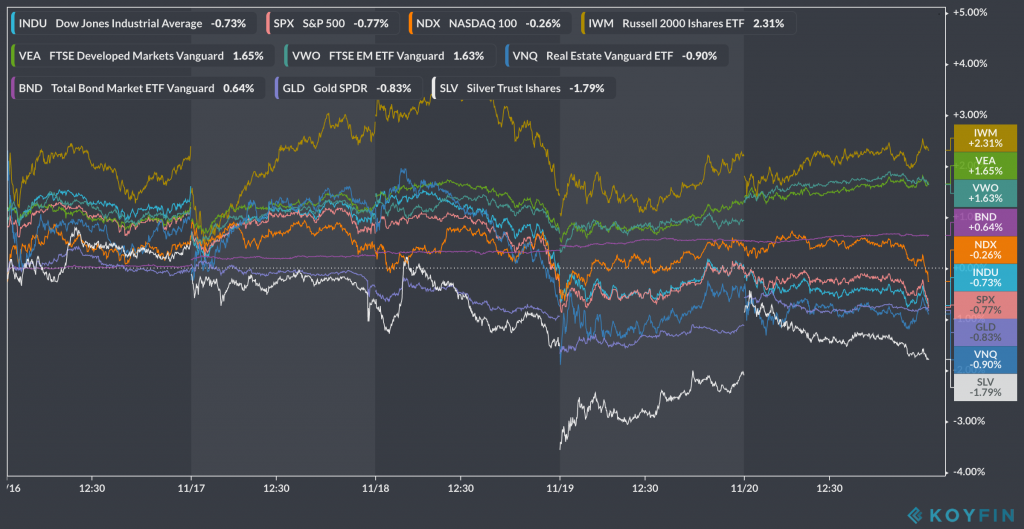

Saturday. Small caps continued to outperform other equity indexes this week. Here are the last 5 days:

What outperformed small caps? $BTC. The interest from people who usually aren’t into it is ballooning, as is the media attention. It’s ascending quickly. Some alts are beginning to jump as well. My only advice is to recognize that it can and likely will have large pullbacks. A 30%+ dip at some point wouldn’t surprise me, especially if it continues flying instead of hanging here at $19k for a while.

US jobless claims rise to 742,000; millions to lose aid. This week was, “the first increase in five weeks and a sign that the resurgent viral outbreak is likely slowing the economy and forcing more companies to cut jobs.”

The latest wknd notes from Eric Peters is out: The Ultimate Intangible Asset. What do you know? This issue features digital currencies. “After the horrific loss of life that looms this winter, amplified by our gross negligence and profound political division, daily life will return to something more normal, perhaps even euphoric, as has been the case throughout human history when our plagues subside. But what will never return is the way that we once looked at money. This coronavirus was the final blow to our collective notion of money as something real. After agonizing for years about multi-hundred billion-dollar deficits, America’s Treasury more or less borrowed $3trln from our central bank. We gave that money to ourselves. But the world didn’t end. The dollar didn’t collapse. Interest rates remained low. Inflation did too. Stock naturally surged. The rich got richer, the poor got poorer. From this blow-off top in inequality, we begin the next stage of a transition that started with the 2016 election and surely has a decade to run. And while no one knows precisely what will happen, we can be quite sure that governments will disburse funds to citizens quickly. Digitally. And we can be certain that a dollar in a decade’s time will be worth a fraction of what it’s worth today… Those most focused on monetary matters sought protection from the government’s concerted efforts to erode the value of money. Some bought stocks out of habit, even as the history of monetary debasement indicated this carried enormous risk. Others bought real estate, gold, both well-known hedges from the past. And a few started to slowly accumulate things the world had never seen, things that until quite recently were a practical impossibility. Cryptocurrencies. These were backed by little more than their limited supply and a common faith that had been lost in society but was reforming in the cloud. And as the ultimate intangible asset, the value of such currencies was restrained only by our collective imagination. Which is the most powerful force in the universe.”

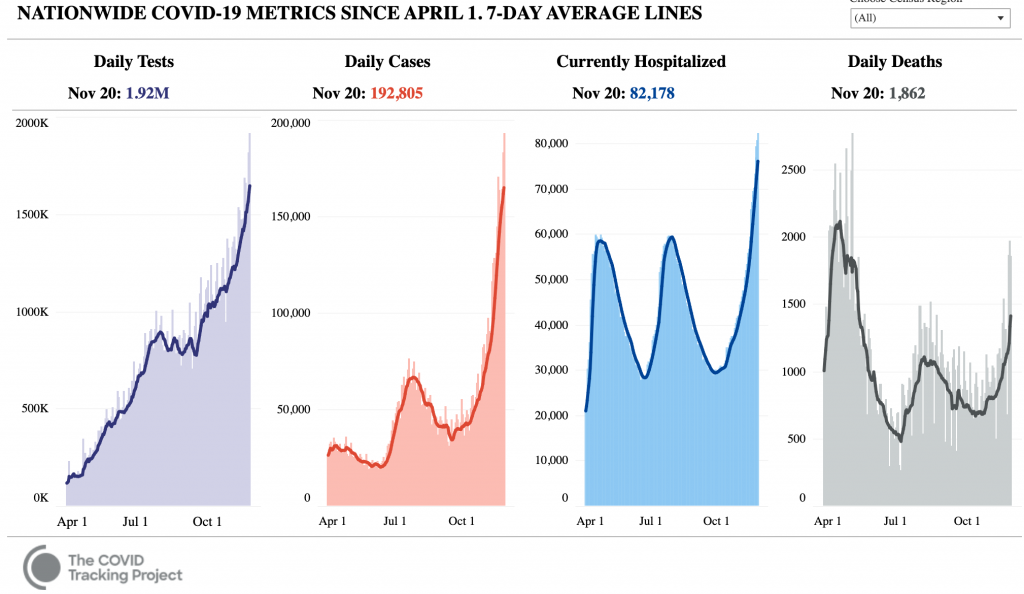

COVID trends are alarming, and Thanksgiving surely won’t help. “On Friday, more than 195,500 new infections were reported — a number many considered unheard of just weeks ago. The highest number of single-day cases during the country’s summer surge was a little more than 77,100 in July. And while infections continue to soar, hospitalizations are also hitting grim records, with now more than 82,100 Covid-19 patients across the US, according to the COVID Tracking Project. A rising death toll follows. In just the past week, more than 10,000 American deaths have been reported — nearly double the weekly death toll of just a month ago.”

Nov 22

Sunday. Stock markets are sleeping. Yesterday ended with the first red candle for $btc in a week. The breather is a good thing, although not everyone believes that. I’ve seen people who recently entered who are literally worried by it, and expect it to just go vertical every single day. People always amaze me.

Guitar Center is the latest well-known retailer to file for bankruptcy.

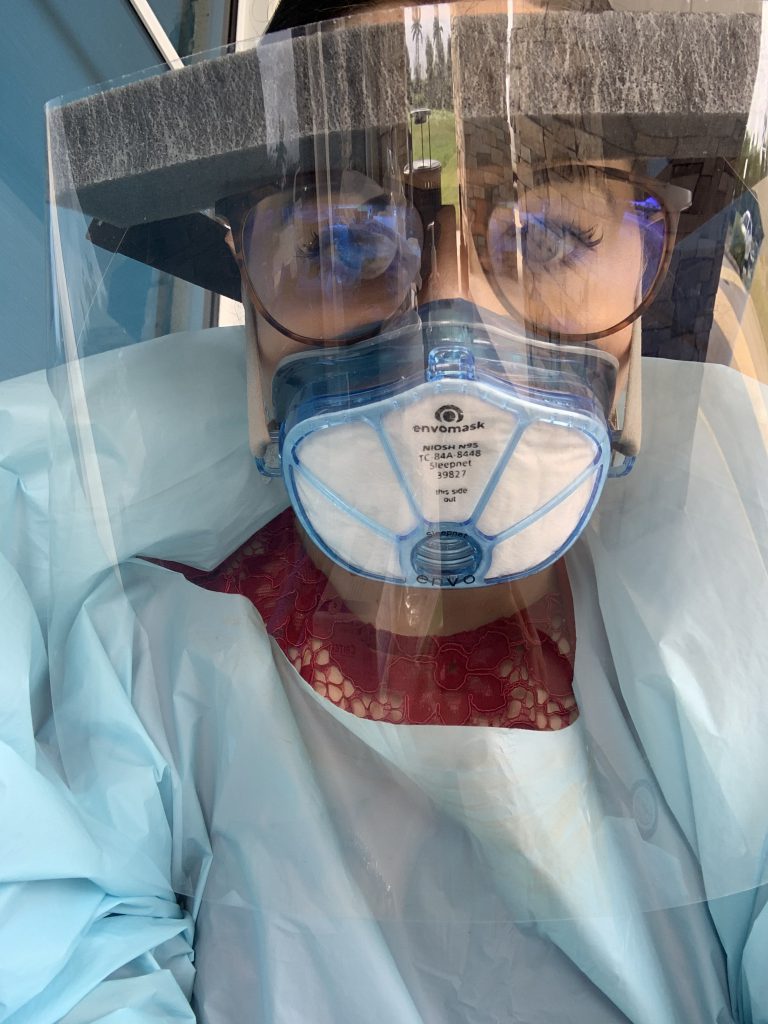

We feel fortunate to have moved to Florida from Maryland a little over a year ago. This is our 2nd FL winter so the awesome November weather still feels like a vacation. Quarantine-winter-weekends are a bit better for us here than if we were still in MD. We take a nice walk every Saturday and Sunday morning, we Peloton, we take a drive along the beach, scour Netflix for evening entertainment, and we both try to read and write a bit. We also try hard to live in the moment (something I’m trying to get better at). After all, my wife loves her job but her weekends are just a tad more enjoyable than workdays due to the added stress from COVID. Here’s what a workday looks like for her:

