E-commerce Predictions: Will consumers choose cryptocurrency to shop online?

Shilo Jones and his team at Statbid conduct an interesting survey each year polling participants on various e-commerce predictions. This years results of the 2022 survey can be found here.

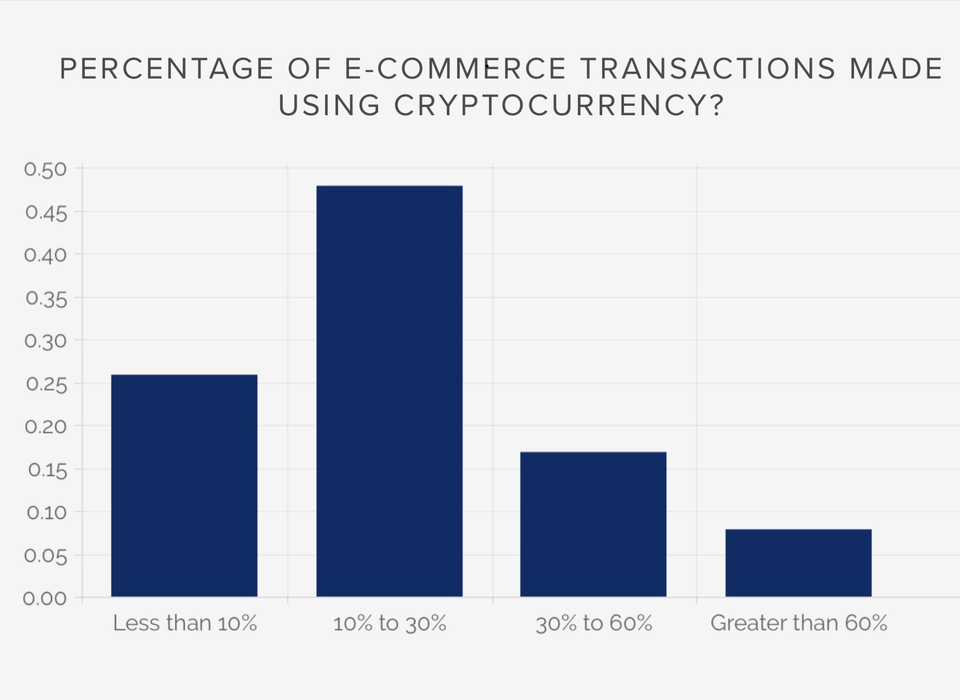

One of the questions was “what percentage of e-commerce transactions will be made using some form of crypto currency 5 years from now?”

The respondents were surprisingly optimistic.

Having crossed professional paths in the past, Shilo reached out to ask me if I’d be interested in sharing a response to the results. I’m in no way an expert on the crypto space but I thought this would be a fun thought exercise so I shared the response below.

My response:

It takes a very, very long time for anything to change when it comes to the payments space, especially when it comes to payment method adoption by consumers. One simple reason for this is that it’s really hard to change user behavior without a 10x improvement in both user experience and end user value. Cash works, and everyone already knows how to use it. Debit and credit cards work really well, and people know how to use them. They also provide a lot of value to consumers (rewards, protections, security, etc.). For a new payment method to gain adoption, it’s going to need to be 10x easier, safer, and provide significantly more value to the end user, and that’s extremely difficult to do. Think about Apple Pay penetration… amazing user experience, but still not quite dead simple for the masses to figure out. Additionally, there’s always a classic chicken and egg problem when it comes to payments. Like Apple Pay, crypto will have to overcome a chicken and egg problem between merchants and consumers for use cases around payments to gain clarity. Nothing changes fast, and 5 years is categorized as lightning fast in this context.

Crypto is still considered a frontier technology (one that doesn’t have mass adoption, or even value prop clarity). It’s extremely early… promising, but early. The value prop for merchants in the US to accept crypto payments isn’t remotely clear at this point in time, and it’s largely dependent on the value prop and penetration for consumers (hence the chicken and egg problem). This is the crux of the issue. It’s not yet clear what the value prop is for many of the current cryptocurrencies and cryptoassets for consumers. Many theories exist, and there are some benefits, but nothing with certain and obvious clarity at this stage. When it comes to Bitcoin in particular, it doesn’t make sense for most people to want to spend it within the next 5 years, as it’s currently designed to satisfy the store of value/digital gold use case. And this is OK. If it is to have a shot at being used for transactions in the future, it likely needs to be a trustworthy store of value first, and that is going to take many years to work itself out. It doesn’t make sense for the masses to want to give up any of an asset that is being used as a store of value (especially one that is expected to grow significantly in value). Aside from that angle, there are all of the obvious holes that are going to take a few years to fill around custody, key and recovery phrase management, taxes, regulatory clarity, etc.

From a merchant perspective, we have to think about the value prop to them here in the US, and it’s far from clear. They have to deal with all of the same issues that consumers do around custody and that’s no easy feat for most businesses. There’s just not a clear benefit to most merchants to accept crypto in the US until the value prop for consumers to earn, hold, and spend crypto clarifies itself.

With all of this being said, I can envision a future where an ‘internet money’ gains traction and provides a lot of value to both merchants and consumers, but we’re likely more than a decade away, if it even ends up happening at all. Until the full ecosystem gets built out, there won’t be mass adoption. This ecosystem will have to include everything from crypto dispersed payroll and retirement contributions to lending and borrowing instruments. We’re already seeing lending products come to market like the folks at BlockFi. It’s likely that payments is just one use case that crypto proves useful for, but it won’t happen in the next 5 years. We first need to see if the store of value use case pans out. After all, what merchant will want to accept something that isn’t considered a trustworthy store of value? It’s extremely exciting to think about the progress that will be made over the next 5 years in the crypto space regarding regulations, taxes, custody, onramps, and new value props while we learn if bitcoin satisfies the digital gold use case.

My advice to any retailer thinking about accepting crypto as a form of payment would be to think long and hard about who your customer (or desired customer) is and what value they’re getting out of paying in crypto. It’s unlikely that the demand is there yet. You may get more PR value out of headlines promoting that you’re accepting crypto than you will out of new customers that shop with you due to the fact that you’re accepting some form of it. If you think there’s value and want to explore it further, then reach out to Coinbase about their Coinbase Commerce product. I’m pretty sure they aren’t even charging for the service at this time. If you’re already a believer in the likelihood of bitcoin becoming a store of value with an increasing price (and if you have the risk appetite for it), then it’s probably worth adding it to your website even if you only get a few sales, because those few sales just may end up being worth significantly more in the future than if they paid in fiat. But know that it’s a huge ‘if’, and you’ll need to learn to store it securely.

The rest can be read on Statbids blog post: https://www.statbid.com/blog/will-consumers-choose-cryptocurrency-to-shop-online