On the entertainment front, I recently read a book called Murder on the Dark Web, which was very uncharacteristic of me. I normally only read books about personal finance, investing, business/product management, or biographies. We recently watched The Trial of the Chicago 7 which was great. We’re in the middle of listening to Donnell Rawlings & Dave Chappelle on Joe Rogan. Times are so weird that comedians are literally recording stand-up specials from their own homes. Look at the crowd in Kevin Harts living room:

I coincidentally came across two really well-written pieces pertaining to personal finance:

- How to Build Wealth Fast by Lyn Alden

- Is Buying a Home a Good Investment by Nick Holeman at Betterment

Homeownership is a hot topic right now. The WSJ published U.S. Home Sales Rose to 14-Year High in October. “U.S. home sales rose to a 14-year high last month, a rare bright spot for the economy as ultra low borrowing costs and the sudden shift in living preferences during the pandemic power the market… In the pandemic, nothing has been more surprising—positively surprising—than single-family housing.”

NPR published 1,000 U.S. Hospitals Are ‘Critically’ Short On Staff — And More Expect To Be Soon.

By the way, please get your flu shot.

Nov 23

Monday. The Russell 2k closed +1.8%, Dow +1%, S&P 500 +.5%, and Nasdaq +.2%. $GLD & $SLV both dropped more than -2%. Energy was the leading sector, jumping +7%. $BTC is hanging in the $18ks while $ETH crossed $600 for the first time in over 2 years.

@LuisMiguelValue published a thread from Q3 13Fs to highlight the Top 5 holdings from top managers:

The latest wknd notes from Eric Peters is out: Losing Faith in Fiat. Always an enjoyable read. “…markets increasingly believe that no matter how dysfunctional our political parties, how damaged our democratic institutions, how deep our self-inflicted wounds, in the end, all paths lead to an increasingly abundant supply of debt and dollars. And the market is not wrong… But perhaps the greatest gift of this pandemic is that it forced us to stop. Slowed the pace. Interrupted this mindless race. And into that space, nature crept back, to teach. Rope swings arcing. Water sparkling. Catching bull frogs, turtles. Waltzing egrets, stalking minnows. Coyotes. The fat fox, our terrified chickens. A golden eagle, soaring, supreme, sublime. Our children, amidst it all, awed. And while we cannot know what their future holds, it is profoundly altered, they are changed, in ways that will forever remain mysterious, magnificence.”

ValueWalk created A 10 Part Series on the Life and Career of Charlie Munger. Awesome resource.

- From ‘Cash is King’ on p. 17: “When you keep cash on hand, you need to be patient and wait for the perfect opportunity. Patience is a fundamental element of Charlie Munger’s sit on your ass strategy: ‘I did not succeed in life by intelligence. I succeeded because I have a long attention span.'”

- From ‘the most important advice’ on p. 19: “Spend less than you make; always be saving something. Put it into a tax-deferred account. Over time, it will begin to amount to something. This is such a no-brainer… Each person has to play the game given his own marginal utility considerations and in a way that takes into account his own psychology. If losses are going to make you miserable – and some losses are inevitable – you might be wise to utilize a very conservative patterns of investment and saving all your life. So you have to adapt your strategy to your own nature and your own talents. I don’t think there’s a one-size-fits-all investment strategy that I can give you.”

I bit on the TradingView Black Friday deal. I like Koyfin but everyone’s always raving about TV so figured I’d take advantage of the deal.

Thanksgiving is on Thursday and the CDC Urges Americans Not to Travel for Thanksgiving. “The CDC said it is concerned about Covid-19 transmission during gatherings, as well as at transportation hubs where people might crowd to get on a bus or plane. An infected traveler could inadvertently spread the virus to an older family member or someone with an underlying condition, such as diabetes, that puts them at risk of severe illness, Dr. Walke said.”

Nov 24

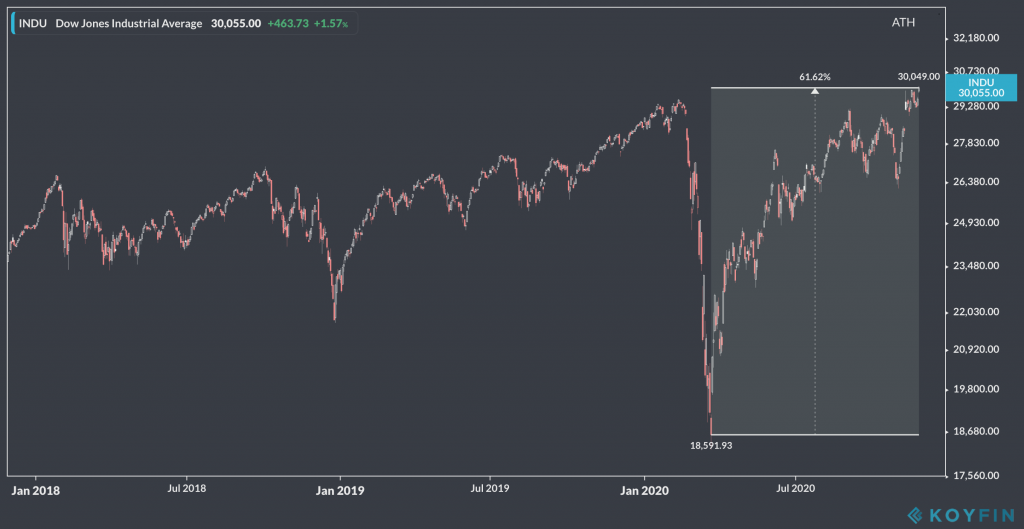

Tuesday. A day of records. The Russell 2k led again, closing +1.9%. The S&P 500, Nasdaq, and Dow each rose more than 1% as well. Energy was the leading sector again, closing +5%. $GLD and $SLV both dipped ~1.5%.

Headlines:

- $BTC crossed $19,000 today, for only the 2nd time ever (first was in Dec 2017).

- Total international $VXUS hit a 52wk high.

- Crude oil $WTI hit $45, the highest since March.

- The Russell 2k $IWM is on the way to its best month ever, up over 85% from the March low.

- The S&P 500 had a record close at 3,635.

- The Dow crossed 30,000 for the first time ever, climbing over 60% from the March low.

@dmuthuk captured the thoughts of many:

CNN: “Hospitalizations are at harrowing highs. More than 85,800 Covid-19 patients were in US hospitals Monday — the 14th straight day this count set a pandemic record. Hospital systems around the country have been warning their staffing and ICU bed capacity are being stretched thin. Pennsylvania’s top health official warned Monday the state could run out of ICU beds within a week.”

Nov 26

Thanksgiving Thursday. Yesterday, the Nasdaq closed +.5%, S&P 500 +.16%, and both the Russell 2k and Dow dropped about -.5%. $BTC has dropped ~13% over the last 24 hours, bringing it to a price level not seen since all the way back to… 11 days ago.

Not so bad when you look at the daily:

I wrote this less than a week ago: “A 30%+ dip at some point wouldn’t surprise me, especially if it continues flying instead of hanging here at $19k for a while.” Reminder:

I listened to the latest Panic with Friends episode with Lewis Johnson. It was a breath of fresh air. I loved hearing Howard say, “I get zero interest rate pay for growth. I’m not going to fight that. But I know the other side of this mountain is so messy, so much unwinding. And that’s what I worry about. I know that cyclically no matter what drugs they give this market, that rates at zero, money printing… there’s all these avenues being built and everyone’s trying their best to come up with shit to keep this party going, but I want people to know that these things can’t last.” And here was a gem from Lewis that seems to be getting lost a lot today: “This is a lesson that people will learn in the next bear market, but valuation does matter. It never matters in a bull market but it matters in a bear market.“

Jobless claims increased for the 2nd straight week. “Although the stock market has surged to a record high on optimism about a vaccine, the cresting wave of coronavirus infections is throttling the jobs market, casting a shadow over economic growth as officials mull stricter social distancing protocols in key areas.”

Like most holidays in 2020, Thanksgiving is pretty different than normal (for those being extra cautious). I’m thankful that my wife and I are healthy, can enjoy the nice November Florida weather, hang on the beach for a few hours, ride the Peloton, and order sushi for dinner. Also thankful that I discovered a great new series (No Man’s Land on Hulu) after thinking we’ve watched everything that exists. Jokes aside, we’re thankful for how fortunate we are compared to others. These aren’t good times for many.

Nov 28

Saturday. S&P 500, Dow, Nasdaq– all green yesterday.

I read a month-old post from Lewis Johnson, Where We Are in the Cycle: Revisiting Asset Allocation & Indicators. I’m glad I recently discovered him on Panic with Friends. I think everyone investing heavily in chasing the next hot tech or WFH stock should spend some time on his blog. “Finally, another scenario, by far the trickiest to navigate, is that there simply are no precedents. Can you think of another time when massive monetary stimulus combined with a workforce locked at home, with an investing grubstake care of the government, trading stocks online – with no-cost commissions!? I cannot. As we think through these questions, we are grateful for the benefits of diversification, and hope that you are too.”

Entertainment this weekend is provided by No Man’s Land on Hulu (which we just finished, and loved), and reading One From Many (for Maia’s fintech book club). It’s very philosophical so a lot of it can be applied to different scenarios. Like this line: “Today, the past is ever less predictive, the future ever less predictable and the present scarcely exists at all.“

My wife gave me one of those awesome ‘quarantine cuts.’ They’ve been growing in popularity throughout 2020. For those who come across this blog in the year 2070, just know it’s a haircut style that makes you first laugh, then cry, then cringe in disgust, and then laugh again.

Nov 30

Monday. Last day of the month. The day was red but the month was green. The Russell 2k closed the day -1.97%, Dow -.9%, S&P 500 -.45%, and Nasdaq -.06%. $BTC hit an ATH. Coindesk published Bitcoin Price Sets New Record High Above $19,783. “Year to date, bitcoin has gained 167%. Since its yearly lows in March, after crashing more than 50% in a single day, bitcoin has rallied more than 400%.”

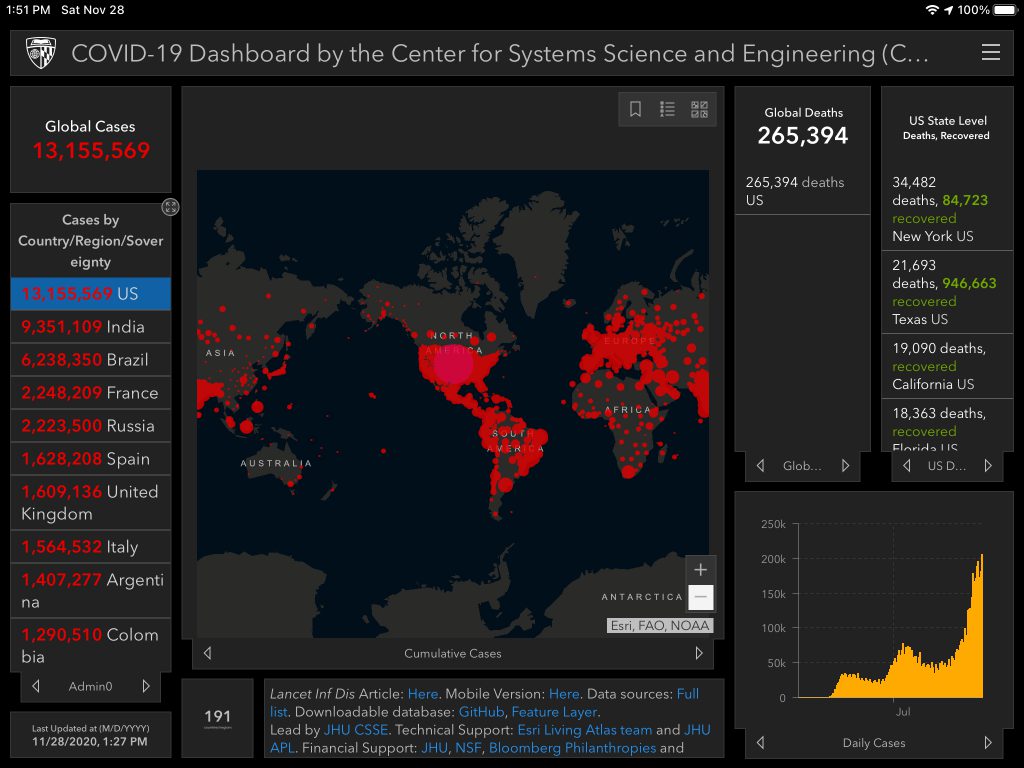

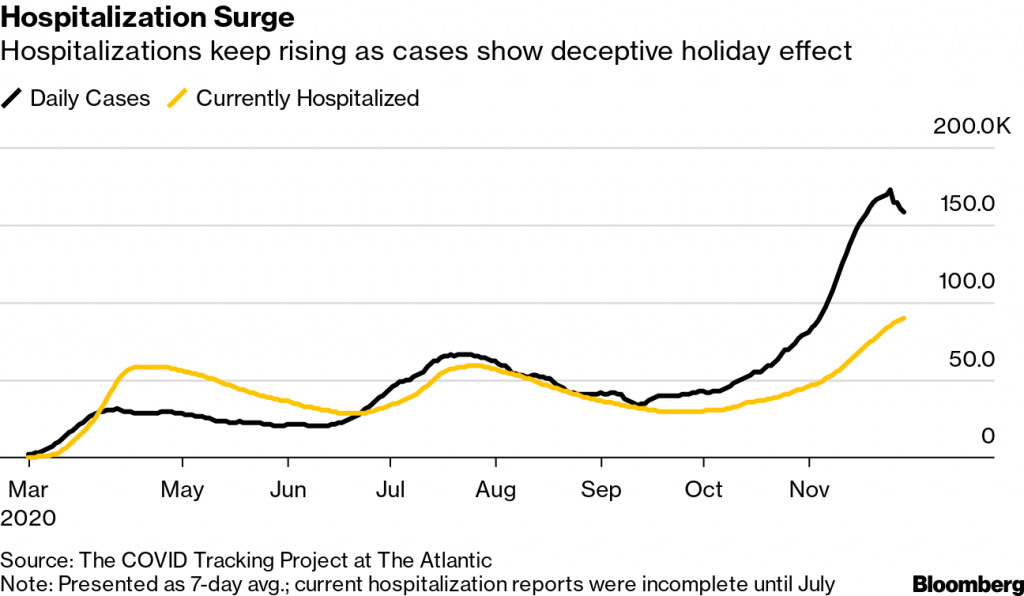

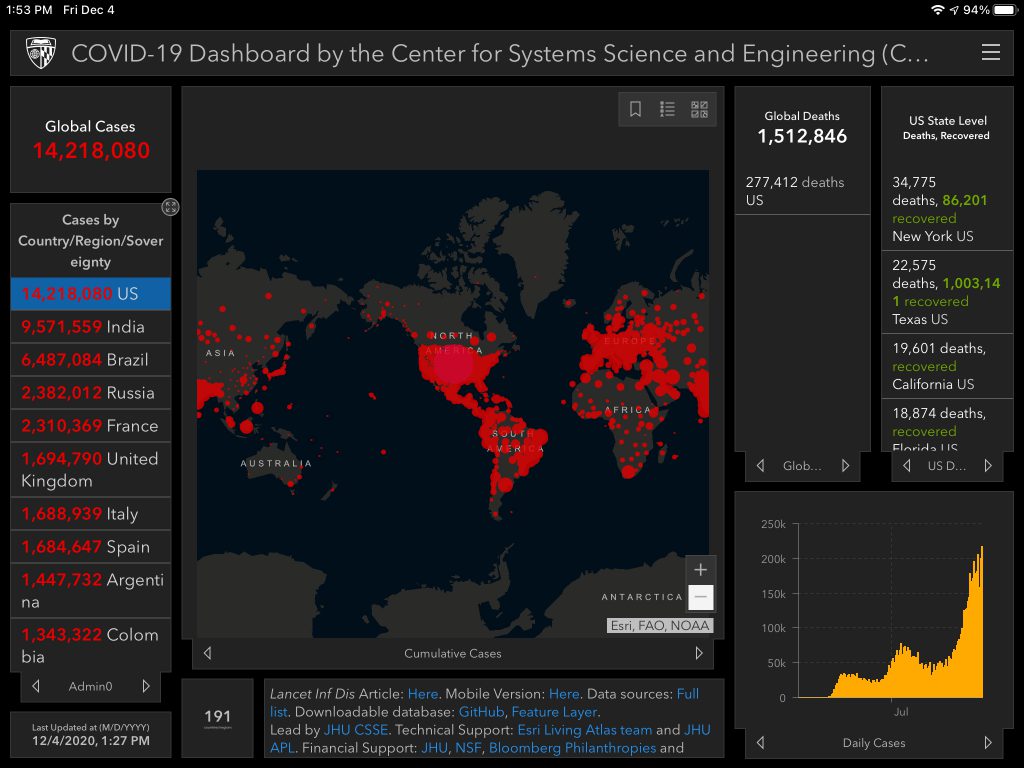

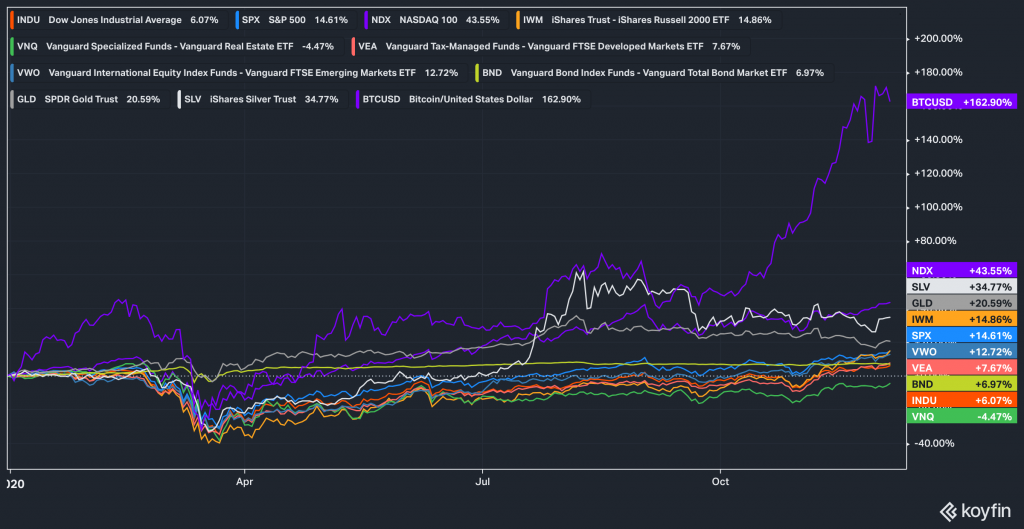

Gold and Silver both dropped a bit but equities had a pretty amazing November. One can’t help but think it was largely driven by vaccine porn. The Russell 2,000 had its best month in history. Other indices shattered records too. Here’s the monthly:

Today is Cyber Monday which means we’re a few days past Black Friday. I’ve gotten news alerts announcing record-breaking online sales, as well as headlines such as, “Retail apocalypse will spread after gloomy holiday season.” Very 2020. Divergences everywhere. K-shaped recovery.

For future reference, I should probably note that there has been a lot of news and reports on the vaccine front recently. Almost daily at this point. Early results seem promising. But I purposefully don’t share them in each post.

Last night was the finale of The Undoing— one of the better shows to come out during the pandemic. We also started watching The Valhalla Murders on Netflix. I don’t love it but it’s starting to seem like we’ve watched everything that exists. Pandemic problems. I started reading How I Invest My Money. The reviews aren’t great but I’m a sucker for these types of books and am actually enjoying it so far. I also really like reading whatever Josh Brown publishes.

December

Dec 4

Friday. All of the major US indexes are positive for the week so far. Same with developed, emerging markets, gold, and silver.

The latest wknd notes from Eric Peters is out: Crowds and Counterintuition. He shared a 2018 post that’s just as relevant today as it was then. “You see, in my early years, if twenty-two people said boom, I said bust. They said bear, I said bull. Mechanistically, blindly. That lonely, painful approach works periodically, sometimes spectacularly. But with experience comes an appreciation for subtlety. I came to realize the crowd is usually right, particularly about things that don’t matter (like the economy and its connection to financial asset prices). The two are correlated, either positively or negatively, often counterintuitively, erratically. Identifying which direction this correlation runs is art, not science. Generally, when economies look worst, financial assets are great investments. When economies look best, they’re bad. Plus, markets lead economies, just not always. And it’s so perplexing that scientists resort to forecasting something concrete, like GDP, and cling to it, pretending it matters. Anyhow, all twenty-two people were unabashedly bullish on the S&P 500. They expected a 2018 melt-up, fueled by fresh buying, as other people ascend the wall of worry built 10yrs ago. And they’re probably right, but I just kind of wondered who all those other people are?”

December brings year-end recaps and future predictions. In many ways, everything changed in 2020. In some, less changed this year than ever before. It has certainly been a year of divergences and k-shaped recoveries.

I’ve been thinking a lot about my own behaviors, thought processes, and decisions related to personal finance and investing. Like Eric, I too tend to say bust when others say boom, or bear when others say bull. I’m trying to figure out when I became this way. Is it just my personality? Is it the impact people’s stories of 1999-2001 had on me? May it be due to my initial investing experience, joining the workforce in 2008? Or could it be from misinterpreting some lessons from the investing books I read in my 20s?

- “…successful investing is often contrarian and counterintuitive. If you go against the crowd, buck the current trends and ignore your emotions, you will succeed.” Patrick O’Shaughnessy in Millennial Money

- “Finance, though, for the reasons explained above, is the exact opposite; when all your friends are enthusiastic about stocks (or real estate, or any other investment), perhaps you shouldn’t be, and when they respond negatively to your investment strategy, that’s likely a good sign. A working knowledge of market history reinforces this sort of profitable but highly counterintuitive behavior…” William Bernstein in If You Can

- “So when all your friends are investing in a certain area, when the business pages are full of stories about a particular company, and when “everybody knows” that something is a good deal, haul up the red flags. In short, identify current conventional wisdom so that you can ignore it… The conventional investment wisdom is usually wrong.” William Bernstein in The Four Pillars of Investing

If you read the previous posts in this series then you know I’m holding a lot of cash and stay away from the most popular tech stocks. I missed (am missing?) out on some monstrous gains from many of the soaring Stay-at-Home stocks like Netflix, Zoom, and Shopify. But in the grand scheme of things, I’ve still done very well. I’m beating the S&P 500 YTD by double and my portfolio didn’t dip nearly as low in March. I’ve slept well at night. My portfolio is funky by past comparison but these are funky times. With that being said, I think I need to have a better appreciation for momentum in the future. Like Eric, my initial reaction needs to be more subtle. I need to recognize the possibility that “the crowd is usually right, particularly about things that don’t matter (like the economy and its connection to financial asset prices).” But that doesn’t mean I should change my entire philosophy or risk profile. Conviction matters and risk management is personal. What keeps one person up at night might be the exact thing that makes me sleep like a baby. There’s a lot more to investing and personal finance than having the highest returns over a 9 month period.

Eric Cinnamond at Palm Valley Capital Management published A Generational Buying Moment. It’s a great post as usual, and timely given it’s reflection month. “The past decade of overprotective central banking has likely influenced today’s younger generation of investors. Through their relentless support of asset prices, the Federal Reserve has conditioned young investors that they can enjoy the above-average returns of risk assets without assuming the associated risk. In the current environment, it’s challenging for young investors to understand risk without incurring it. The feeling and emotions associated with losing money are difficult to replicate on a spreadsheet or price chart. Risk, or loss, is something that must be experienced to fully appreciate its consequences… While we can’t predict the future, based on price and valuation, we are fairly certain young investors are not being presented with a generational buying moment. More likely, we believe investors are being offered a generational selling moment!”

Man, talk about uncertainty. Howard Marks may as well start recirculating his memo’s from earlier in the year.

U.K. Approves Pfizer Coronavirus Vaccine was the big headline earlier this week. “First to be vaccinated will be doctors and nurses in the country’s National Health Service, along with nursing home workers and people 80 and over with previously scheduled doctors’ appointments… Eventually, people will get their shots in mass vaccination centers being set up by the military at soccer stadiums and racecourses, or at doctors’ offices and pharmacies.”

Dec 5

Saturday. Here’s a glance at the YTD:

I finished reading How I Invest My Money (which really should have been titled, ‘How I Manage my Personal Finances’). Ever wish you could see labels hovering above someone’s head that displays their net worth and how they got there? This book is kind of the next best thing. It also helped reinforce that I’m on the right track. My views on asset allocation, holding cash, savings, and homeownership were very much in line with many of the authors. Some excerpts:

- Morgan Housel: “Being able to wake up one morning and change what you’re doing, on your own terms, whenever you’re ready, seems like the grandmother of all financial goals… And achieving some level of independence does not rely on earning a doctor’s income. IT’s mostly a matter of keeping your expectations in check and living below your means.”

- Joshua Brown: “There is no such thing as a one-size-fits-all portfolio, because we all have different time horizons, risk factors, wants and needs, and emotional triggers.”

- Bob Seawright: “Like compound interest, success is sequential. It takes time for good choices to add up before exploding exponentially… Our financial investments do that, and so do our personal and family investments. Generosity and service compound. So do healthy living and education. Love is the most powerful compounder of all.”

- Debbie Freeman: “I am so privileged to get the opportunity to participate in a company plan. I am grateful I can afford to contribute every month… This boring account is much more than a monthly deposit. To me, it holds the promise of choice tomorrow and provides a sense of well-being and gratitude today.”

Here’s a very 2020 headline: Hawaii is offering free round trips to remote workers who want to live there temporarily.

Dec 9

Wednesday. All of the major US indexes closed red for the day– for once. Doesn’t seem like that happens too often these days.

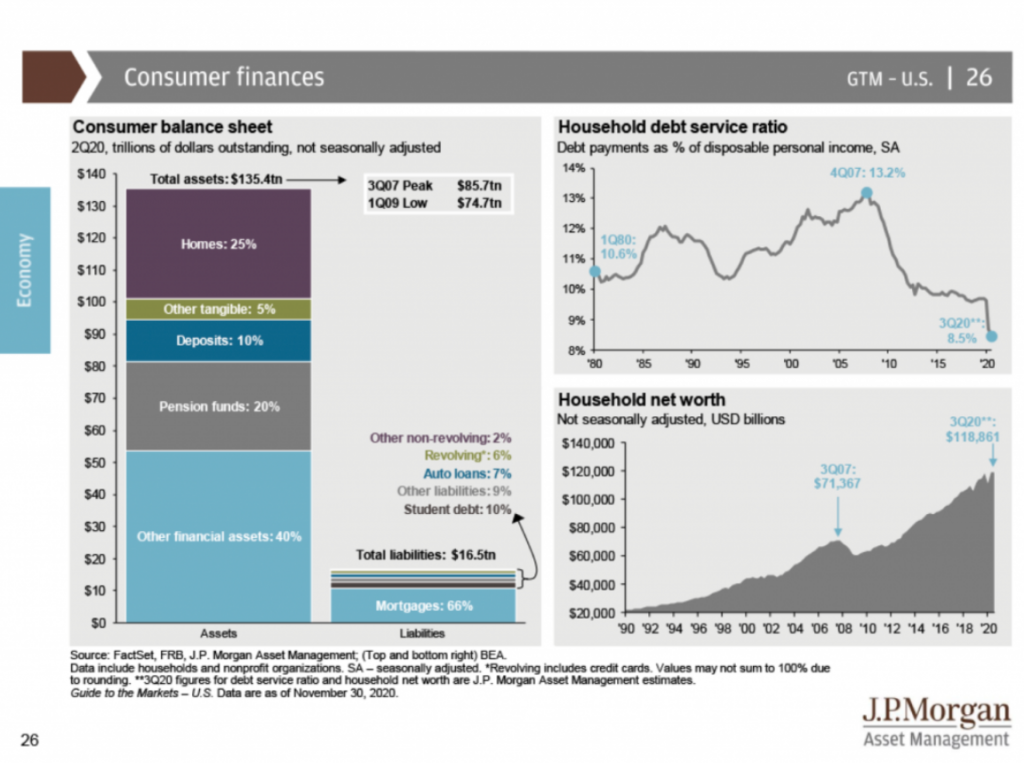

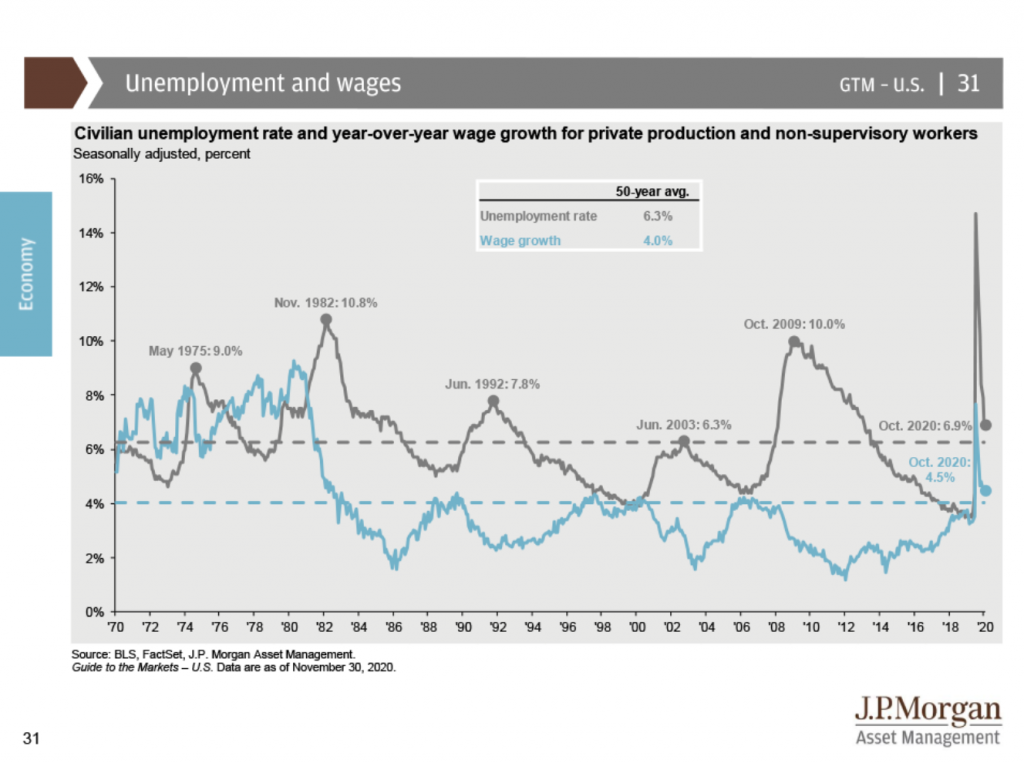

JPM released their Q4 Guide to the Markets Report. A few slides:

LPL Financial published their 2021 Outlook Report. “The idea of a K-shaped recovery has gained traction as a way to characterize this economic recovery… As is common during recessions and recoveries, parts of the economy have been improving quickly, while other parts are lagging. If you view this also in relation to workers, then this recession and subsequent recovery have widened the divide between the haves and have-nots… Continued fiscal support, such as stimulus payments, is needed to help those who are struggling, but a widely available vaccine is needed to help shore up the weaker parts of the economy and lift up the bottom half of the “K.” Even as COVID-19 continues to spread, we expect the economic recovery to continue, bolstered by stimulus… Although not our base case, we think the odds of a potential double-dip recession, two recessions spaced closely together, may increase as we move into 2022. Recessions are necessary to flush out the excesses.”

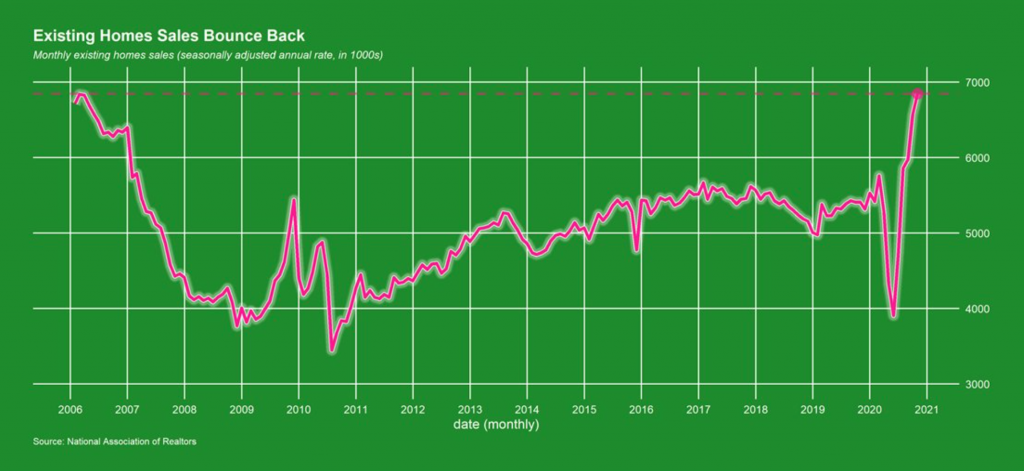

The housing market is hottt. Low rates, low inventory, high sales. Len Kiefer shared some highlights:

Bitcoin and crypto are getting a lot of media coverage lately. Bitwise’s Crypto Index Fund Becomes Available to US Investors. Not quite an ETF, but much closer. JPMorgan Says Gold Will Suffer for Years Because of Bitcoin. Institutions like Wells Fargo are even recognizing it now. “Cryptocurrencies could become investment-worthy one day, though. Over the past 12 years, they have risen from literally nothing to $560 billion in market capitalization. Fads don’t typically last 12 years.”

It’s IPO season. DoorDash Shares Jump as Much as 92% in Debut After IPO. Airbnb is expected to begin trading tomorrow.

America’s nurses could use some mercy now.

Dec 11

Friday. The Dow and Gold rose slightly but the Russell 2k, Nasdaq, S&P 500, and Silver fell. $btc is still hanging around $18k.

Jobless claims rose to 853k (725k were expected). This is the highest week since mid-September.

Fidelity published An emerging-markets breakout for 2021. “So what we have here is an index which after 11 years of trading sideways is trying to ‘break out’ to new highs, while the relative return cycle is poised to reverse higher. All in all, in my view EM equities may well be a high conviction ‘outperform’ for 2021 and beyond.“

The Economist published Companies have raised more capital in 2020 than ever before. “Initial public offerings (IPOs), too, are flirting with all-time highs, as startups hope to cash in on rich valuations lest stockmarkets lose their frothiness, and venture capitalists (VCs) patience with loss-making business models… In a world of near-zero interest rates, it appears, investors will bankroll just about anyone with a shot at outliving covid-19. Some of that money will go up in smoke, with or without the corona-crisis. What does not get torched will bolster corporate haves, sharpening the contrast between them and the have-nots.”

Lewis Johnson published Real Estate Software Eats the World? “We have written before about our conviction that the real estate cycle is set for a powerful multi-year upcycle… We believe now is one of those special times to profitably own real estate… We believe we see in the publicly traded real estate software companies the opportunity for them to eat the world of the traditional real estate brokers. If we are right, we stand to benefit from the secular tailwinds of a powerful real estate cycle supercharging a scalable business model primed to gain market share for many years.”

Robert Shiller published Making Sense of Sky-High Stock Prices. “Indisputably, asset markets are substantially driven by psychology and narratives… Eventually, down the line, bond yields may just rise, and equity valuations may also have to reset alongside yields. But, at this point, despite the risks and the high CAPE ratios, stock-market valuations may not be as absurd as some people think.“

Google released their 2020 Year in Search.

We started watching The Flight Attendant. I don’t like it as much as my wife but we’re scrounging for good entertainment.

Dec 13

Sunday. Checked in on my portfolio. +24% YTD (S&P 500 is +14%). Below are my top holdings as the year comes to an end. At >30%, Cash is sitting in the top spot. Cash isn’t trash.

By the way, I’d like to highlight to certain readers that your investment portfolio isn’t what matters most when it comes to financial health. Net worth and catering to your own emotional triggers are what matter. I feel very lucky to say that we’re ending the year feeling secure with our personal finances (and physical health). It’s not lost on me how fortunate we are compared to many. We’re extremely fortunate to be a double-income household. But we also prepare for the worst, live below our means, and save aggressively. That lifestyle helps a lot and allows us to sleep better at night during times of uncertainty.

It’s the end of the year so the reviews, recaps, and predictions will be coming in hot for the next few weeks. Ben Carlson published My 2020 Investing Lessons. “Markets are getting faster. In a four week period from late-February through late-March the stock market experienced the fastest bear market of 30% or worse from all-time highs. Those highs were back again just 5 short months later. Companies that are losing money are seeing their market caps grow by billions of dollars a day as investors look to the future of what they could become. Some of these companies may yet grow into those expectations while others will sadly disappoint shareholders. It doesn’t matter to investors right now because everything is on hyperdrive. I expect that to continue in a world where technology is making everything faster. That includes market cycles.”

I also just read Ben’s newest book, Everything You Need To Know About Saving For Retirement. Quick, easy read. It would make for a great holiday gift for young people entering the workforce. “Personal finance is one of the most important life skills you can develop yet no one is tasked with teaching you how to do it. Just six states require students to take at least one semester of personal finance courses. They teach other languages in our schools but not the language of money.” I strongly agree which is why I’ve toyed with communicating personal finance lessons through different avenues. “The best thing you can do as a young person is to start saving and investing as soon as possible to take advance of your long time horizon.”

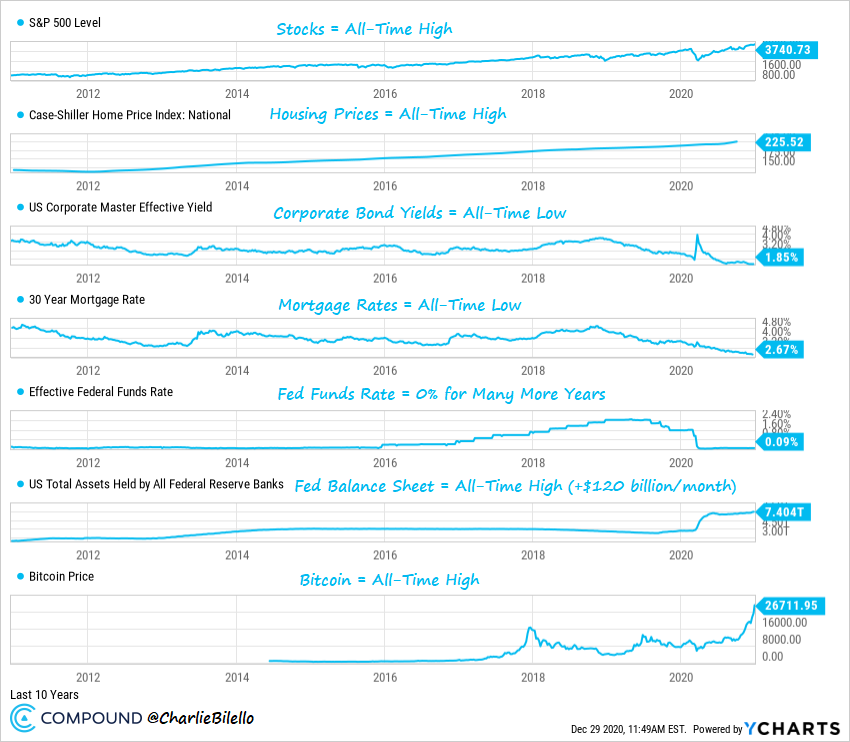

Charlie Bilello published Pandemic + Recession = Multiple Expansion? “As Graham and Dodd once said, in the short run ‘the stock market is a voting machine rather than a weighing machine.’ What they meant: sentiment is all that matters in the short run (changes in the multiple investors are willing to pay) while in the long run fundamentals increasingly become more important (what are the actual stream of earnings and cash flows). Rarely has the voting machine been more optimistic than it is today. It remains to be seen what the weighing machine will have to say about that in the future.”

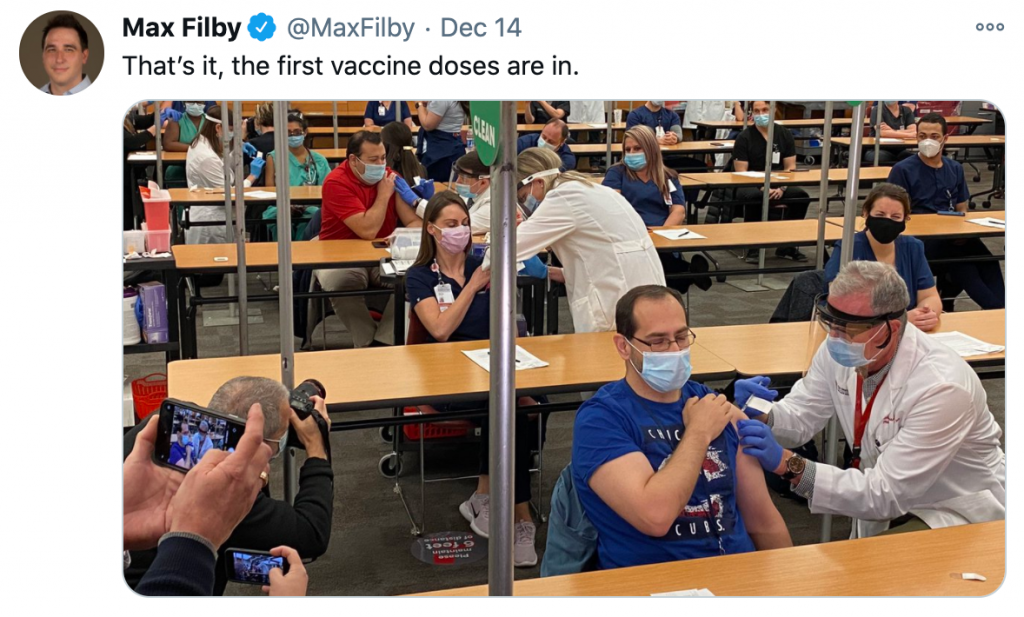

The big news: F.D.A. Clears Pfizer Vaccine, and Millions of Doses Will Be Shipped Right Away.

Dec 19

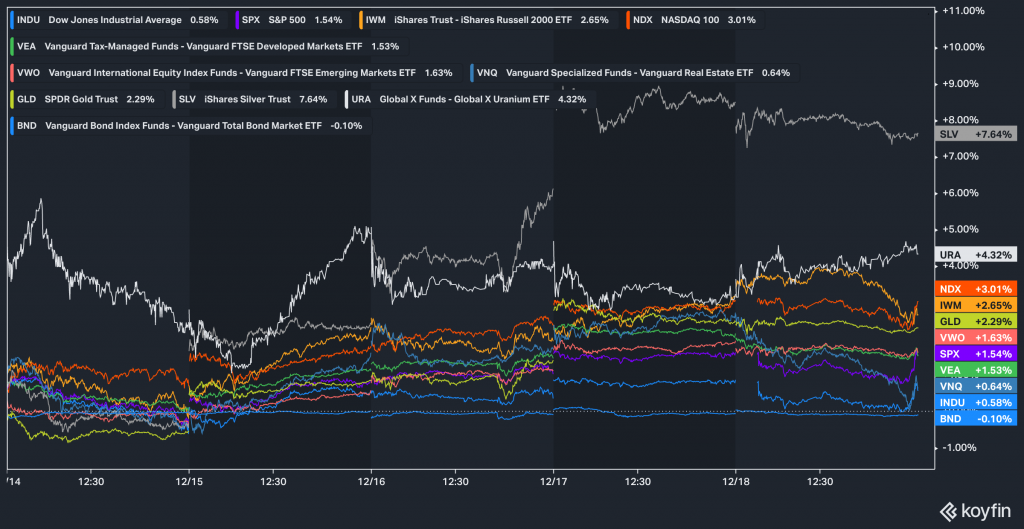

Saturday. I made a few buys this week– $PODD, $GAN, $SCHL, and $T. Here’s the weekly:

And I have to cover bitcoin since it shot up past the ATH to ~$23,700 after hanging around $18k-19k. It’s $23,500 as of right now. We’ve got Scott Minerd from Guggenheim on Bloomberg TV saying, “Our fundamental work shows that Bitcoin should be worth about $400,000.” We’ve got Cathie Wood from Ark reiterating her bullishness. But the most exciting news this week for me was reading how Eric Peters launched a new company focused on digital assets. They quietly bought over $600M. If you’ve followed this series then you know Eric Peters writes a near-weekly series called ‘Wknd Notes’ and that he’s grown to be one of my favorite writers. I just didn’t expect him to go this route so I think it brings another level of legitimacy to the macro issues and potential role bitcoin can play in the future. “This is the most interesting macro trade I’ve seen in my career.”

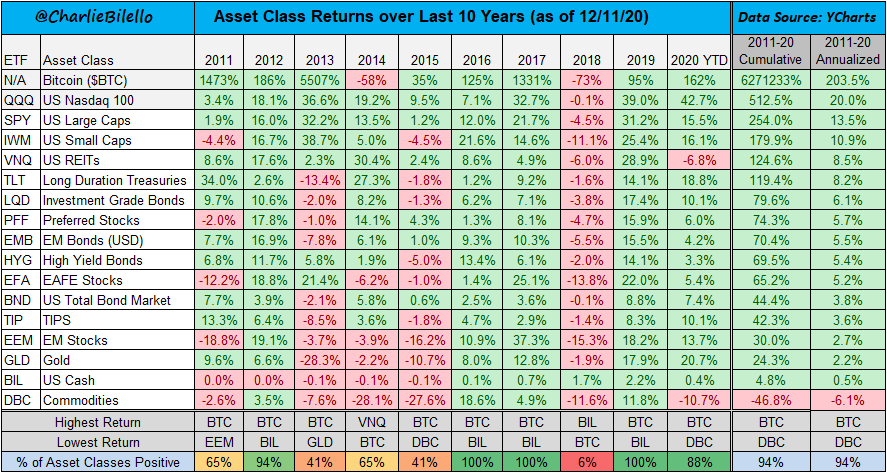

Charlie Bilello shared this chart of asset class returns:

I identified 5 days on May 12th that felt like major sentiment shifts. I thought June 26th was another. In that same post, I wrote, “It seems to me like the majority of Americans believe (and the markets are pricing in) that there’s an 80%+ chance an effective vaccine will be available this year. And I think that’s preposterous.” I was very wrong and couldn’t be happier.

My wife gets hers next week!

Vaccines + stimulus… I mean, what in the world can bring the markets down in the next ~6 months? It’s starting to seem highly unlikely that anything will. Tippy-top sentiment or reality?

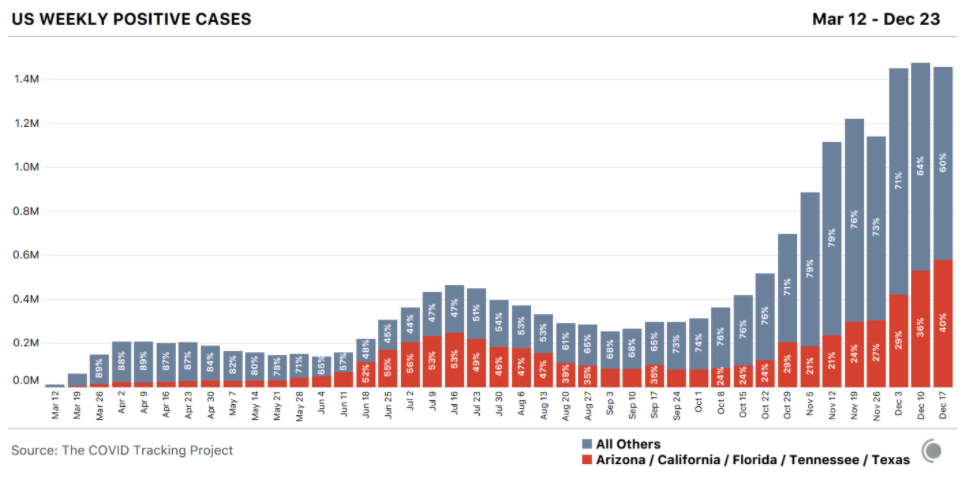

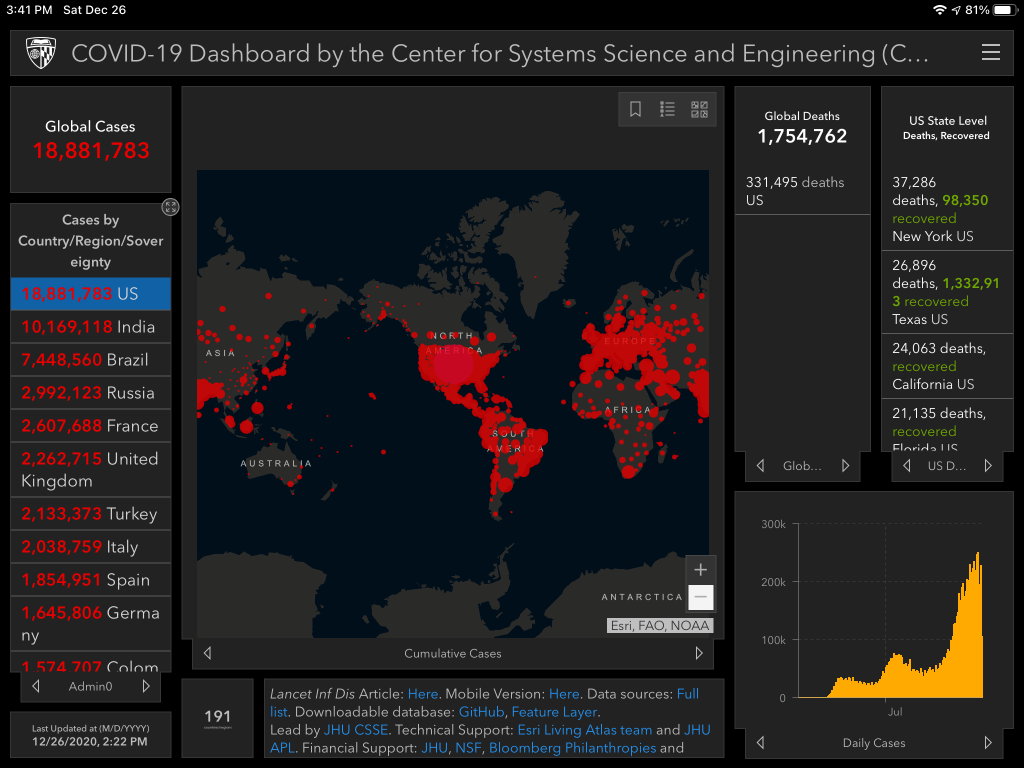

The top half of today’s post is the euphoria in various pockets– those in the top half of the K in this recovery. It seems like the gaps are only going to get wider for the foreseeable future, which is really sad for most people. And although vaccines are here, that doesn’t mean Covid isn’t. Just 19 days into December and it’s already the 2nd worst month of the pandemic. “For the second week in a row, more COVID-19 deaths were reported in the United States than at any other time in the pandemic.” We crossed 300,000 deaths (in the US). Healthcare workers across the country (especially in states like CA) aren’t sitting around reading blogs like this and thinking about the markets. People are struggling. And the struggle will continue for a while. It’s important for us to remain grounded and think about others in less fortunate and safe circumstances.

Dec 26

Saturday. Probably my 2nd to last post of the year (and of this series). Short week for the markets because of Christmas. $IWM is the only major index that I normally track here that rose this week, closing +1.4%.

$BTC deserves a mention. It’s making a run at $26k today. In a year of astonishing financial headlines, bitcoin belongs there near the top.

I read Crescat Capital’s December Research Letter. “When it comes to scarce commodities, at Crescat, we have an affinity first and foremost for gold and silver, the monetary metals that are among the most supply constrained resources on the planet… We expect inflation expectations to continue to rise at a faster rate than nominal interest rates. This is ultimately a self-reinforcing catalyst to drive investors out of overvalued stocks and credit and into scarce commodities including precious metals and oil…”

I read Long-Termism – Another Casualty of 2020? from QMO. “Given the very rich starting valuations, a long-term investor will surely see the importance of diversification now, rather than waiting until it’s too late… in terms of what’s going on within equity markets, this has been a truly unique period. Whether on the upside or the downside, no long-term investor would extrapolate the markets of the last few months into the future. Maybe we are in a bubble as I said at the start, maybe not – many valuations point to the former. But it’s surely true that what has worked in the last six months won’t be of use when we leave the cloud…”

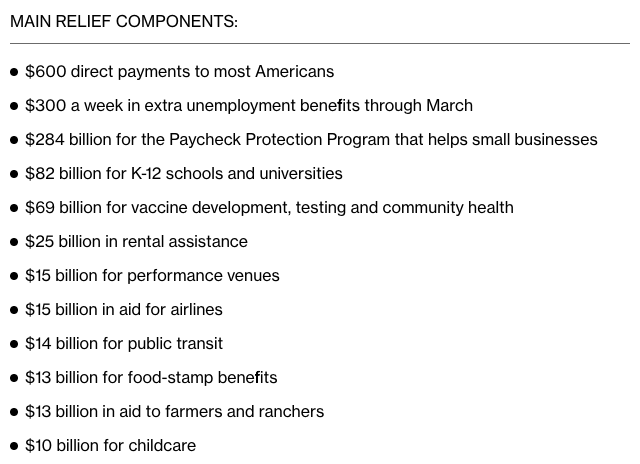

Congress passed another relief bill totaling over 2.3T.

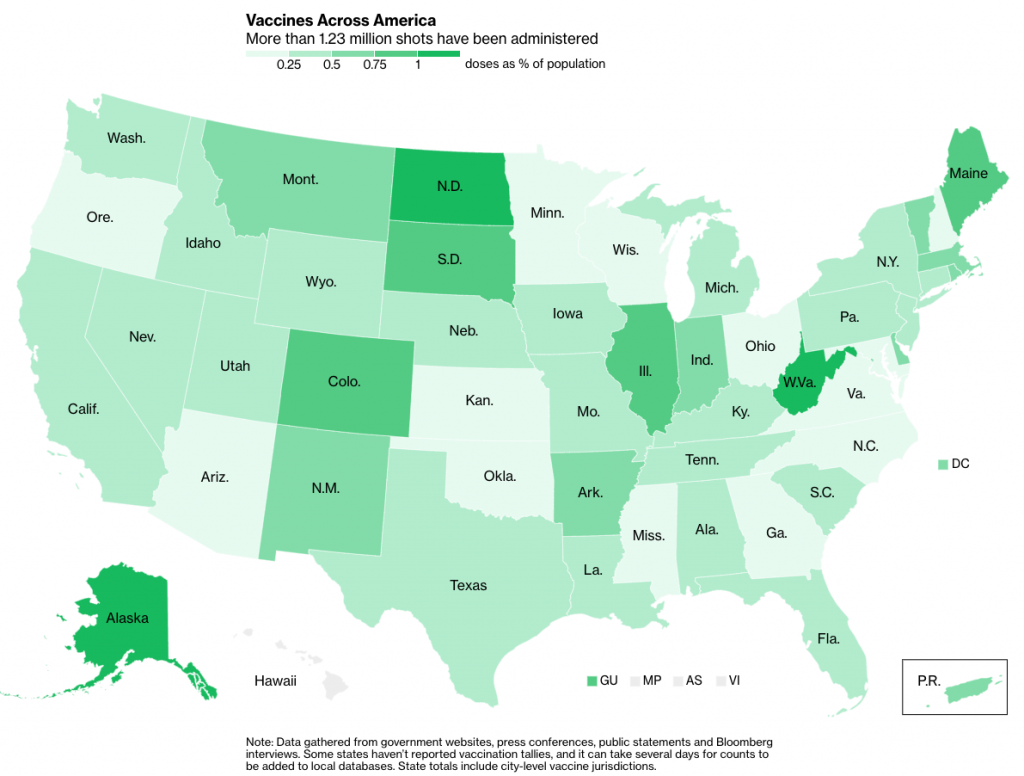

More than 3.5M Covid-19 vaccine shows have been given so far throughout the world.

My wife got the Moderna vaccine. For those wondering– no, she didn’t have any negative side effects. By the way, she’s a type 1 diabetic so someone can add this data point to wherever it may be useful. In fact, I think it gave her superpowers. She was amped after!

From this week’s blog post by The COVID Tracking Project: “December is already the deadliest month since the beginning of the pandemic in the United States.” January will inevitably be even worse given the amount of traveling taking place for the holidays.

Dec 29

Tuesday. 2nd to last post of the year (and series)– I mean it this time. The major US indexes were all down today with the Russell 2k dropping the most at -1.8%.

These are bizarre times.

Eric Cinnamond at Palm Valley Capital Management published Don’t Stress It, Press It. Like all of his posts, it’s very well written. “With prices and valuations reaching extremes, we believe it’s never been more difficult to stay the course and maintain discipline… Successful investing is not supposed to be as easy as pressing a button. And it certainly is not supposed to be as ‘easy’ as it is today.“

On the other hand, we’ve got Nick Maggiulli publishing Should You Buy An All-Time High? “Regardless of which risky asset classes you have in your portfolio, as this post illustrates, buying near all-time highs should not be a cause for concern. Of course, you may get unlucky with an asset class during a particular period of time, however, if you own a diversified portfolio, the impact of such an occurrence should be minimal.”

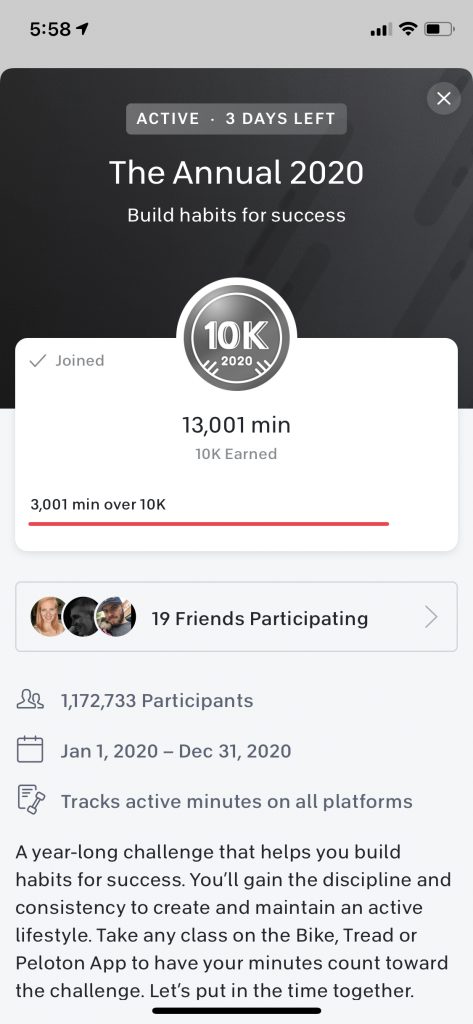

On a personal front, I’m proud of myself for staying focused on my health this year. I just crossed the 13,000-minute mark on Peloton, smashed the number of calories I burned vs. 2018 & 2019, barely drank any alcohol, and improved my sleep. Oh, and I didn’t get sick at all. I’m very thankful.

Dec 31

Thursday. New Year’s Eve. This is my last post of the series: 2020, Corona Crash or Everything Bubble Pop?

My final trades of the year included adding a little more $TNDM, $NET, $VEA, $VWO, and parting with a tiny bit of $GBTC. I end the year holding a lot more individual holdings than I started with, being a bit more of a market timer, a bit more active and still feeling whiplash from the crazy market action in March. Thankfully, I’m also ending the year physically healthy, mentally healthy, and financially healthy. I’m very fortunate. Even better, my wife is healthy despite the added stressors to all healthcare workers like her. Although it was a year where prudence got punished, my portfolio still returned ~30% despite holding roughly 40% in cash for much of the year. It was harder than ever to pick losers. And more importantly, our net worth grew a good amount more than that. It’s hard to believe but the reality is that many portfolios performed much better with the pandemic (well, Fed actions) than they would have without. Which sadly also means that many people faired way worse than they would have had COVID-19 not existed.

Who would have expected my series to be so poorly named?

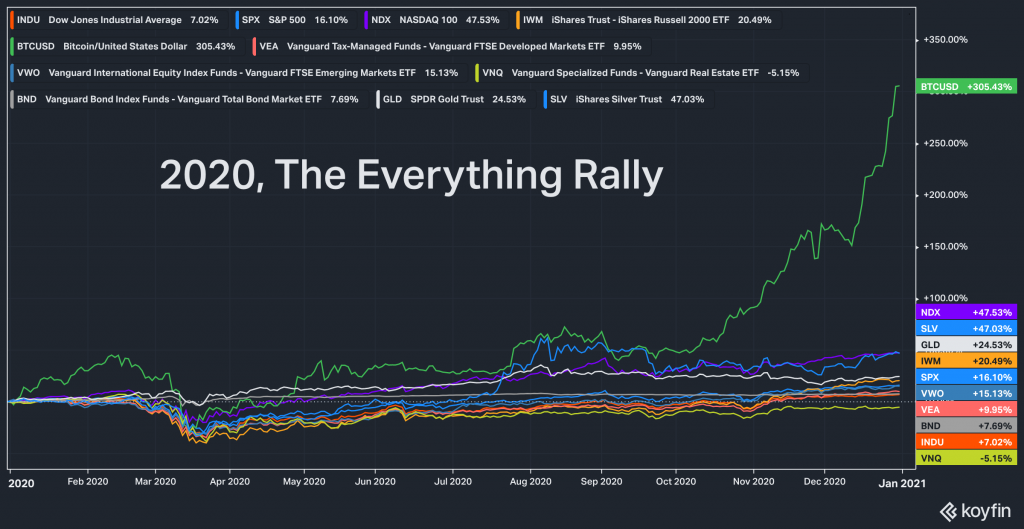

2020, the Corona Crash or Everything Bubble Pop?

Turns out 2020, the Corona Crash or the Everything Rally? would have been more fitting.

Below are our top holdings heading into 2021.

| 1. Cash (27%) | 6. GBTC | 11. VFORX | 16. GOOGL | 21. VTV | 26. PRNT |

| 2. VEA | 7. BRK.B | 12. ARKG | 17. TNDM | 22. IDN | 27. VBR |

| 3. GLD | 8. DXCM | 13. FB | 18. HD | 23. VNQ | 28. KRMD |

| 4. VWO | 9. DJCO | 14. AMZN | 19. NET | 24. URA | 29. CRM |

| 5. VTI | 10. SLV | 15. PODD | 20. ARKW | 25. VOE | 30. GS |

COVID-19 is far from over. 2021 will be unlike any other year we’ve experienced. Hopefully more predictable than 2020, but still far from normal. Be thankful for what you have. Don’t take your health or financial positions for granted. Don’t get cocky. Luck was involved. And urge people to be a little less selfish. We’re all part of a system and our actions impact other people in ways you could never imagine– for better and for worse. Wear a mask, physically distance yourself, and get your vaccine when it’s your turn.

Oh, and one last word of advice. Please realize that you’re supposed to wear your mask not only over your mouth but OVER YOUR NOSE too.

Back to the start of 2020

Advice

- It’s always a good time to learn about personal finance.

- Podcasts are a great way to stay informed & entertained:

- This too shall pass, like everything always does.

- It could always be worse. No matter how bad shit gets in your life, there are always ways that it could be even worse.

- Don’t be selfish. Help others. Stay home. Stay clean. Wear a mask. Donate.

- Stay rational. Don’t panic.